CIO Viewpoint: Will the Dollar Strength Continue?

Author: Yao Wang | Editor: Nicolas Sioné

The US dollar has surged against most other currencies this year. As of mid-October, the Euro dropped to its weakest level in 20 years while the yen and the British pound both reached their lowest in 30 years.

As the Fed started to signal smaller rate hikes after the November meeting, we may soon reach the peak of the Fed tightening cycle, leading to a weakening dollar. But the odds of exceptional scenarios remain.

In this letter, we try to address the drivers behind the recent dollar strength, possible forces to reverse this trend, and the longer-term dollar dominance.

What is the strong dollar pricing?

The rising inflation pressures since 2Q 2021 led to hawkish turns from global central banks, led by the Fed. The Fed hiked its policy rate by 300 basis points (bps) within seven months since March 2022. Most other major central banks followed suit, but at slower paces.

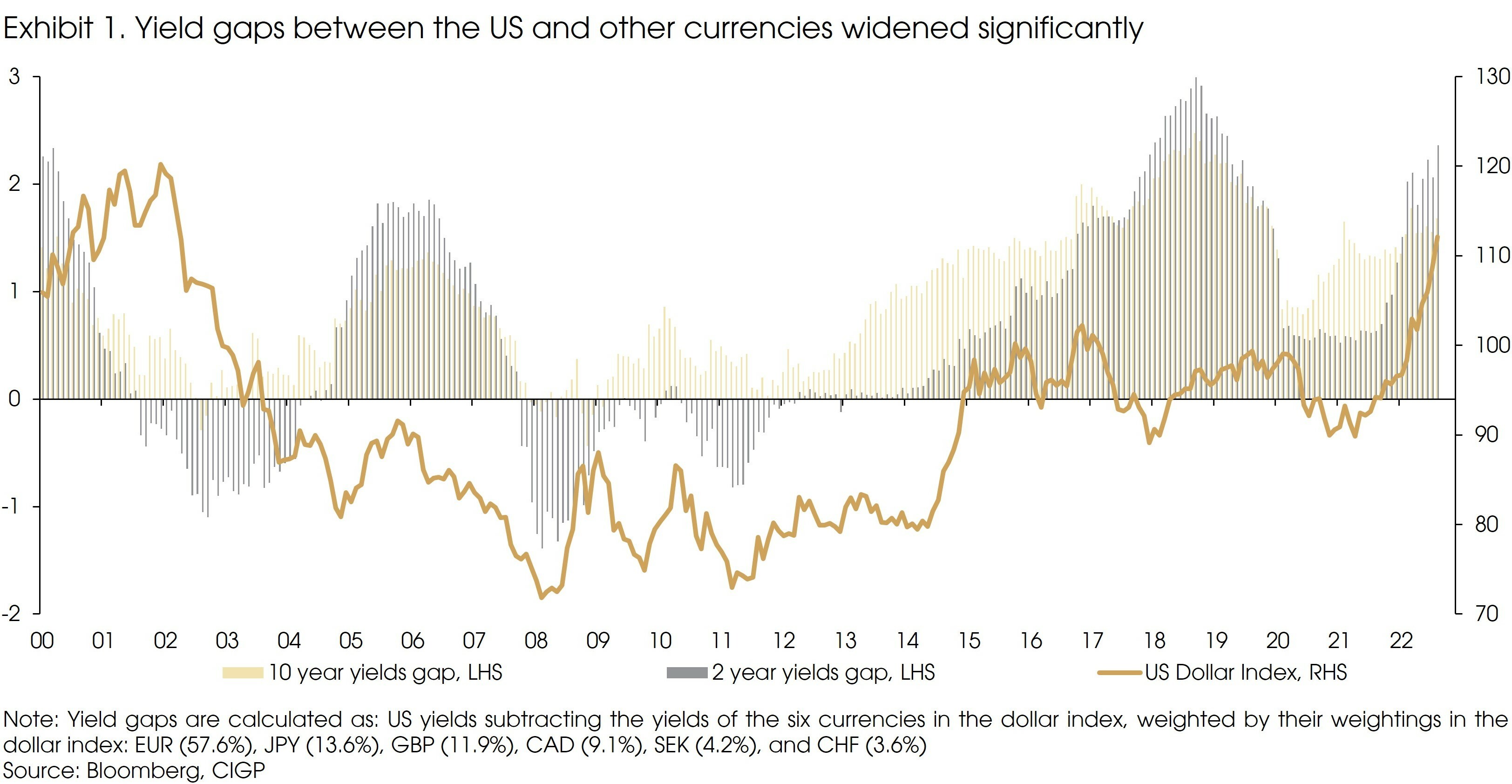

Such gaps in monetary policies have resulted in the interest rate advantage of the US dollar. Yield gaps between the US and other major economies have widened significantly since June 2021, fueling the rally of the US dollar index (Exhibit 1).

That said, current yield gaps between the US and other major economies are not as wide as they were in 2018, time at which the Fed sped up rate hikes. The current appreciation of the dollar far exceeded that of 2018. The dollar index surged by 17% year-to-day as of end-October, while only strengthening 9% during the 2018 upturn.

The widening yield gaps are only part of the story.

