In Focus: The Growing Importance of Safe Havens

Author: Guillermo Muros Editor: Nicolas Sione

Welcome to this new edition of CIGP WM Focus which discusses the ever growing importance of safe havens by taping into the notions of

- Future uncertainty

- Identifying adverse events

- Safe haven vehicles

- The status of treasuries

- Adapting investment strategies

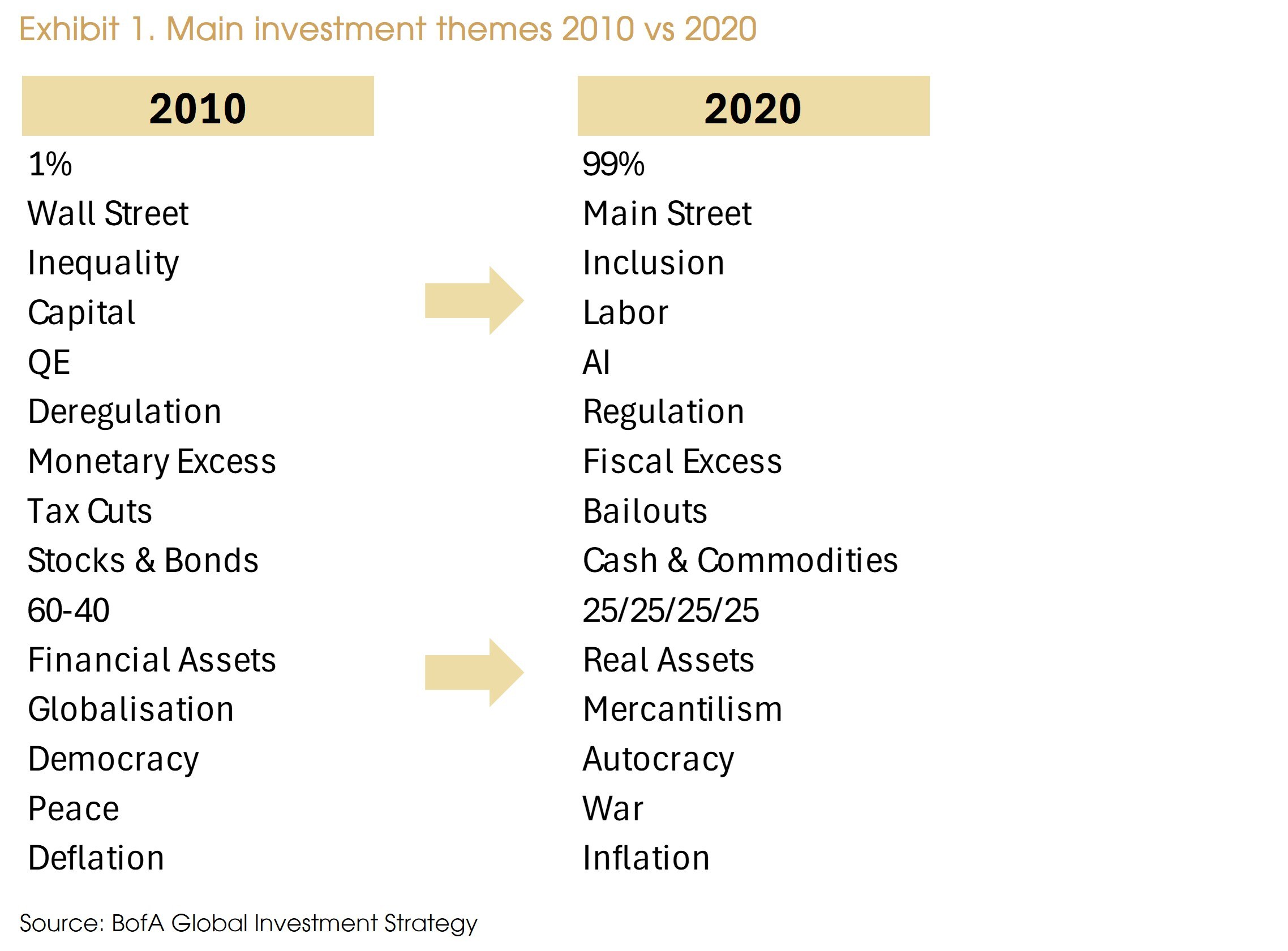

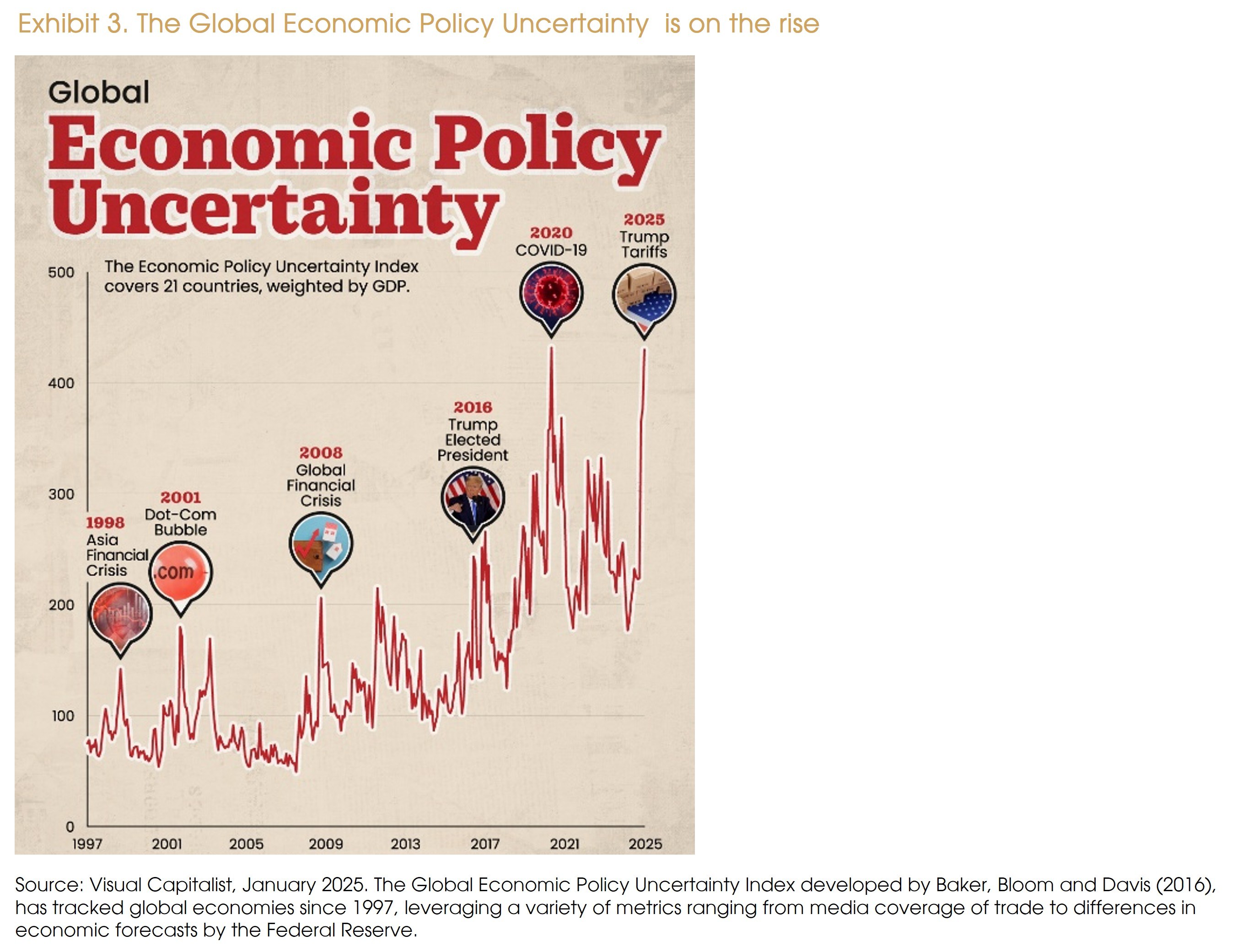

The current decade presents a stark contrast to the preceding twenty years. The political landscape in most Developed Markets, exemplified by Trump's victory in late 2024, suggests we may be entering a "new era" relative to previous decades. Francis Fukuyama, in an article for the Financial Times, noted a "decisive rejection by American voters of liberalism and the particular way the understanding of a 'free society' has evolved since the 1980s." While it is not accurate to claim that this decade will be more uncertain than previous ones (i.e., there has always been and will always be uncertainty around), it seems the nature of uncertainty has fundamentally changed across economic, social, and environmental dimensions, altering the framework through which investment choices are evaluated.

