CIO 2023 Outlook: Entering the Post COVID Era

Author: Yao Wang and Jess Cheung | Editor: Nicolas Sioné

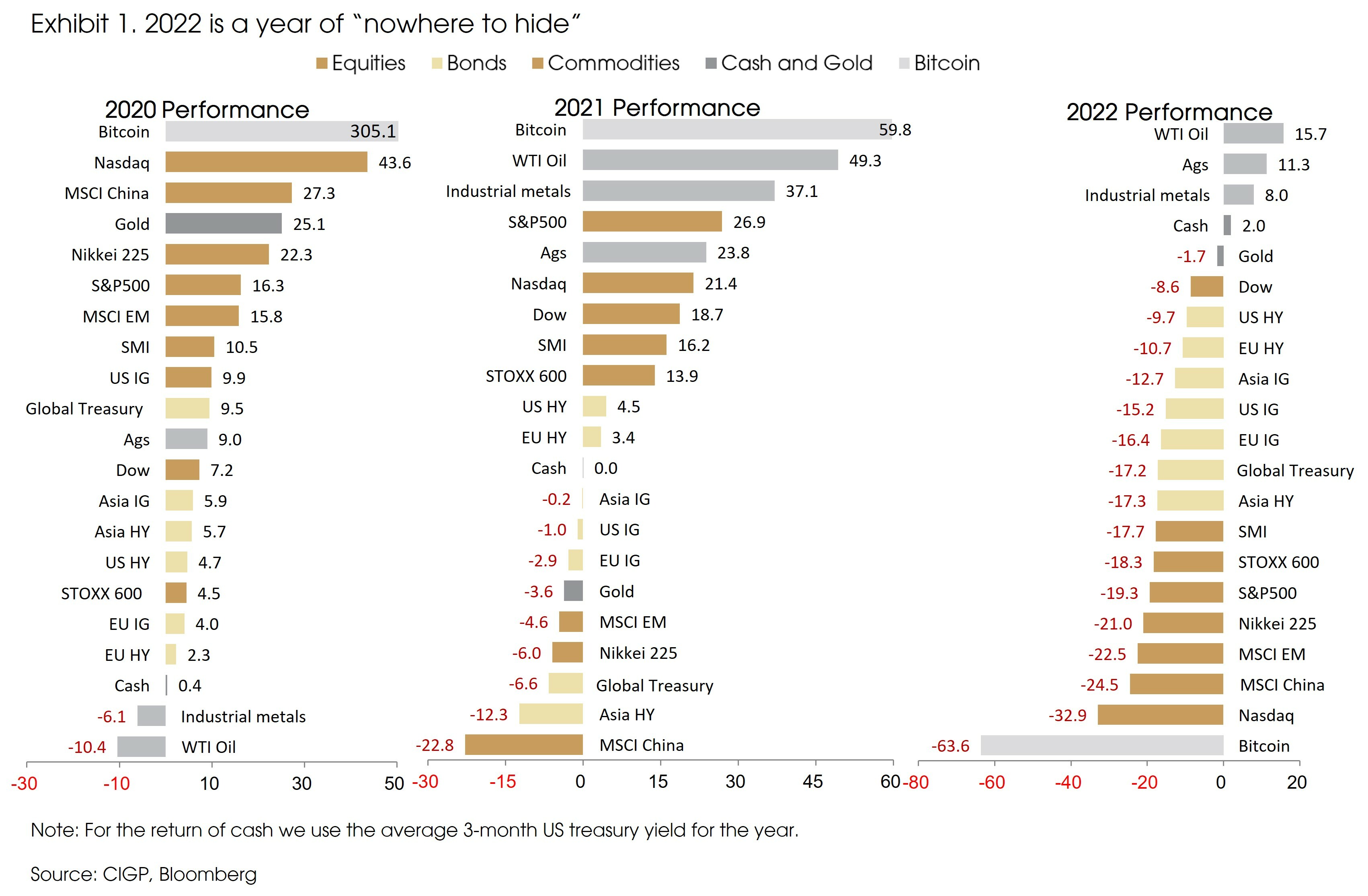

2022 has been a difficult year for investors. The war in Ukraine resulted in surging energy prices and inflation throughout the world, which forced major central banks to aggressively hike interest rates. China’s COVID zero policy imposed for the first eleven months of 2022 added to the downside risks of global economy. Increased geopolitical risks, surging inflation, and aggressive monetary tightening resulted in dramatic destruction of asset prices in 2022.