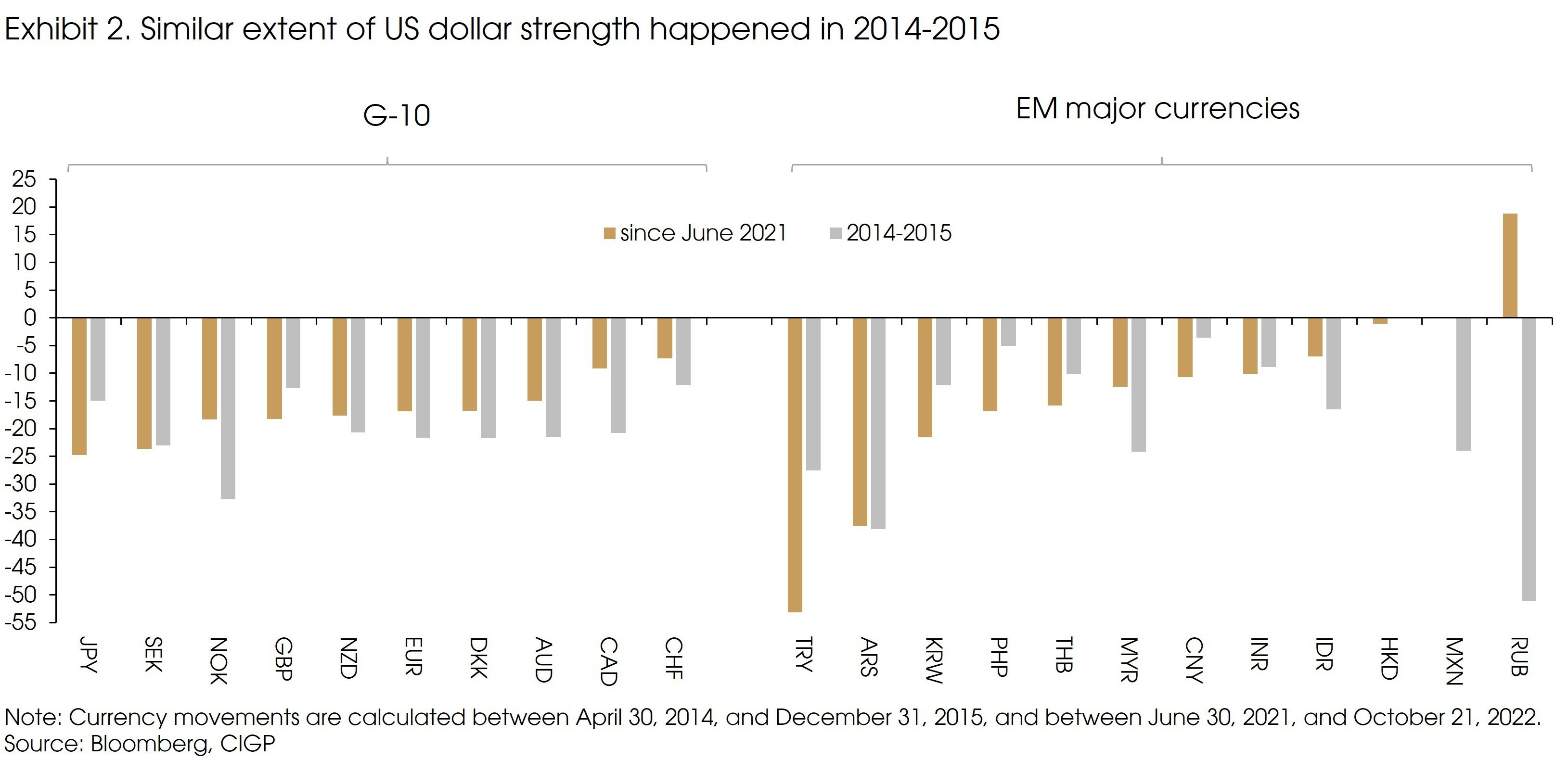

A similar US dollar rally happened during 2014-2015, when the Fed started the last tightening cycle (Exhibit 2).