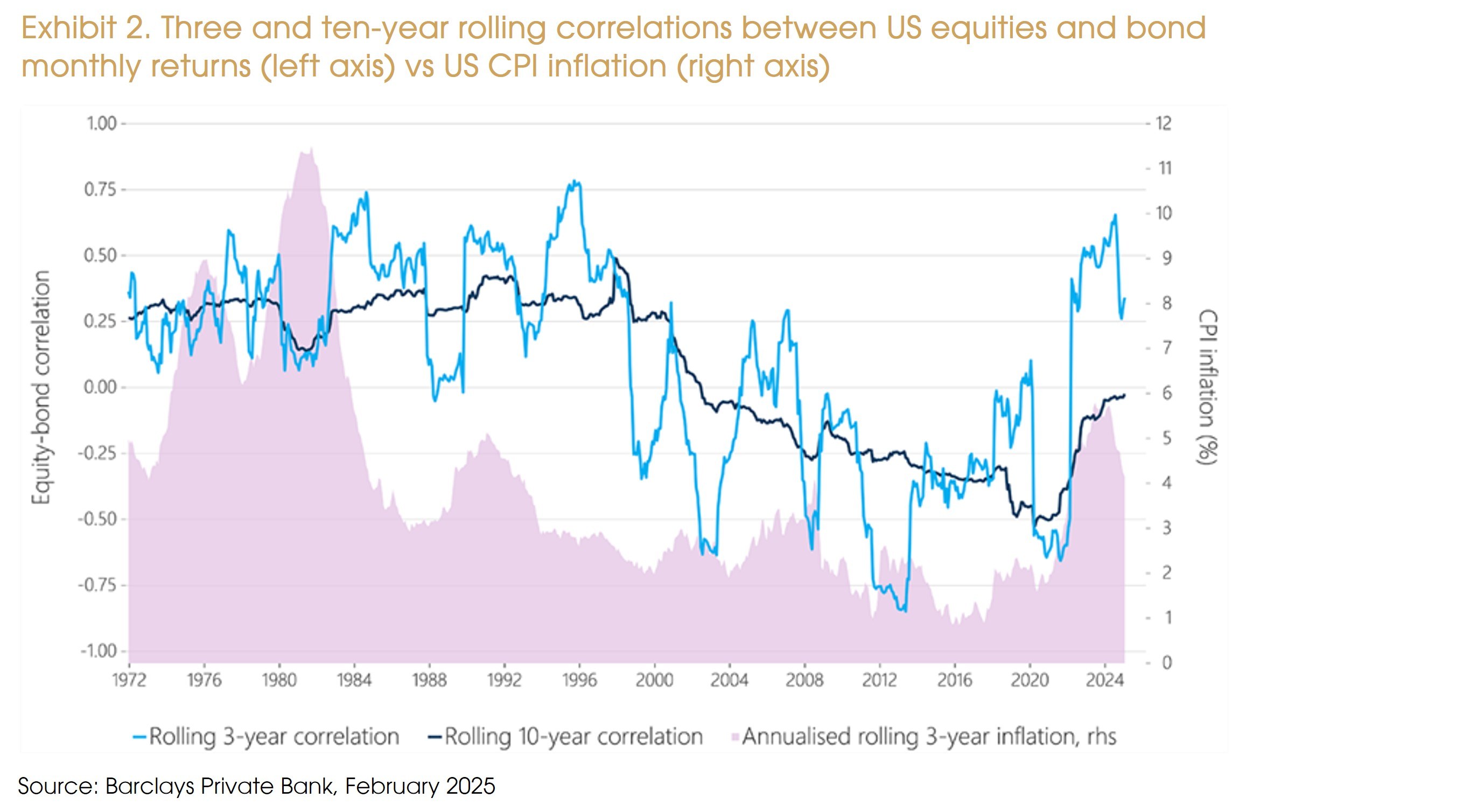

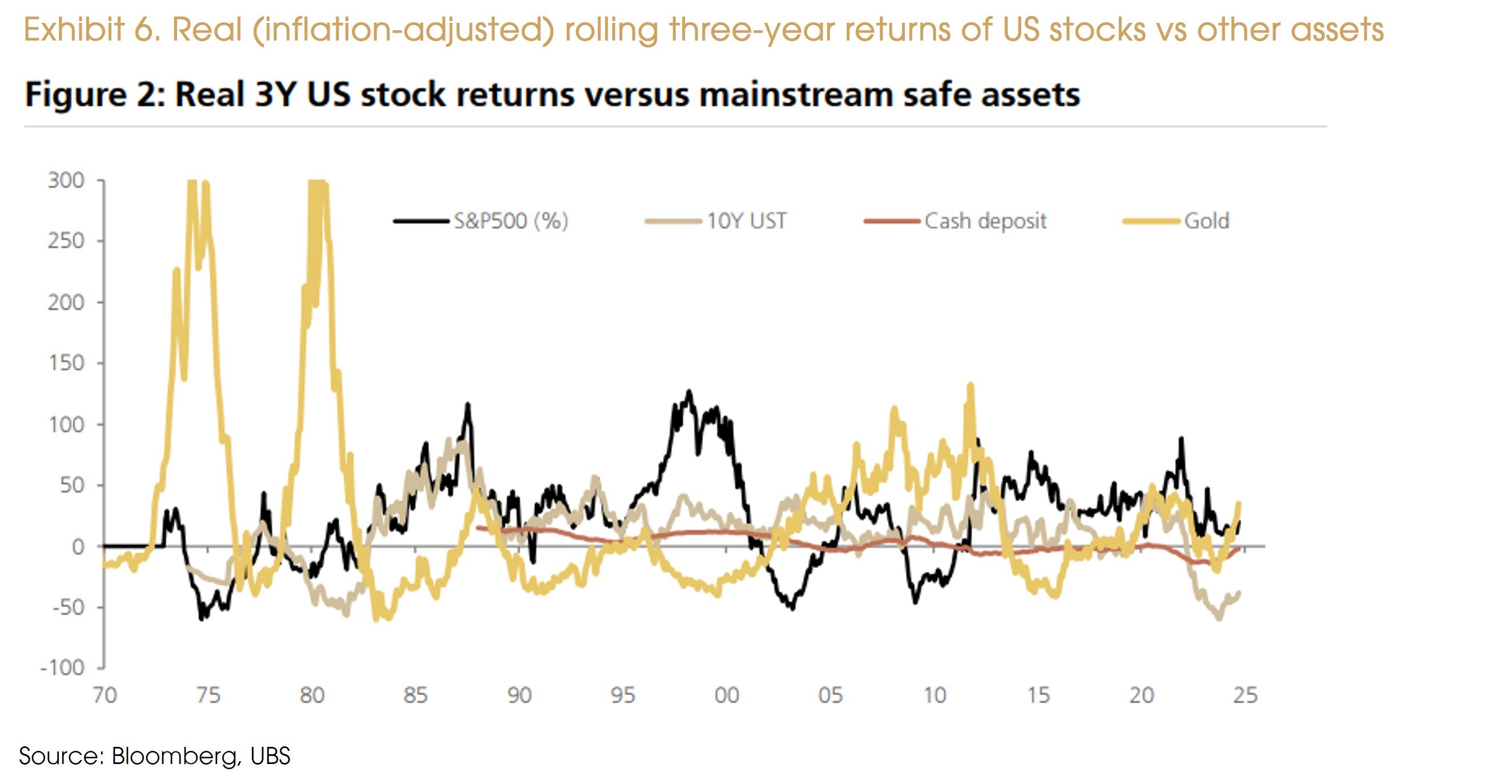

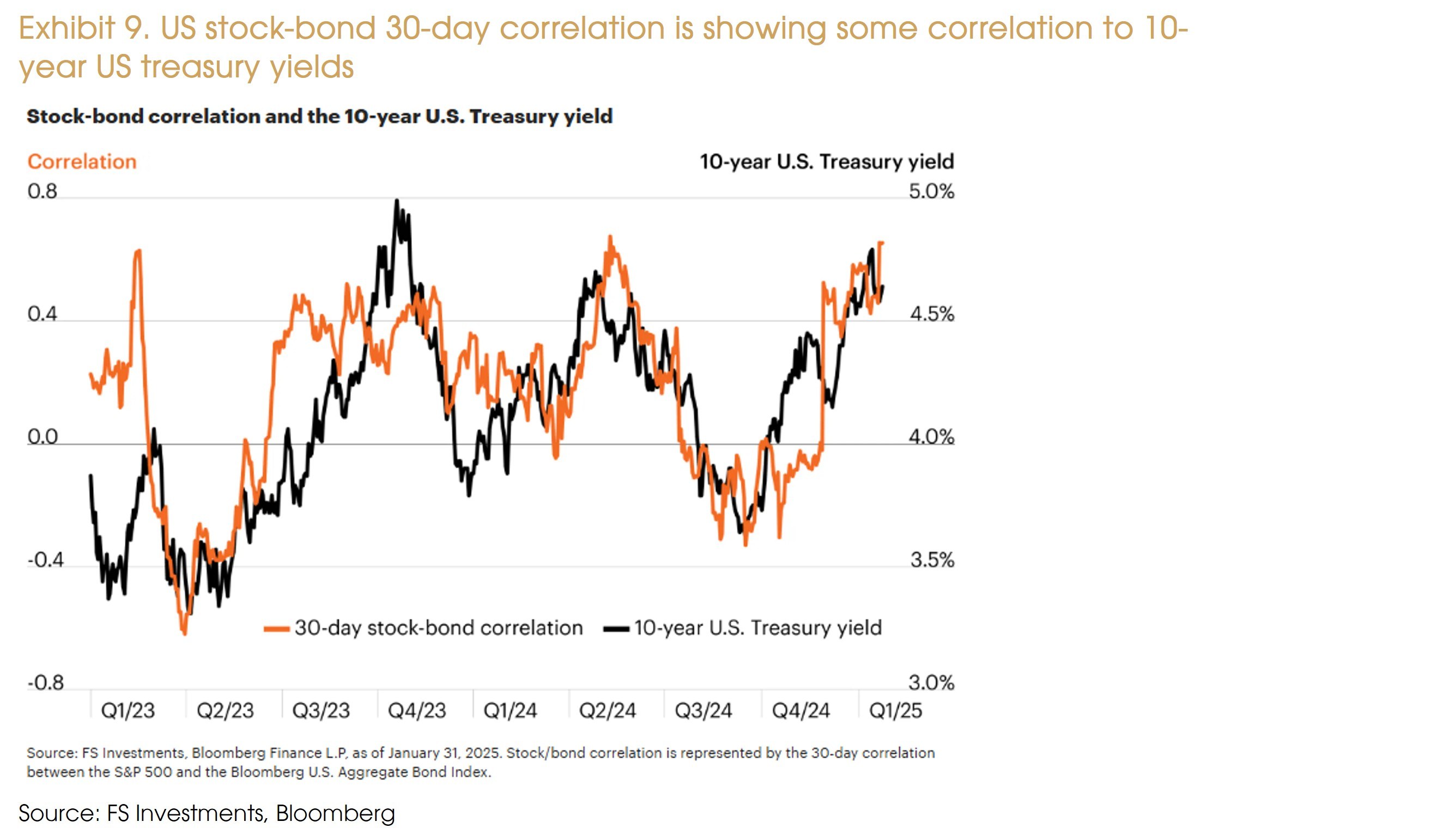

Moreover, historical patterns show that traditional correlations between asset classes can shift abruptly—particularly during periods of market stress (as we can see in the graph below). This highlights the importance of continually reassessing and adapting investment strategies and frameworks.

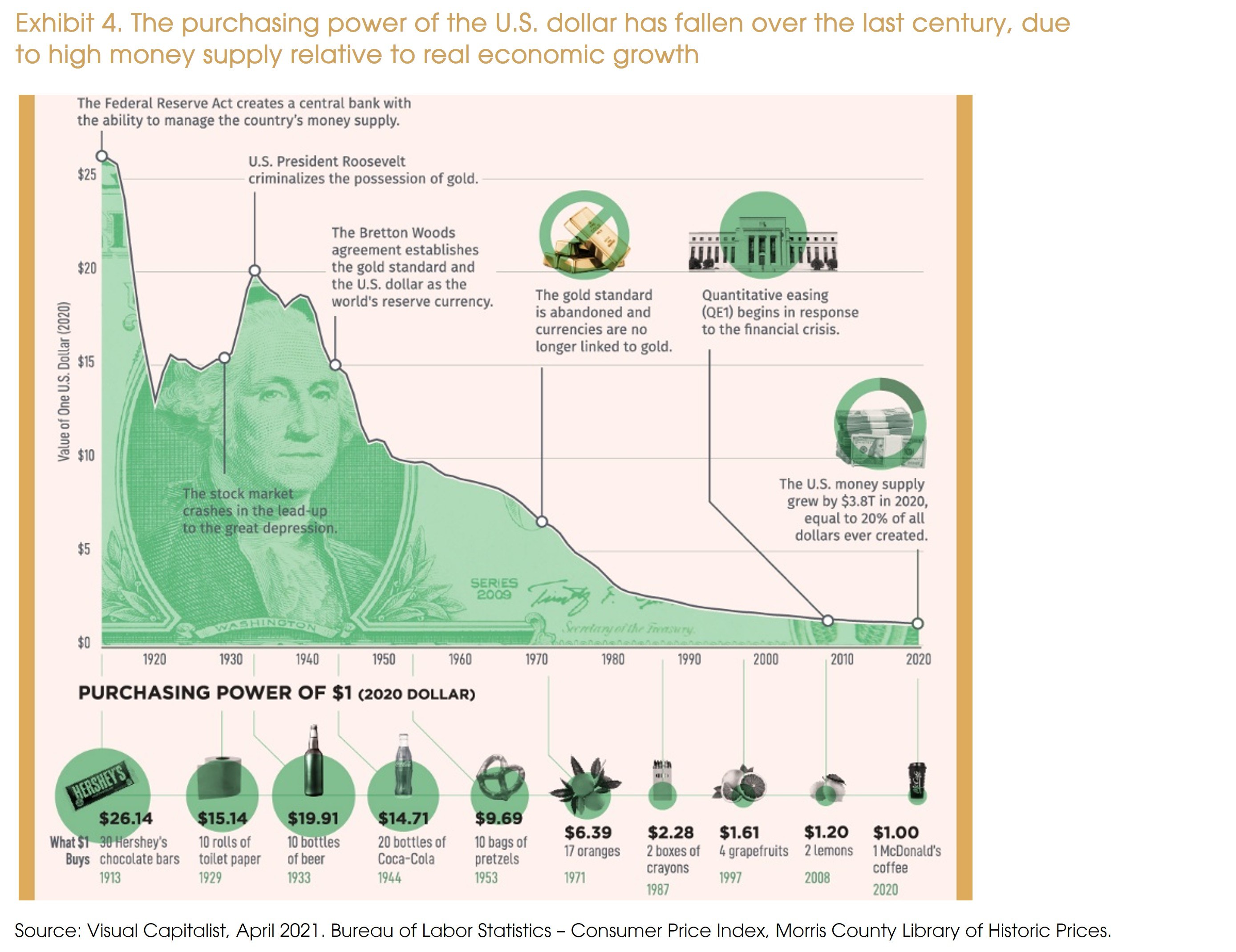

For investors, these shifts have significant implications for the selection of new themes and asset classes. Observing market movements over the past decade, one of the most notable changes since the extensive pandemic response spending is the transition from a period of “deflationary risks” to one of “inflationary risks” in Developed Markets. It is crucial to recognize that "inflation" encompasses not only headline CPI but also extends to investments such as Real Estate and Financial Assets.

Furthermore, the changing economic environment has led to alterations in portfolio composition. The traditional 60% (equities) - 40% (bonds) portfolio model has been struggling these last years versus more synthetic tools, such as Harry Browne’s Permanent Portfolio, consisting of 25% (equities) – 25% (bonds) – 25% (gold) – 25% (cash); reflecting the increasing need for a more diversified set of financial assets.

Consequently, the current decade's political and economic shifts necessitate a reevaluation of investment strategies and portfolio compositions to diversify beyond from the “traditional assets” (e.g. equities and bonds) and include “alternative assets” (e.g. such as safe havens assets). Allocators must adapt to these changes to navigate the evolving landscape effectively.

Oxford Languages defines a safe haven as “a place or situation that provides protection or refuge from danger or trouble”. And to us, safe haven assets are investments that maintain their purchasing power over time and ideally gain in value when adverse events occur. We think that purchasing power protection is a sine qua non condition for safe assets. It is essential that these assets maintain their intrinsic value over time, safeguarding against different adverse events.

In addition, Safe haven assets are expected to exhibit a negative direct correlation to systemic turmoil. While this condition is not always met due to the varying and unpredictable nature of new systemic shocks, it is crucial for safe assets to preserve wealth in real terms after the fact.