Except for some commodity prices that benefited from the war related supply shocks, such as energy, industrial metals and agriculture goods, almost every asset experienced negative returns so far this year (as of December 23rd, 2022). Given the large rate hikes from major central banks, interest rates have increased significantly, and holding remunerated cash started to make sense this year. Cash, in US dollar terms, yielded nothing during the previous years but recorded an average return of around 2% in 2022.

As China announced the removal of domestic COVID controls and scraping quarantine requirements for inbound travelers in the last two months of 2022, the world is finally entering the post-COVID era.

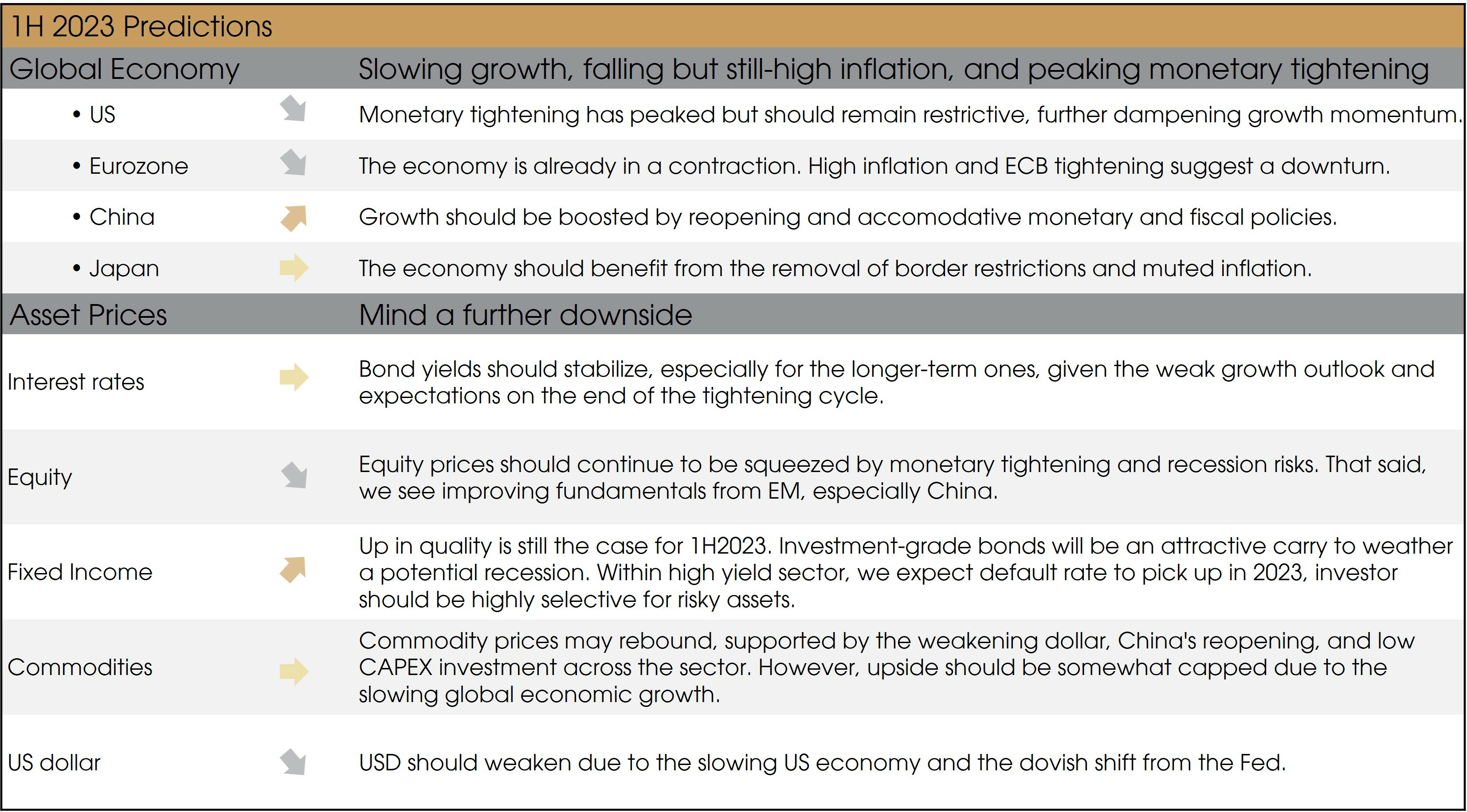

In 2023, we expect to see a further slowdown in global growth, mainly dragged by the significantly increased interest rates, but no severe recessions among major economies are expected.

Inflation should decrease meaningfully (especially in the US and in Europe) due to the economic slowdown and continued supply side recoveries. Declining inflation will lead to the end of central bank rate hike cycles.

The weakening economic growth and declining inflation are both positive for high-quality bonds. On the other hand, equity prices could be negatively affected by a potential sustained economic downturn. We have therefore turned positive on investment grade bonds, but remain cautious on equities.