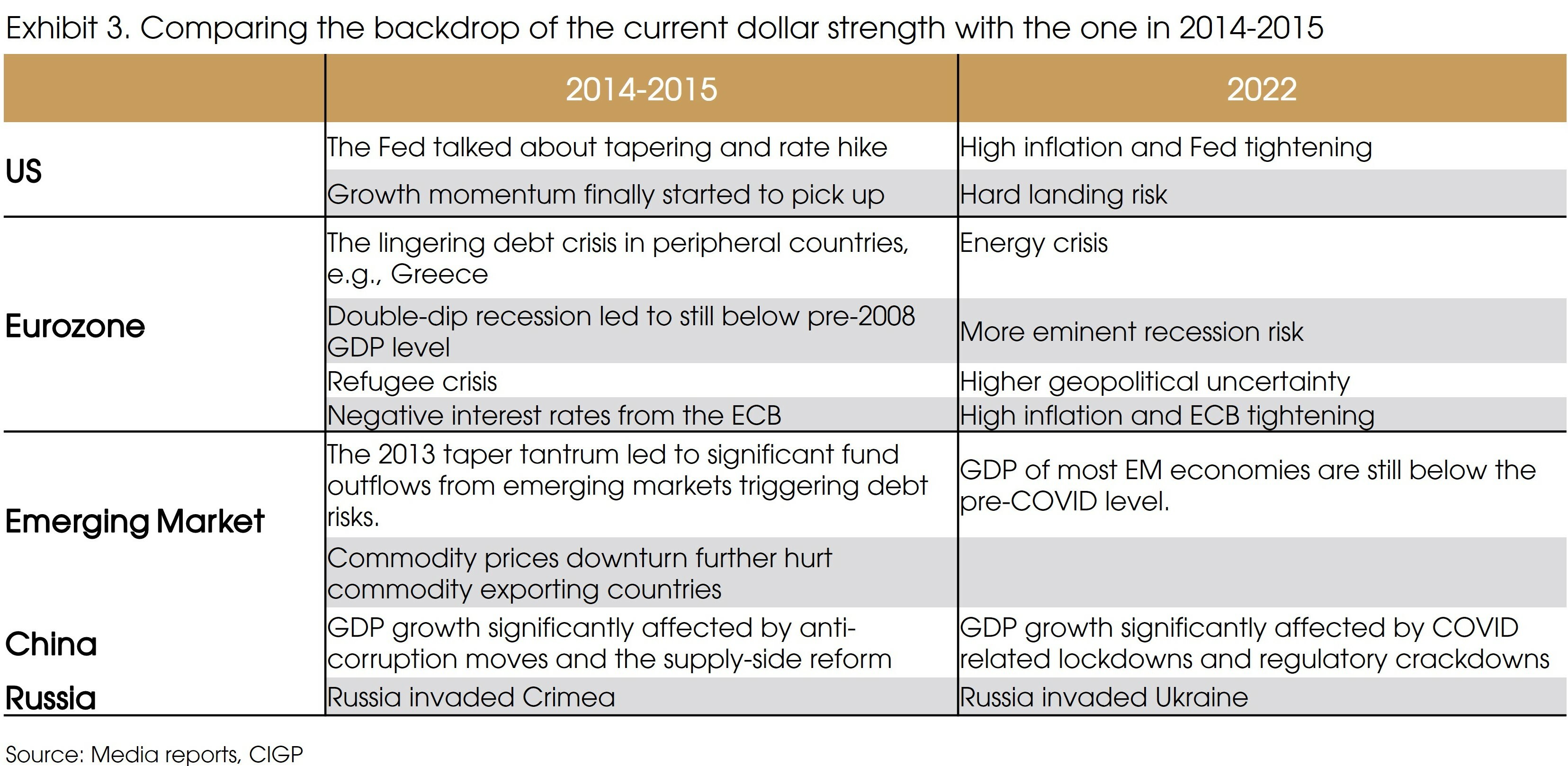

Apart from the widening yield gaps, the 2014-2015 dollar rally shares another similarity with the current situation: The US economy is more resilient than other major economies.

Back in 2014, the US economy started gaining momentum after the 2008 recession, the US GDP recovered to 6% above the pre-crisis level, and the Fed started to send tightening signals.

On the other hand, the Eurozone economy had not fully recovered from the double-dip recession, with its GDP still down 2% from the pre-recession level. The ECB cut interest rates to negative territories for the first time to restore growth momentum.

In 2015, the Greek debt crisis endangered the euro. The refugee crisis triggered political divergence among European countries and led to the rise of populists/Eurosceptics parties, increasing political instability in the region.

Meanwhile, emerging market economies were affected by the Fed taper tantrum of 2013. Latin American debt issues re-emerged while the Chinese economy was significantly affected by the anti-corruption movement and supply-side reform. Geopolitical tension then rose as Russia invaded Crimea.

Sounds like a déjà vu? The current global backdrop mirrors the start of the previous Fed tightening cycle in many aspects (Exhibit 3). Instead of the debt and banking system crisis, Europe suffers an energy crisis and a more imminent recession. The pandemic harshly affected emerging market economies, especially when considering rising food and energy prices. China’s prolonged COVID-zero policy became the biggest growth killer of the economy. The emerging market GDP level remains below the pre-COVID level.