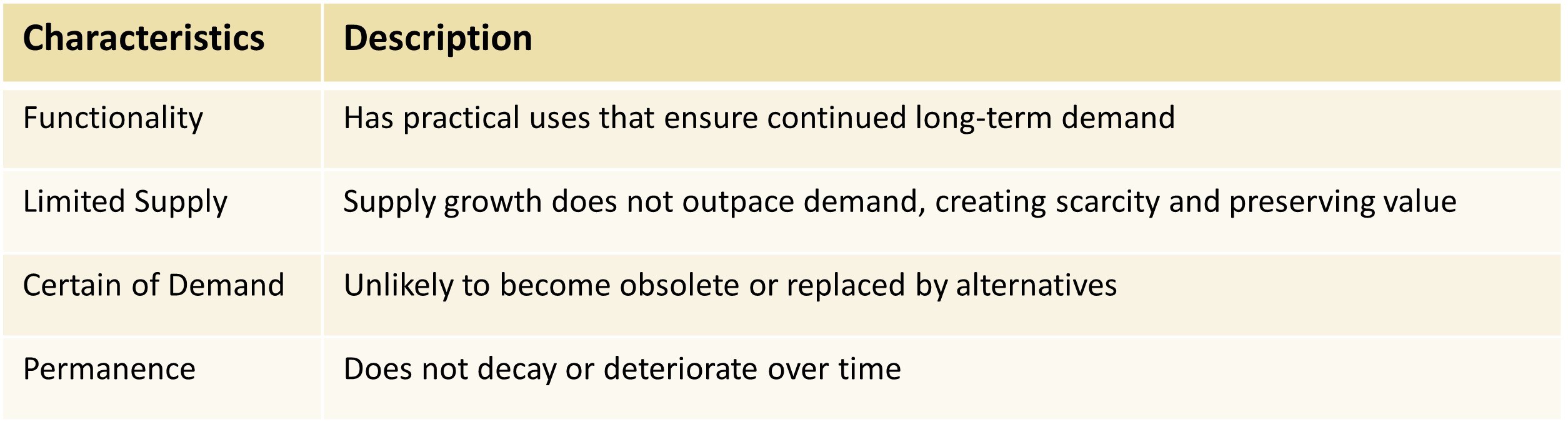

Furthermore, for an asset to function effectively as a safe haven, it typically exhibits several key characteristics:

Regarding the notion of risk, often perceived as volatility by the investment community, we have deliberately omitted it from our definition. As in practice, all safe havens carry their own sets of risks (e.g. custody and storage, volatility, liquidity), which must be carefully managed.

Last but not least Safe havens are more often influenced by sentiment than by economic value. Hence, the psychological aspect is crucial, requiring amongst other things:

- Patience and Discipline: Investing in safe havens often demands patience and discipline, especially during periods of market calm. Investors must maintain their conviction in these strategies even when returns are not immediately high.

- Avoiding Recency Bias: While some safe havens have provided extraordinary returns recently, this should not be the primary consideration for choosing one asset over another. It is essential to have a solid understanding and confidence in the foundations behind the underlying asset.

Ultimately, there is no single perfect 'safe haven'—rather, different instruments that offer protection against different types of adverse events.

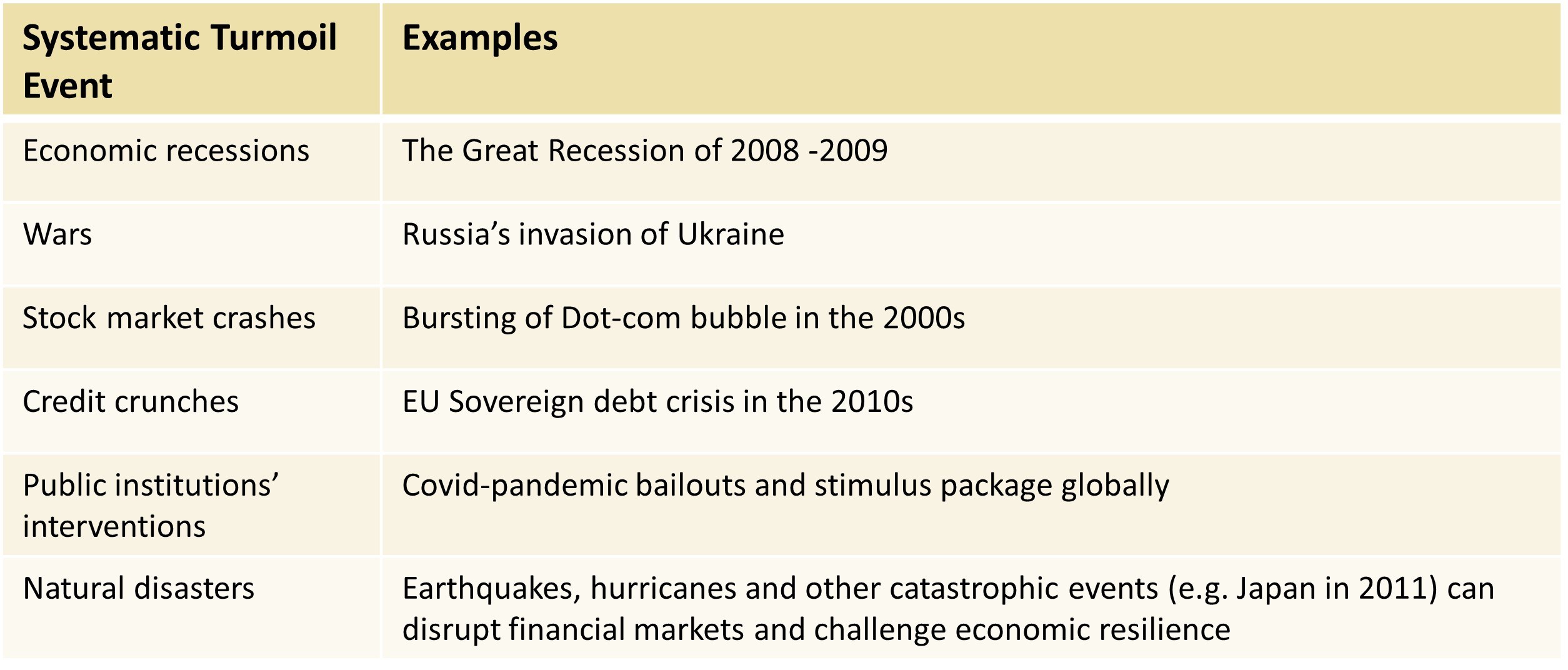

A first step in selecting a safe haven asset is to characterize the systematic turmoil events we seek protection from.

In our view, in light of the increasingly complex global economic and political landscape, investors are progressively seeking diversified protection against growing swings in financial market volatility and the loss of purchasing power from government-issued fiat currencies.

Other public favorites include:

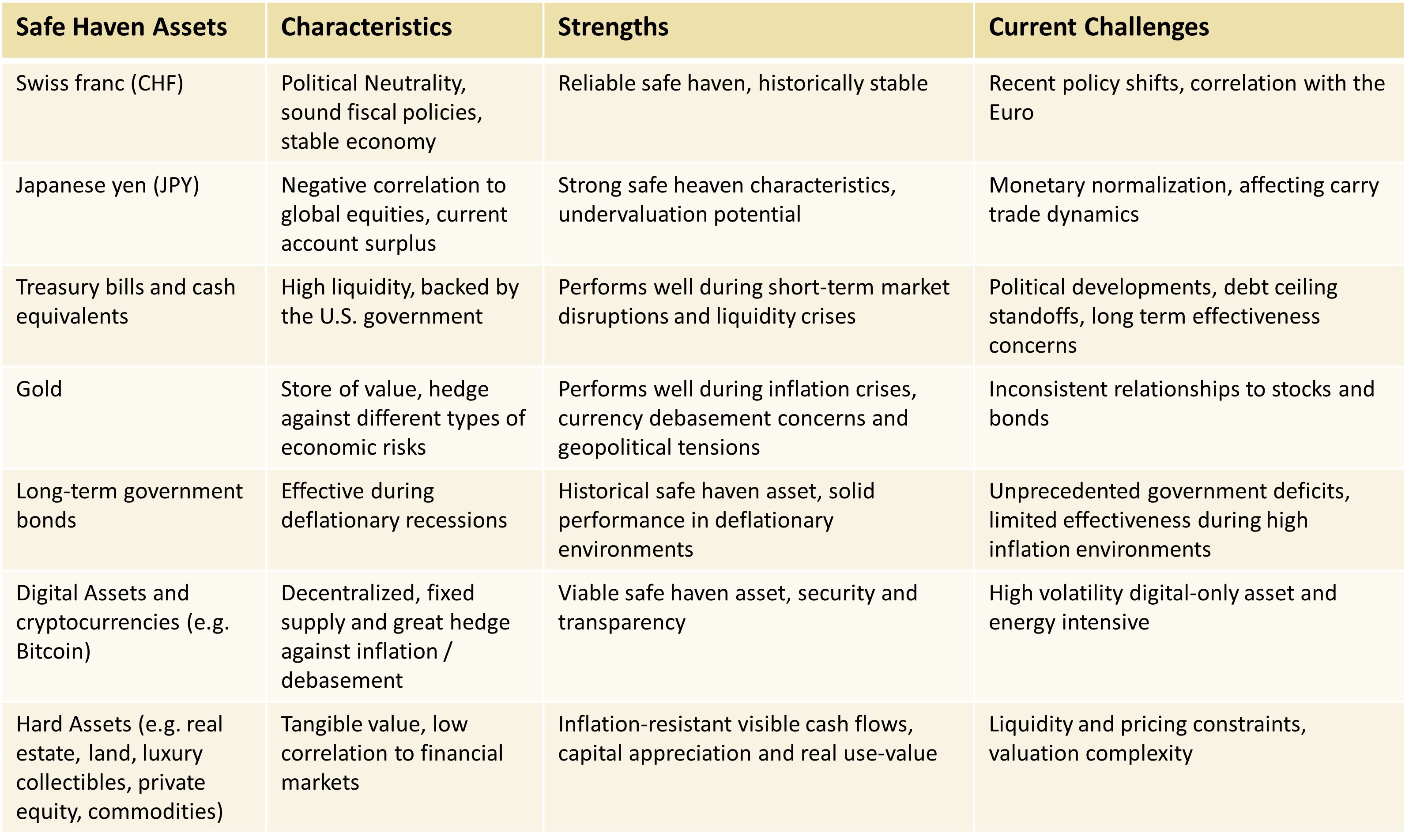

Safe havens are not one-size-fits-all. This section explores how different instruments function, and how their roles are evolving.

First off we have Safe haven currencies and cash equivalents, highly liquid and stable assets that investors typically turn to first during short periods of market stress. These set of currencies tend to keep their value in times of uncertainty, offering a layer of protection to diversified portfolios.

However, the current economic landscape presents a complex set of challenges for currency allocations as central banks pursue divergent policies, inflation pressures persist in some regions while abating in others, and traditional correlations between asset classes continue to evolve.

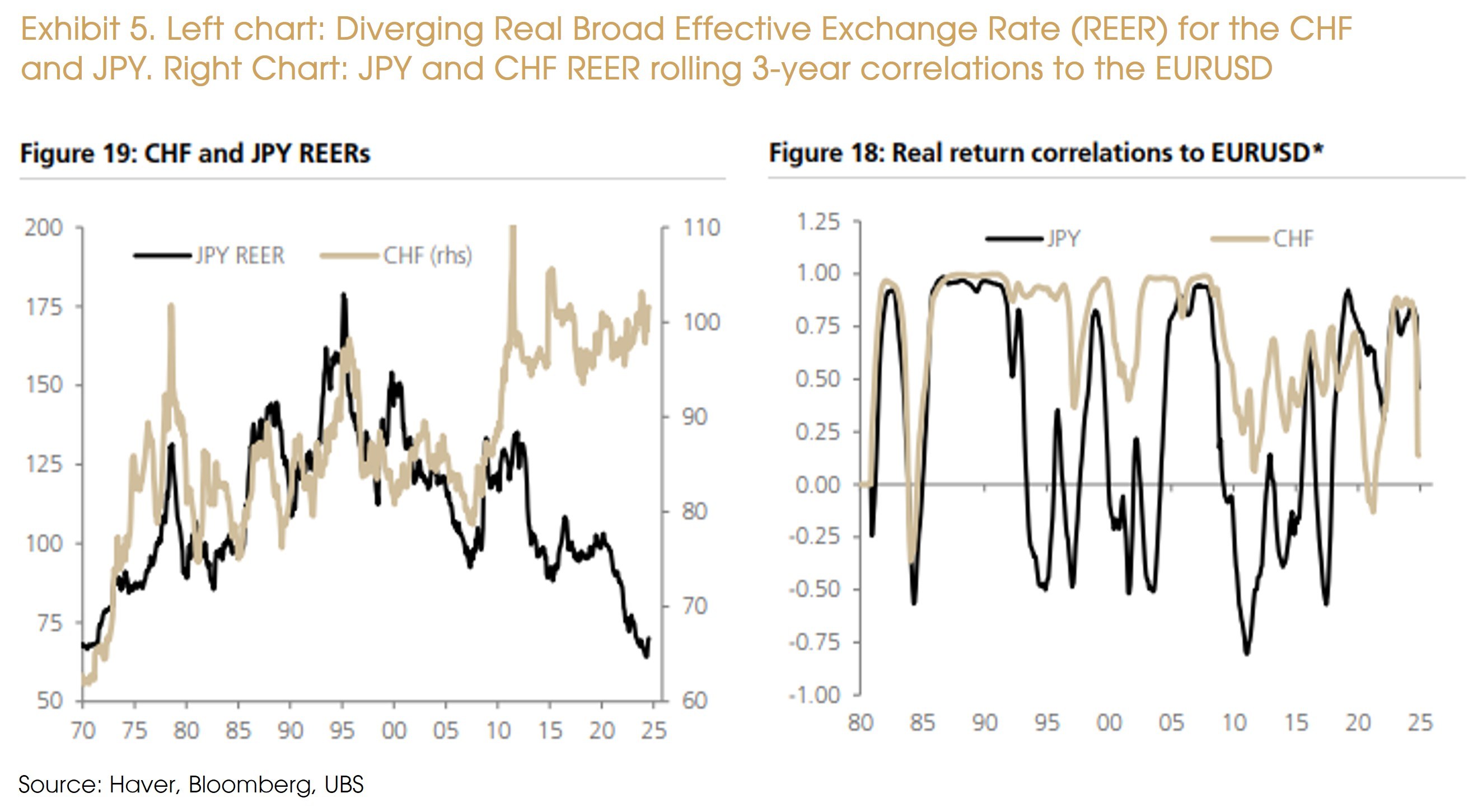

- The Swiss franc (CHF): has historically been a reliable safe haven due to Switzerland's political neutrality, sound fiscal policies, and stable economy. However, recent policy shifts by the Swiss National Bank (SNB), which has moved from curbing inflation to addressing downside growth risks, have led to rate cuts, contrasting with Japan's tightening cycle, potentially diminishing the CHF's attractiveness from a yielding perspective. Additionally, the CHF's movements are often correlated with the Euro, making it less idiosyncratic than the Japanese yen (JPY).

- The Japanese yen (JPY): has historically demonstrated strong safe haven characteristics, showing a negative correlation to global equities. However, Japan's transition toward monetary normalization presents a nuanced picture for investors, as the Bank of Japan moves away from its ultra-loose policy stance, potentially affecting the yen's traditional carry trade dynamics. Despite these shifts, the yen maintains several fundamental attributes supporting its protective role, including Japan's persistent current account surplus. Additionally, significant undervaluation based on purchasing power parity models suggests the yen offers both safe haven qualities and appreciation potential.

Moreover, the chart below highlights the significant divergence in the Real Effective Exchange Rates of the Swiss Franc (CHF) and Japanese Yen (JPY) during the 2010s, illustrating that even long-standing correlations can break down over time. In the aftermath of the global financial crisis, Switzerland and Japan adopted contrasting monetary strategies, with Switzerland taking measures to prevent excessive currency appreciation and Japan implementing policies to weaken its currency and boost export competitiveness, thereby challenging the latter's safe haven status.

- Treasury bills and cash equivalents[AS1] : maturing in one year or less, have been considered among least volatile investments (relative to traditional financial assets like stocks and bonds), and high liquidity due to their backing by the U.S. government. They perform well during short—term market disruptions and liquidity crises, as seen in the Global Financial Crisis and COVID-19 turbulence. However, recent political developments, such as debt ceiling standoffs, have challenged their risk-free status. This evolving landscape has raised concerns about their long-term effectiveness in protecting purchasing power, especially when compared to other currencies.

While traditional short-duration safe havens—such as the Japanese yen, Swiss franc and U.S. T-bills—remain foundational, a broader set of non-currency assets has become increasingly vital to building resilient portfolios through time. We now turn to the defining traits of alternative safe haven assets, including gold, government bonds, hard assets and digital alternatives like Bitcoin.