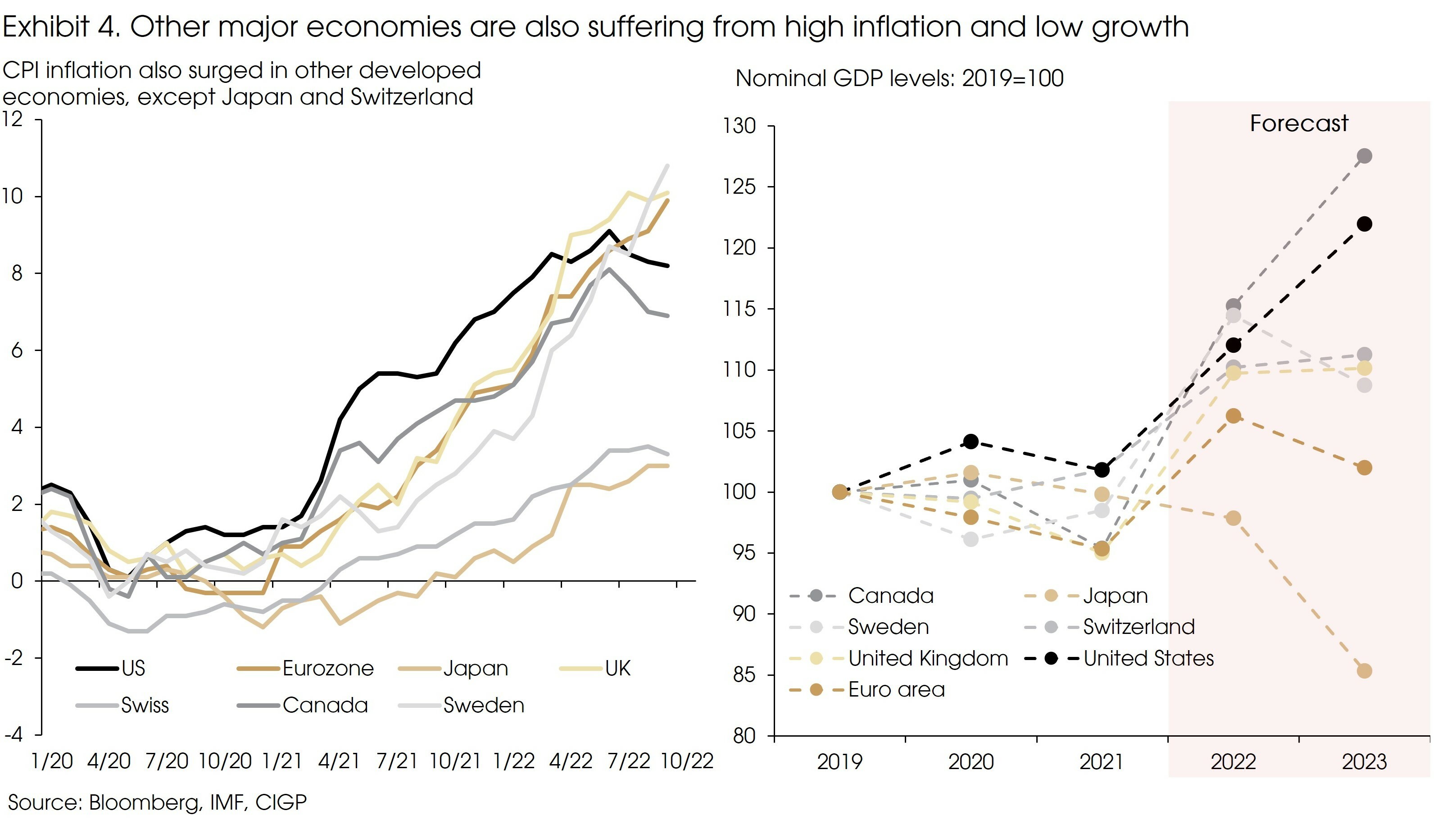

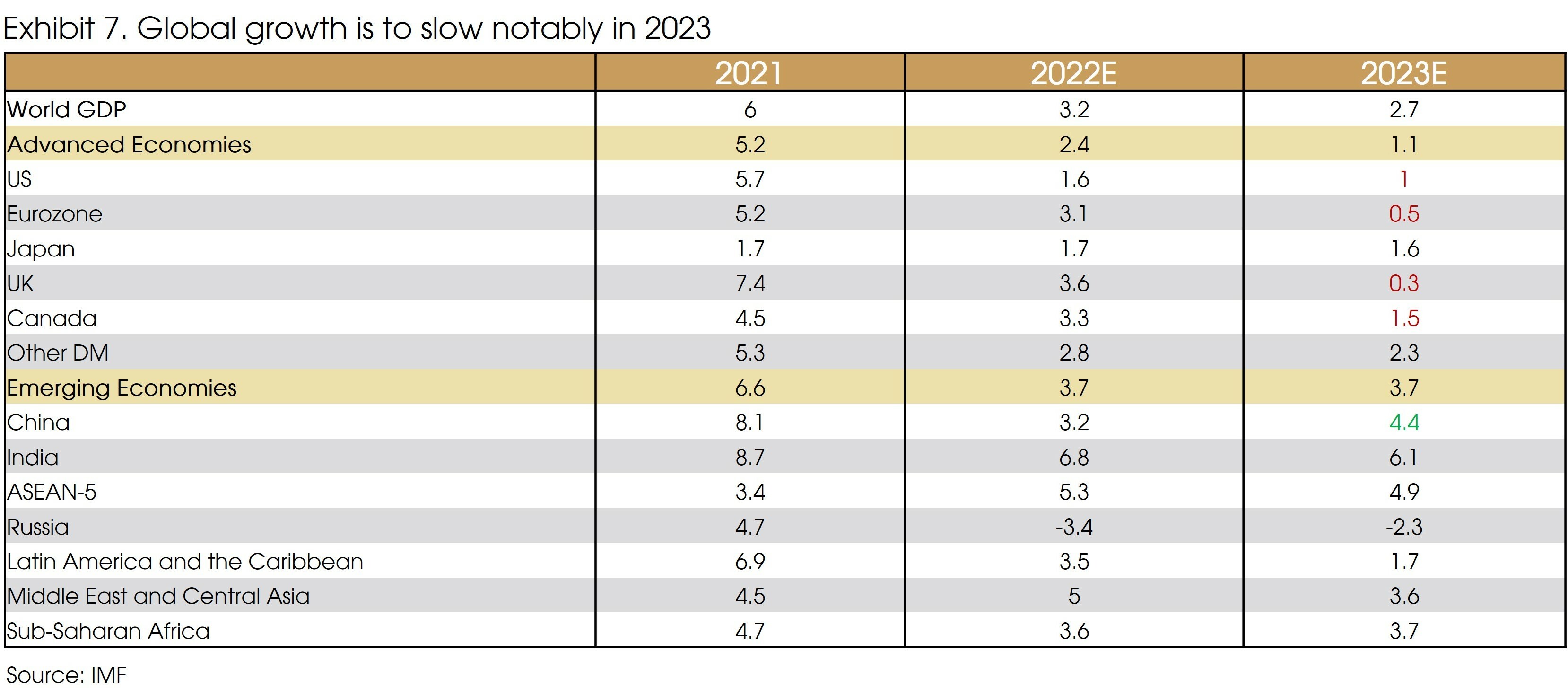

In general, the current high inflation is affecting all major economies. However, the 2023 economic forecast suggests that growth damages to the US economy are relatively milder than that of other economies (Exhibit 4).

As a consequence, if the rising interest rates finally hit economic growth, forcing central banks to pivot, the Fed is unlikely to be the first mover.