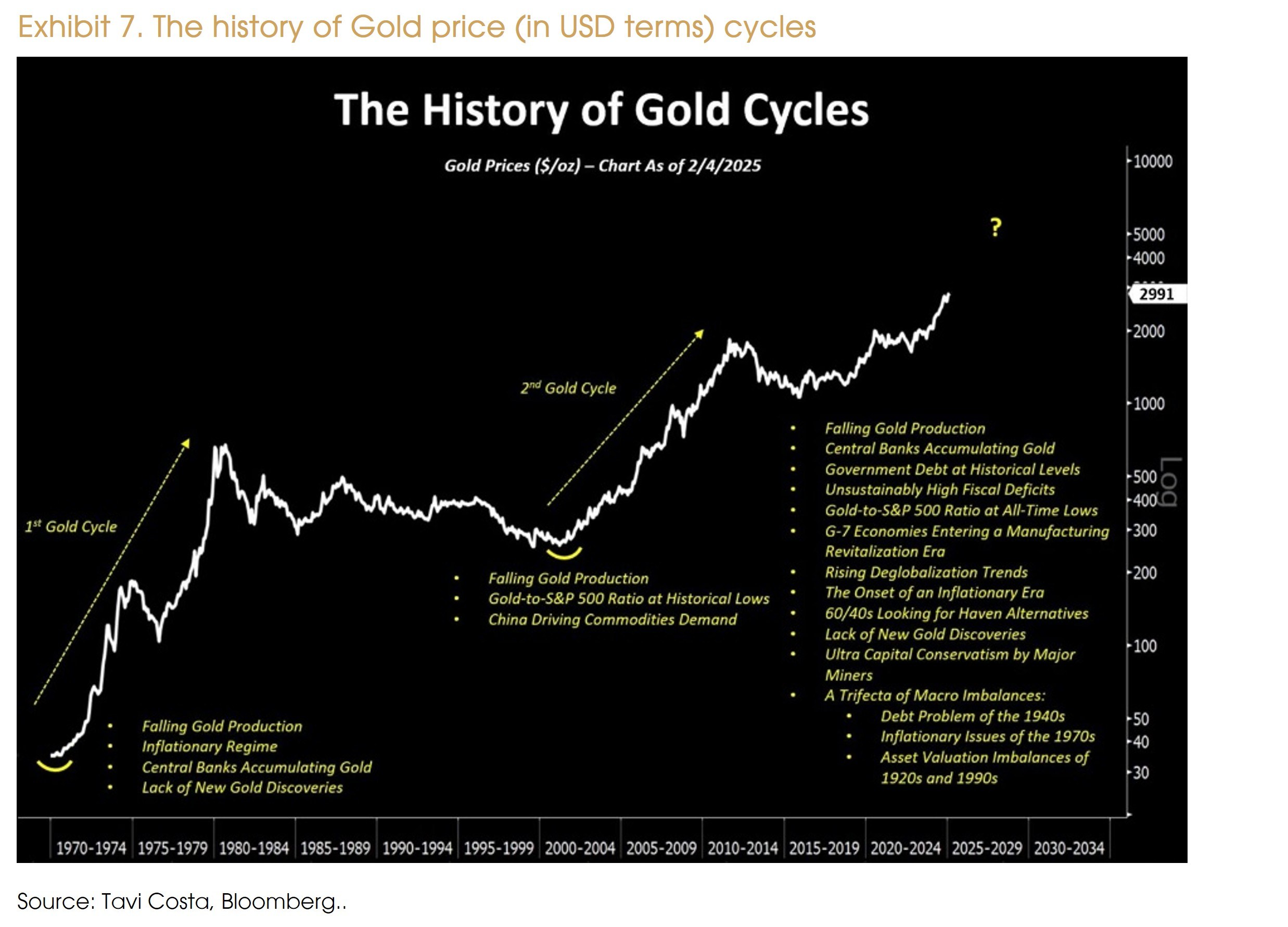

- Gold has been prized as a physical store of value for thousands of years, maintaining its relevance in modern financial markets as a hedge against various economic risks (e.g. fiat currency debasement, geopolitical turmoil and economic uncertainty). It behaves more like currencies than commodities, with inconsistent relationships to stocks and bonds that have become increasingly volatile, performing best during inflation crises, currency debasement concerns, and geopolitical conflicts. Over the last couple of years gold's relationship with traditional market drivers has shifted, reflecting deeper structural changes in the global monetary system: fiscal dominance in developed economies, widespread monetary debasement, and strategic diversification by central banks have all contributed to gold's price strength despite rising real yields.

- Long-term government bonds: Such bonds from developed economies have served as cornerstone safe haven assets, historically providing negative correlation to stocks when inflation is low and macro policy credibility is high. Traditional sovereign bonds face headwinds from unprecedented government deficits, limiting their effectiveness during stagflationary environments (i.e. high inflation, low growth). Research demonstrates that bonds provide negative correlation to stocks only under low inflation and high macro policy credibility, conditions that are currently rare. Bonds are most effective during deflationary recessions but vulnerable during periods of fiscal dominance, where monetary policy becomes subordinate to fiscal policy (i.e. government debt), a characteristic now seen in developed markets.

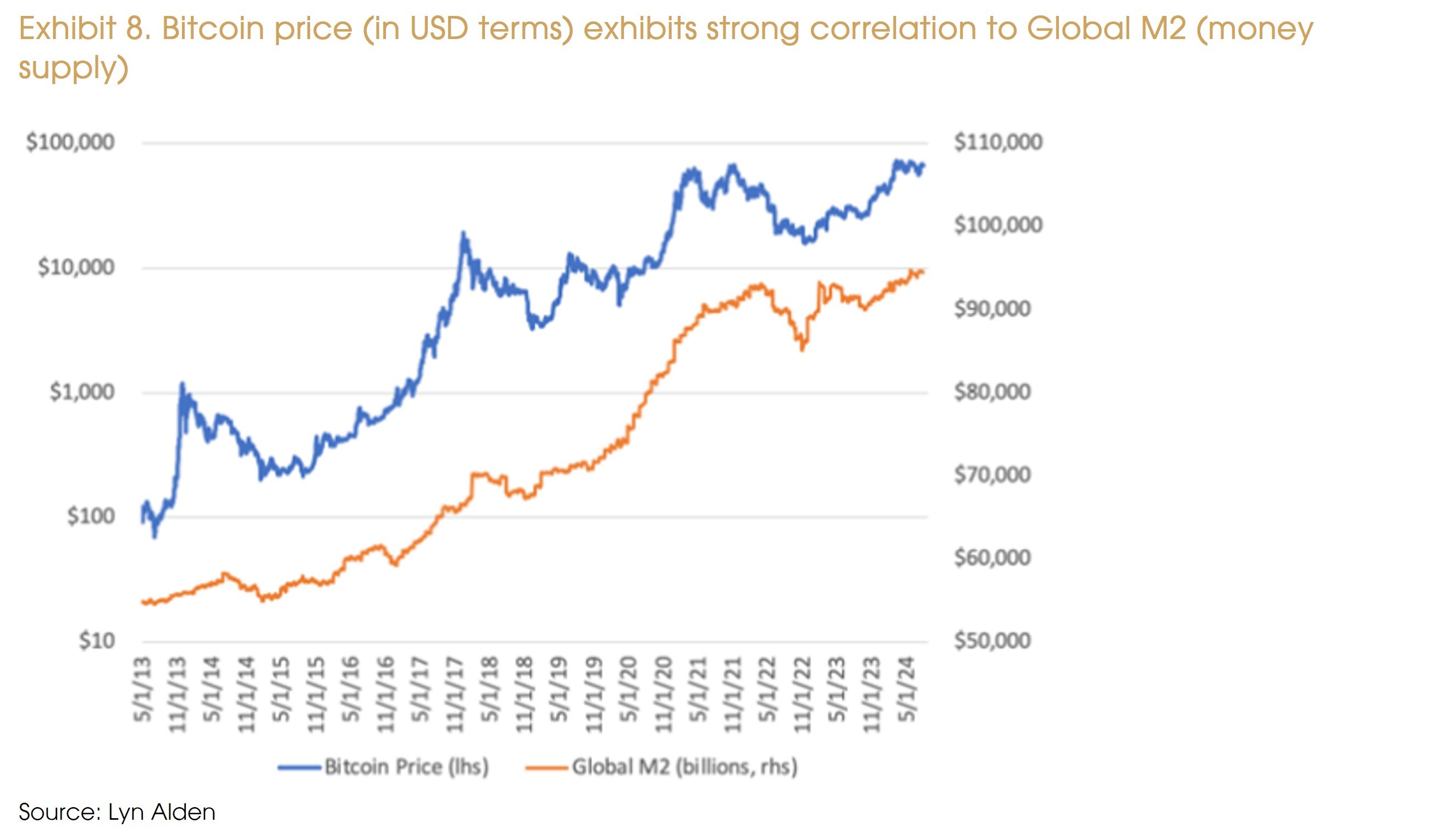

- Digital Assets and cryptocurrencies (e.g. Bitcoin): Despite their positive correlation to stocks (30-40% over the last couple of years) and high volatility, making it less effective as a general market hedge, it is particularly relevant during currency debasement, financial system access restrictions, and scenarios requiring uncensorable value transfer. New digital alternatives like Bitcoin are increasingly being recognized as viable safe haven assets due to their decentralized nature and the trust they inspire in the decentralized system, which enhances security and transparency (i.e. as each transaction is recorded on a public ledger, making it difficult to alter or manipulate data). Additionally, Bitcoin's fixed supply of 21 million coins serves as a hedge against inflation, protecting against the devaluation of currency

- Hard Assets such as real estate, land, luxury collectibles, hard commodities and private investments, offer tangible value preservation amid monetary uncertainty, combining scarcity with intrinsic utility. Real estate and land (e.g. forestry, water, farmland) provides inflation-resistant, visible cash flows and capital appreciation through time. Luxury collectibles like rare watches and limited-edition sports cars have also outperformed traditional assets, with auction prices for vintage timepieces rising strongly as of late, driven by finite supply and growing high-net-worth discretionary demand. Commodities serve as effective safe haven assets during supply-driven shocks, offering strong diversification benefits, especially in regimes marked by restrictive interest rates, geopolitical tensions, and inflationary pressures. Private equity investments in infrastructure and renewable energy projects deliver dual benefits of stable yields and inflation—linked revenue streams, with core infrastructure funds also generating solid double digit annualized returns over the last decades. While these assets face liquidity constraints and valuation complexity, their low correlation to financial markets and resistance to monetary debasement make them compelling complements in diversified safe—haven portfolios.