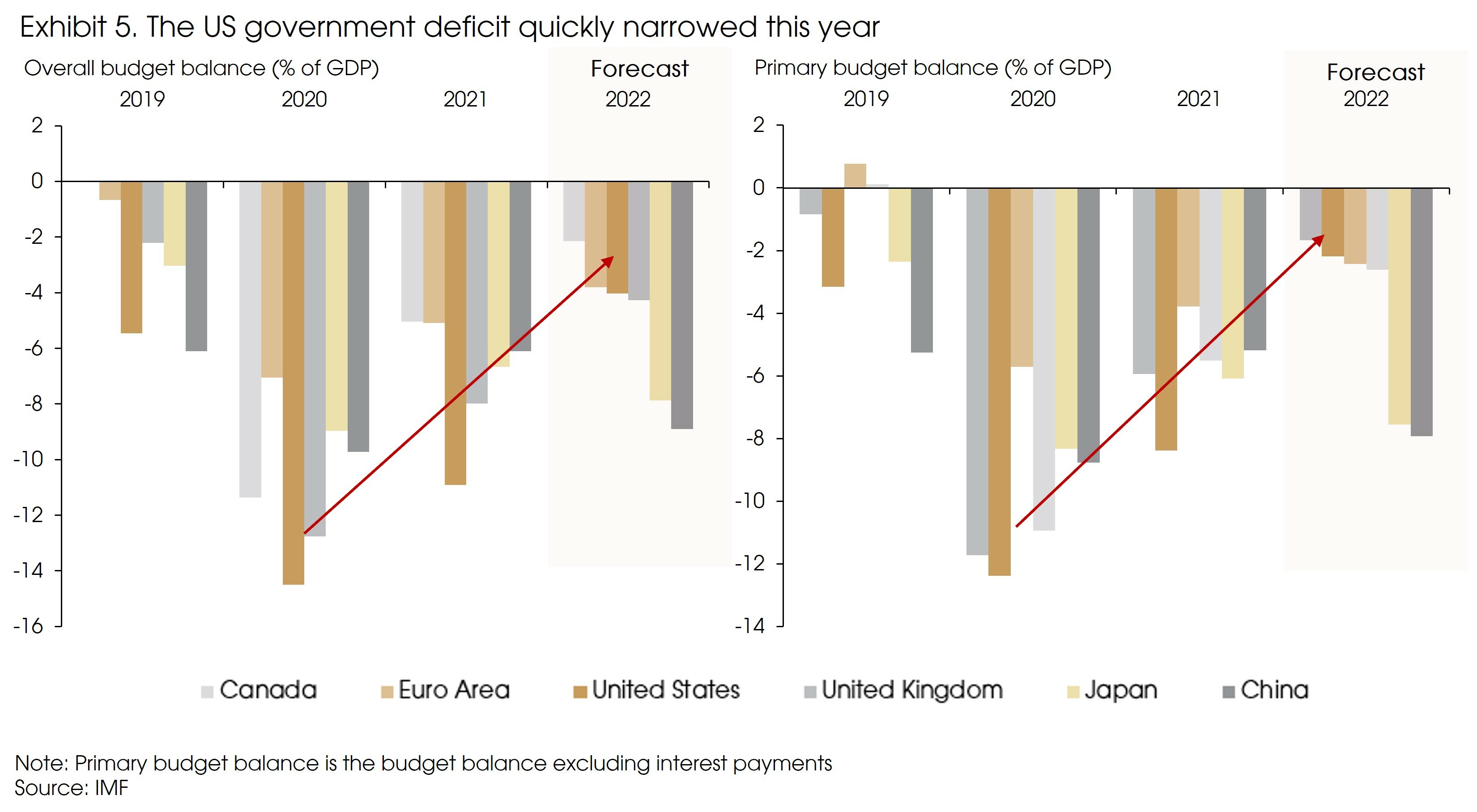

The widening fiscal deficit in the US was considered a key driver for the dollar weakness in 2020. However, the government deficit is estimated to fall significantly from 11% in 2021 to 3.9% in 2022, after the gradual exit of pandemic-related stimulus (Exhibit 5).

Overall, the current dollar strength is not only a reflection of the widening yield gaps but is also pricing in economic downturns, especially in the more troubled non-US economies.

Are we at the turning point?

Intuitively, falling US inflation and the associated slower rate hikes from the Fed should narrow the yield gaps, bringing downward pressures onto the US dollar.

US inflation has been stickier than expected, mainly due to the high service prices. That said, headline inflation will fall even if the monthly inflation rate stays at the current level (0.4% in September 2022), as the high base effect will factor in and bring the headline CPI down to around 6% in 1Q 2023.

In our view, such a significant inflation decline should result in smaller rate hikes, if not a halt.

The US economy is also on the edge of a downturn, as suggested by the deeply inverted yield curve. The 10year-2year yields have been inverted since July, and the 10year-3month yields (a more sensitive indicator for recessions) inverted in end-October.

Several Fed members already talked about a potential “stepping down” of rate hikes, such as the San Francisco Fed President Mary Daly and the Kansas City Fed President Esther George.

All the above suggests that we are already close to the peak of the tightening cycle. The lack of market reactions following the latest strong US employment and CPI data also suggests that further upside of the dollar should be limited.

However, a peak of the tightening cycle and the limited upside does not guarantee a weakening trend of the dollar.

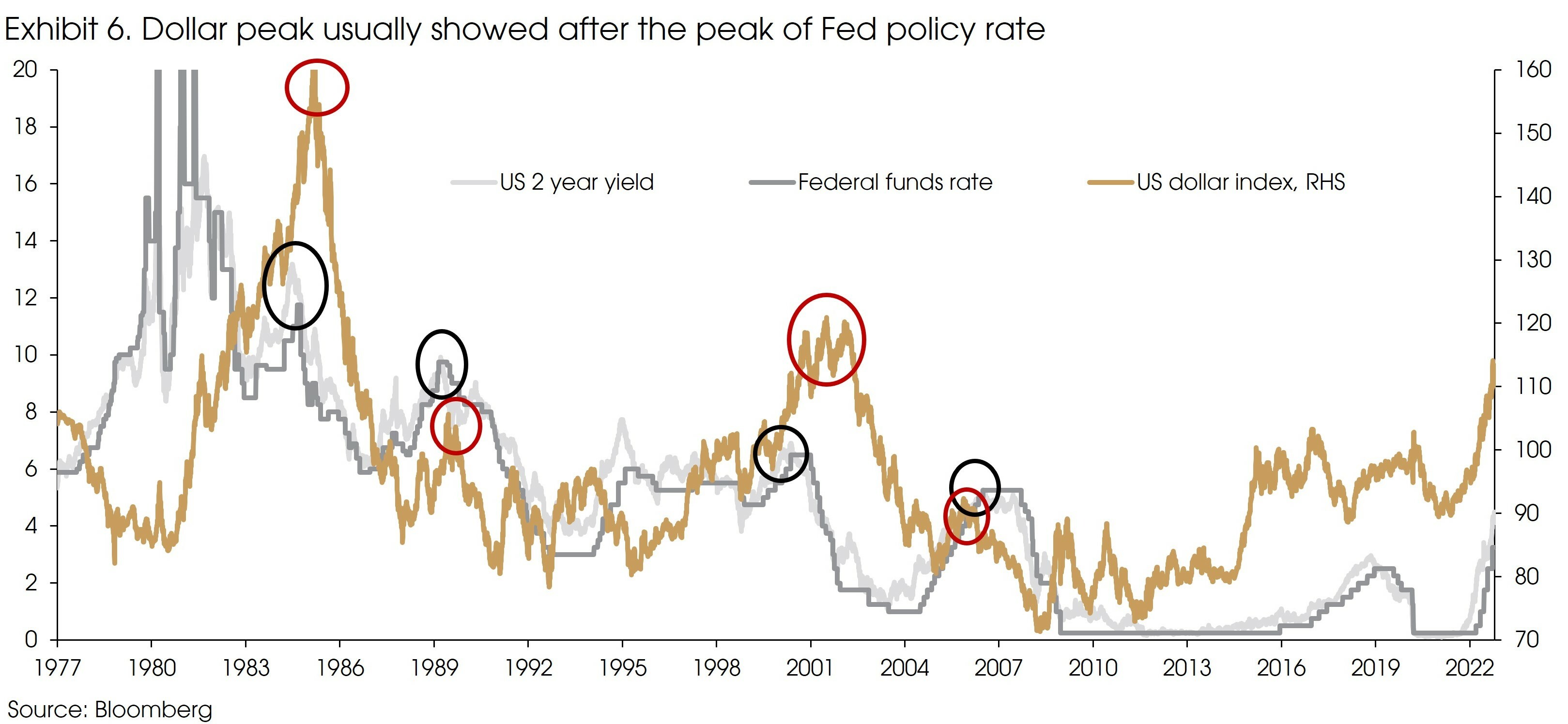

Historically, the downtrend of the dollar usually emerges after the peak of the Federal funds rate or the 2-year interest rates, but there have been exceptions to this observation (Exhibit 6).

For example, in 2019, the Fed unexpectedly ended the hiking cycle and started to cut rates, US yields fell (yield gaps narrowed), but the dollar remained strong throughout the year. The main reason was that other economies remained weaker than the US.

In light of all the above, we still see downside risk on the EUR/USD rate in the near term. The Eurozone economy is entering a recession, as reflected by significant contractions in economic activities. The sharp decline in gas prices is likely to cushion the depth of the recession, but the risk is to the downside due to lingering concerns about gas supply availability. We expect to see a meaningful rebound of the euro in 1H 2023 after the winter downturn.

Meanwhile, the Japanese yen remained weak, even after several interventions from the Bank of Japan (BoJ) to support the currency. However, after easing the COVID-related border restrictions, the increased tourism spending should contribute to higher economic growth. The current BoJ governor, Haruhiko Kuroda, will reach the end of his term in April 2023. There is a chance that the central bank may tighten monetary policy after the Kuroda era.

Finally, a recovery in emerging markets growth will also contribute to an improving risk appetite and better global outlook, pressing the dollar to weaken, mirroring the 2016-2017 situation.

According to the IMF forecast, emerging markets, especially Asia, will have more resilient growth than developed economies (Exhibit 7). China’s growth is expected to pick up after the trough in 2022. The better-than-expected economic growth in 3Q generally supports such predictions. Even if the COVID-zero policy remains in place, the accommodative monetary and fiscal policies may still support the Chinese economy by increasing fixed asset investment.

In conclusion, a Fed pivot will help but cannot guarantee a reversal in the strong dollar trend. At current levels, we see limited upside for the US dollar against other currencies and would only expect a meaningful reversal of the dollar's strength when global growth improves in 1H 2023.

Plaza Accord replay? Probably no.

The powerful rally of the dollar and the multiple interventions from the BoJ to support the yen led to increased namechecks on the 1985 Plaza Accord. However, we do not expect to see a coordinated intervention to happen today.