The traditional view of U.S. Treasuries as the ultimate safe haven asset is increasingly being called into question, as political brinkmanship and structural market shifts undermine their “risk—free” reputation. Recent market volatility has revealed cracks in the Treasury market's foundation, with long—dated Treasury yields surging over 65 basis points in just three trading days during April's 2025 trade tariff announcements, even as stock markets plunged—a reversal of the typical inverse relationship between risky and safe assets.

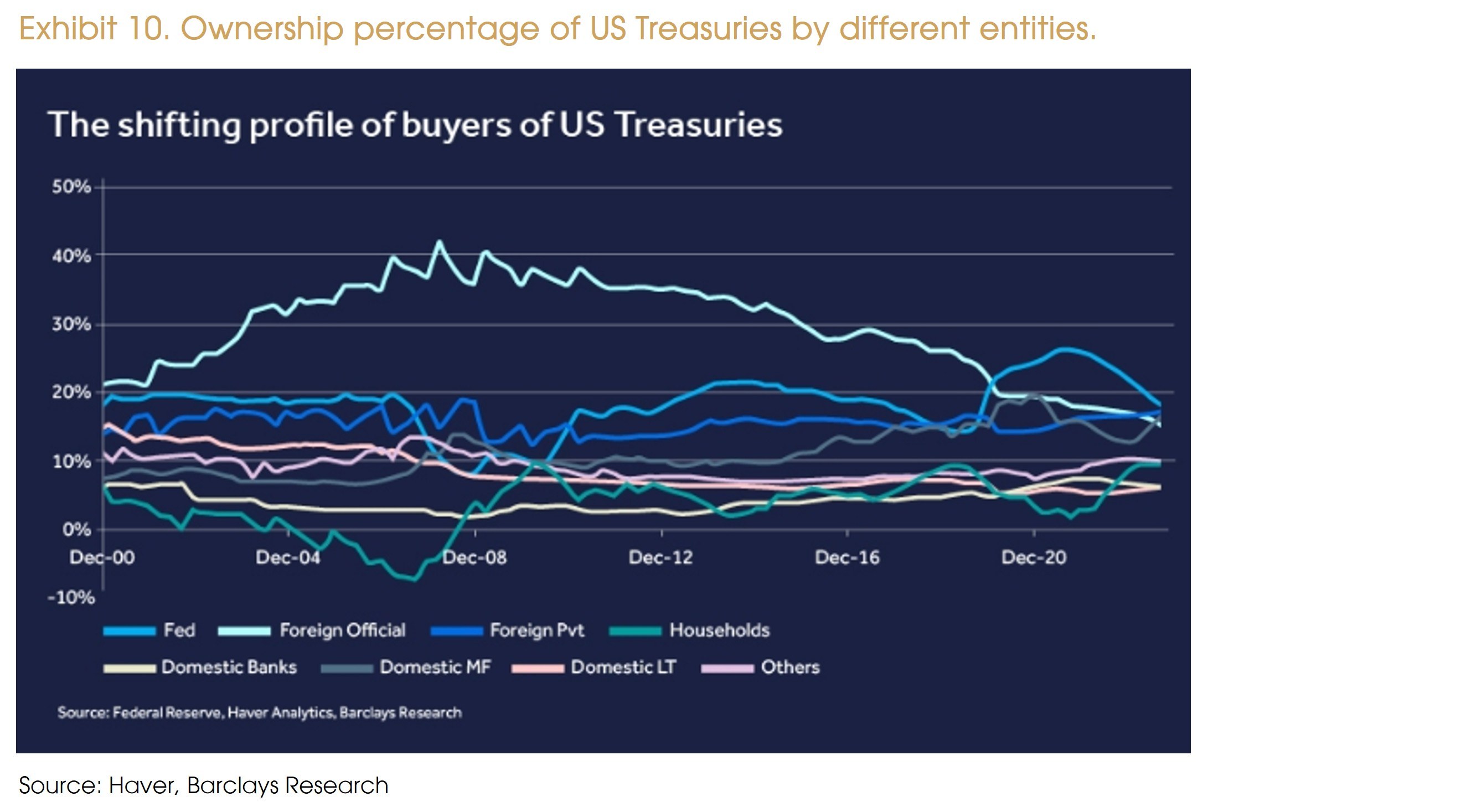

In addition to the ongoing expansion of the money supply—fueled by the Federal Reserve’s accommodative stance—the upcoming debt ceiling debate, scheduled for later in 2025, follows the Department of Government Efficiency’s (DOGE) disappointing delivery of just $100-200 billion in savings, falling well short of the originally promised $2 trillion. Compounding the monetary and fiscal challenges is the urgent need to refinance nearly $9 trillion in maturing U.S. Treasuries this year, most likely at significantly higher interest rates. Additionally, shifts in global geopolitics and trade dynamics have altered the profile of Treasury buyers. Over the past two decades, demand has gradually transitioned from “obligated buyers” such as foreign central banks to “discretionary buyers” like mutual and hedge funds. These evolving dynamics contribute in our view to heightened uncertainty, reflected in the rising term premium—the extra yield investors demand for holding longer—term bonds—which now underpins the elevated real debt—servicing costs of 4–5% in the United States (amongs the highest in the OECD)