The global foreign exchange market daily turnover increased more than 10 times from USD 539 billion to USD 6,595 billion (according to the Bank of International Settlement). It is now much more complicated to enact coordinated interventions than what it was in the 1980s.

In addition, the Plaza Accord was initiated by the US as the strong dollar hurt its economy and more specifically its exports. The US trade deficit widened from USD 13 billion in 1980 to USD114 billion in 1985. Major export sectors, such as farmers/grain exporters, the auto industry, machine manufacturers (e.g., Caterpillar Inc.), and technology companies (e.g., IBM and Motorola) responded by running high-profile campaigns to ask for protectionist policies.

Currently, the US economy has become less reliant on the manufacturing sector and exports. Manufacturing’s share of GDP decreased from 20% in the early 1980s to 11% in 2020. Besides, the current dollar strength comes along with high commodity prices, which has notably hurt traditional exporters such as Japan and the EU.

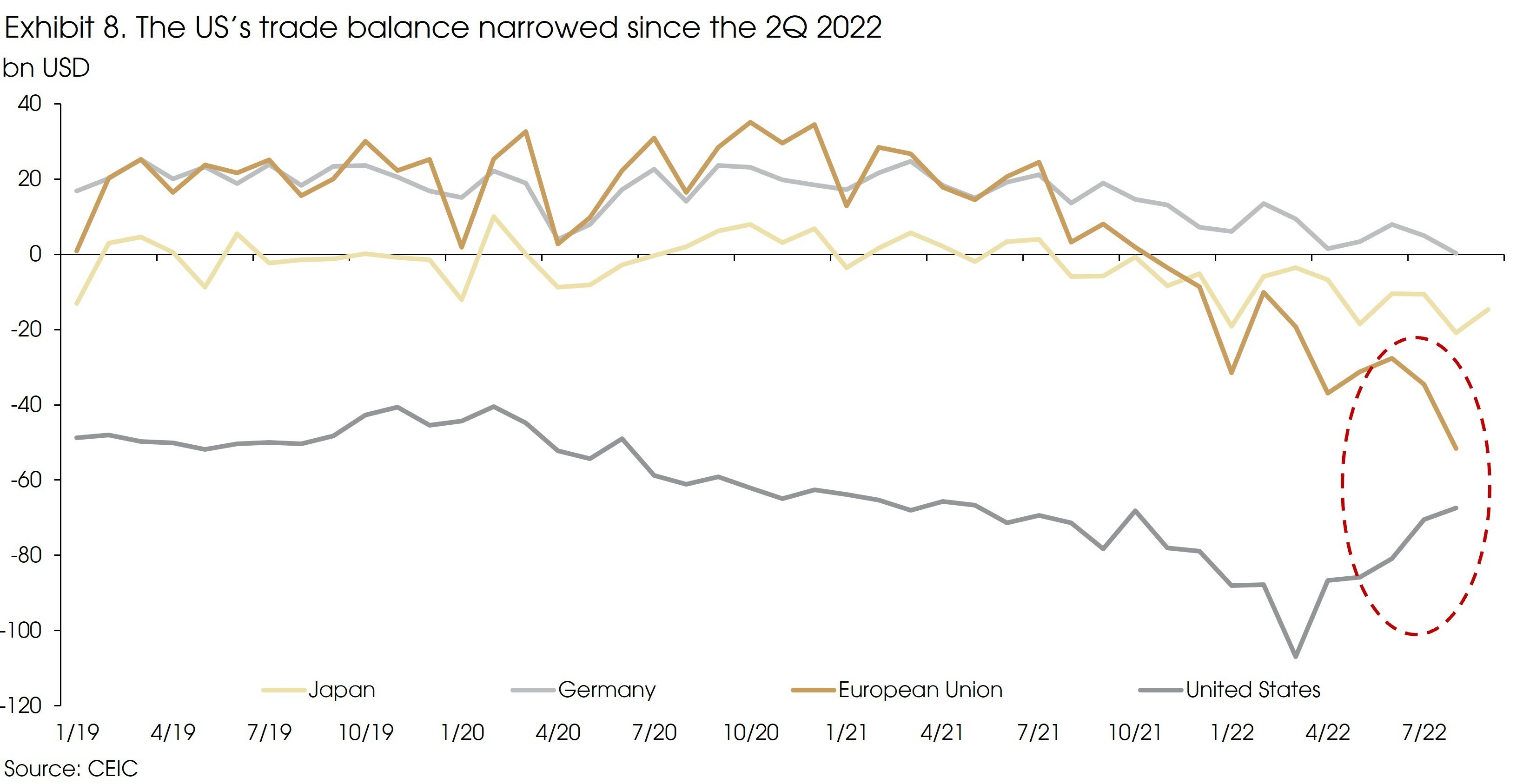

(Exhibit 8) The trade surplus in Germany disappeared due to surging energy prices. The EU’s trade balance has turned negative since November 2021. The boost that Japanese exporters enjoyed when the yen’s slide began last year has diminished, offset by surging raw materials prices. The US, however, generally benefited from its energy independence and lower import prices, leading to a narrowing trade deficit.

Secretary Yellen’s comment on the dollar as the “logical outcome” of different global monetary policy stances in early October also sent messages that the US government is quite comfortable with the strong dollar.

Is the dollar replaceable in the long run?

We are aware that investors may want to diversify and reduce their exposures to dollar assets, as recent geopolitical tensions and associated sanctions increased the risks of holding the dollar.

However, as long as dollar assets or the underlying US economy still offer the most compelling investment opportunities, such diversifications will not challenge the dollar dominance.

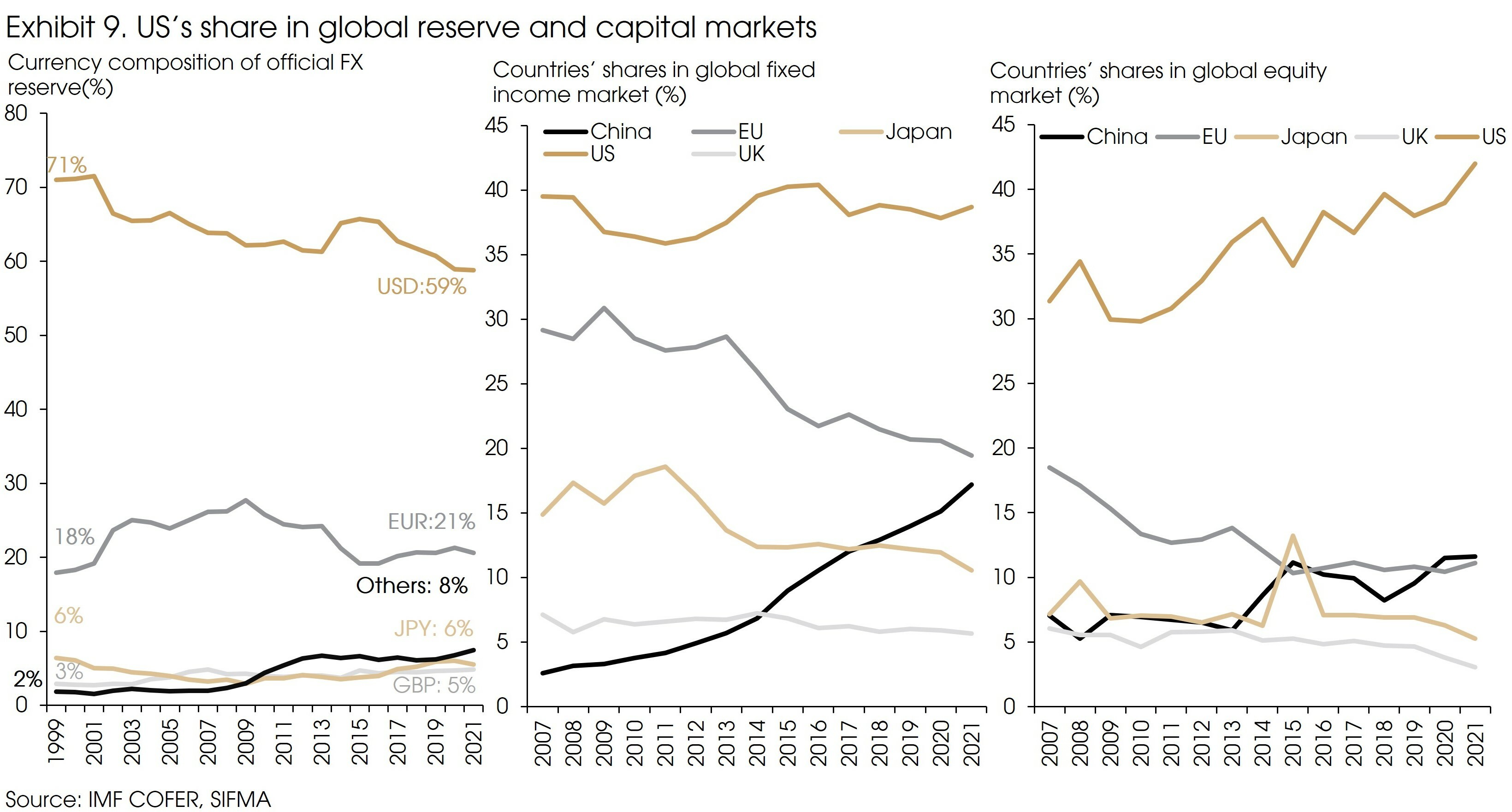

(Exhibit 9) The US comprises 38.7% of the USD 127 trillion global fixed-income markets, twice the next largest EU market. The US’s share in the global equity market (USD 124 trillion) increased from 31% in 2007 to 42%, around 3.6 times the next largest market, China.

The US’s share in the official reserve has decreased from 71% in 1999 to 59% in 2021 but remains more than twice the next largest euro reserve. According to SWIFT, the dollar’s share in global trade settlement has remained stable at around 40% in the recent decade.

Looking forward, we see stronger cases of dollar alternatives in trade settlements and official reserves. For example, Russia increased its RMB reserve from 17% at the beginning of this year to 30%. Given the more turbulent geopolitical landscape, we expect to see a regionalization shift in global trade, potentially promoting the use of regional currencies, such as the euro.

Nonetheless, currency demand from trade and reserve only amounts to around USD 112 trillion, less than half of the size of the global capital market (fixed income and equity). The dollar dominance in the capital market is currently tough to challenge.

The US capital markets are not only the largest in the world but also the deepest, most liquid, and most efficient. The US economy grows at around 2% annually, higher than most other developed economies. US companies lead in many industries, such as technology, pharmaceutical, biotech, and financial services. The most efficient market combined with strong underlying growth will continue to offer the largest set and possibly most compelling investment opportunities to investors.

One could, in the foreseeable future, see a more fractured landscape in the global foreign exchange market, i.e., the US dollar’s share may decline in a few markets. However, such declines are unlikely to be meaningful enough to challenge the dollar dominance as long as the US economy remains a hegemonic power.

Sources: Bloomberg, CEIC, IMF, SIFMA, CIGP Estimates