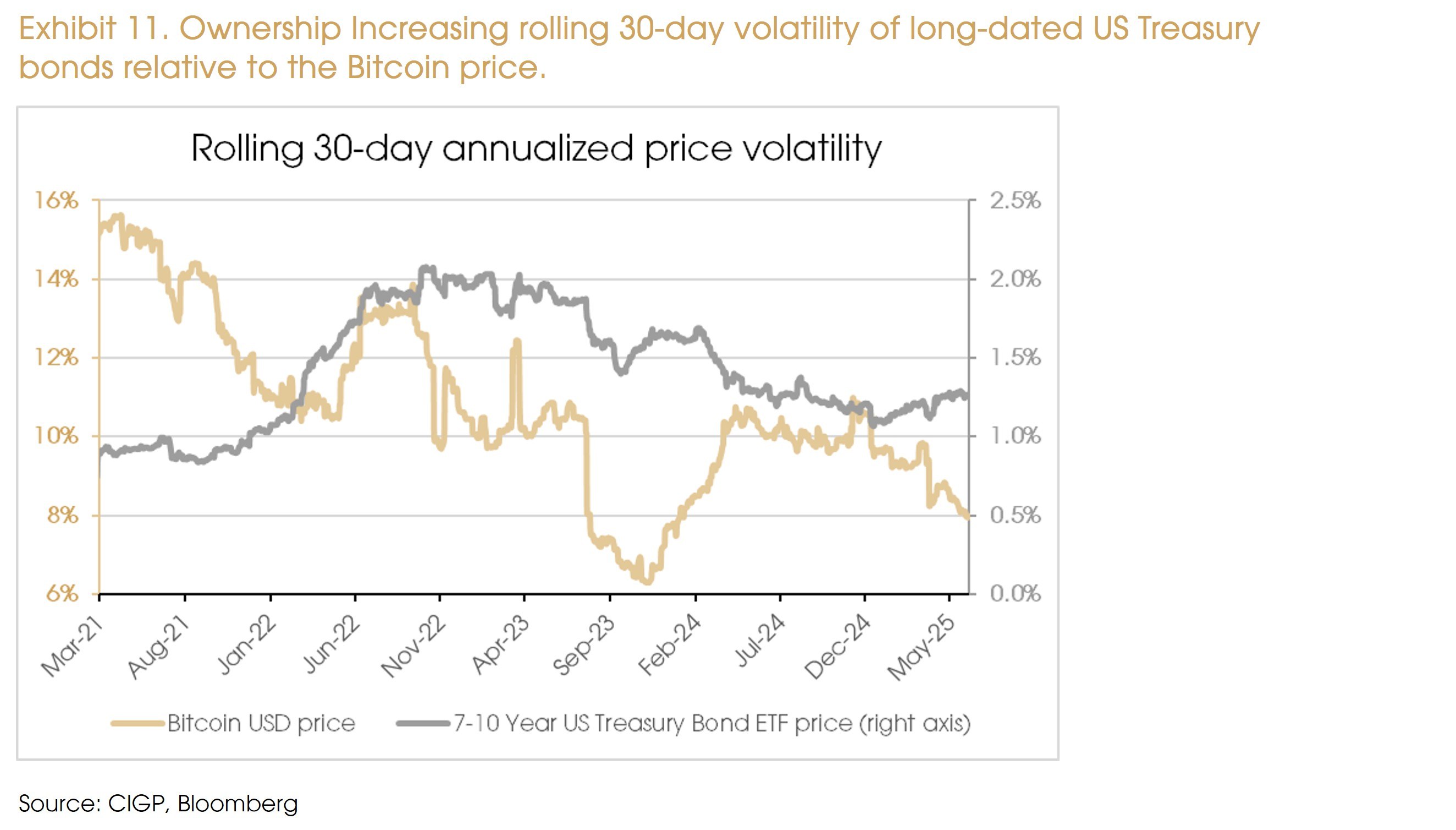

This marks a fundamental shift in asset behavior, illustrated by the declining volatility of traditionally “riskier” assets, such as Bitcoin, whose 30-day realized annualized volatility (yellow line, in the chart below) has steadily fallen over the past three years, coinciding with the onset of global inflation. In contrast, the annualized volatility of U.S. Treasuries has been increasing, as evidenced by the iShares 7–10 Year Treasury Bond ETF (black line) over that same period.

This divergence suggests to us that: investors may be re-evaluating what truly constitutes “safety” in today’s market environment.

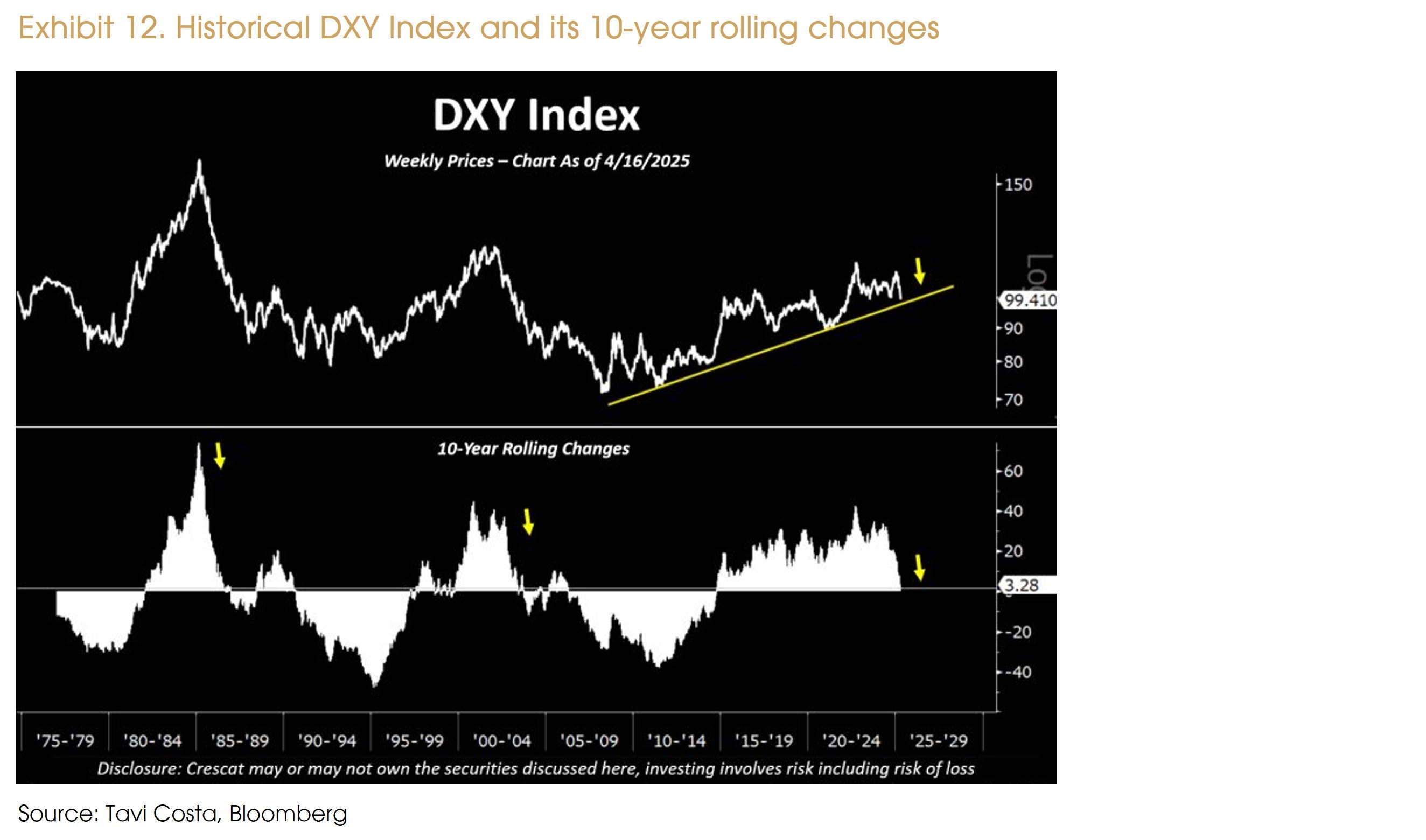

Although short-term Treasury bills have retained their stability and liquidity during periods of market stress, their relative strength—reflected in the DXY index—is increasingly vulnerable as global trade rules are renegotiated and the U.S., as the world’s largest trade deficit nation, faces mounting structural imbalances.

As we navigate the complexities of the global economic landscape, it is essential to recognize the critical importance of safe havens and portfolio diversification in the face of geopolitical uncertainty, distrust in public institutions, fiat currencies debasement and other systemic turmoils.

The evolving economic environment necessitates that investors adapt their strategies, through a Total Portfolio approach (TPA), to include a variety of safe haven and alternative assets, such as gold, commodities, short—duration instruments and digital assets. By understanding the unique characteristics and performance of these assets, we can construct more resilient portfolios that offer protection against market volatility and economic uncertainties. This approach ensures that our portfolios are better equipped to safeguard purchasing power over time and during periods of turmoil.

Through careful selection and management of these diverse assets, we can achieve a balanced and secure investment strategy that addresses both current and future uncertainty.

Disclaimer

This document is issued by Compagnie d’Investissements et de Gestion Privée Group (“CIGP”), solely for information purposes and for the recipient’s sole use and shall not be further transmitted to third parties. You have been provided with this document in your capacity as Professional Investor(s) as defined in Part 1 of Schedule 1 to the Securities and Futures Ordinance (Cap. 571). If you do not meet the Professional Investor criteria, please disregard this document.

CIGP does not assume responsibility for, nor make any representation or warranty (express or implied) with respect to the accuracy or the completeness of the information contained in or omissions from this document. None of CIGP and their affiliates or any of their directors, officers, employees, advisors, or representatives shall have any liability whatsoever (for negligence or misrepresentation or in tort or under contract or otherwise) for any loss howsoever arising from any use of information presented in this document or otherwise arising in connection with this document. This document may not be reproduced either in whole or in part, without the written permission of CIGP. Past performance is not a guarantee of future results. There can be no assurance that forecasts will be achieved. Economic or financial forecasts are inherently limited and should not be relied on as indicators of future investment performance.

This document is not a prospectus and the information contained herein should not be construed as an offer or an invitation to enter into any type of financial transaction, nor an act of distribution, a solicitation or an offer to sell or buy any investment product in any jurisdiction in which such distribution, offer or solicitation may not be lawfully made. Certain services and products are subject to legal restrictions and cannot be offered worldwide on an unrestricted basis and/or may not be eligible for sale to all investors. Unless cited to a third-party source, the information in this document is based on observations of CIGP. The information provided is based on numerous assumptions. Different assumptions could result in materially different results. Before acting on any information you should consider the appropriateness of the information having regard to your particular investment objectives, financial situation or needs, any relevant offer document and in particular, you should seek independent financial advice. All securities and financial product or instrument transactions involve risks, which include (among others) the risk of adverse or unanticipated market, financial or political developments and, in international transactions, currency risk. The contents of this report have not been and will not be approved by any securities or investment authority in Hong Kong or elsewhere.

CIGP acts as an agent when recommending or distributing investment products. The product issuer is not an affiliate of CIGP. CIGP is an independent intermediary, because: (i) we do not receive fees, commissions, or any other monetary benefits, provided by any party in relation to our distribution of any investment product to you; and (ii) we do not have any close links or other legal or economic relationships with product issuers, or receive any non-monetary benefits from any party, which are likely to impair our independence to favour any particular investment product, any class of investment products or any product issuer. Neither us nor our group related companies shall benefit from product origination or distribution from the issuers or providers, whether in monetary or non-monetary terms. We do not provide any discount of fees and charges.