Slowing growth momentum to continue in 1H 2023

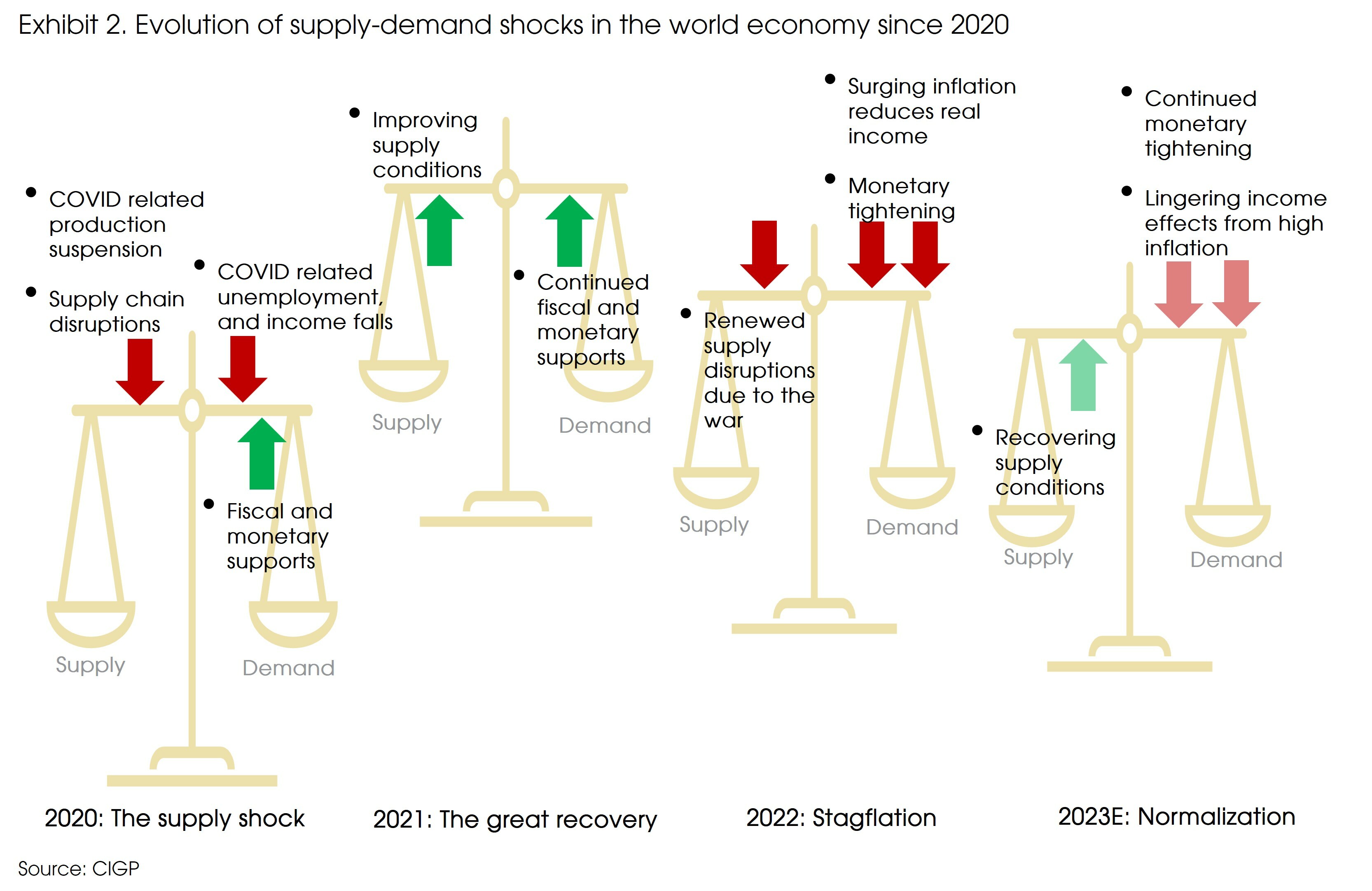

The world economy has been through multiple supply and demand shocks since 2020, such as the pandemic related lockdown and supply chain disruptions in 2020 and 2021, the Russia-Ukraine war, and the aggressive monetary tightening from major central banks this year.

Specifically, the multiple supply shocks with the large fiscal and monetary stimulus led to decades-high inflation in many economies, including the US and Europe.

Central banks reacted to surging inflation pressures with aggressive rate hikes led by the Fed, ending the zero/negative interest rate era of the past decade. Monetary tightening and high inflation (reducing real income) both created significant drags from the demand-side.

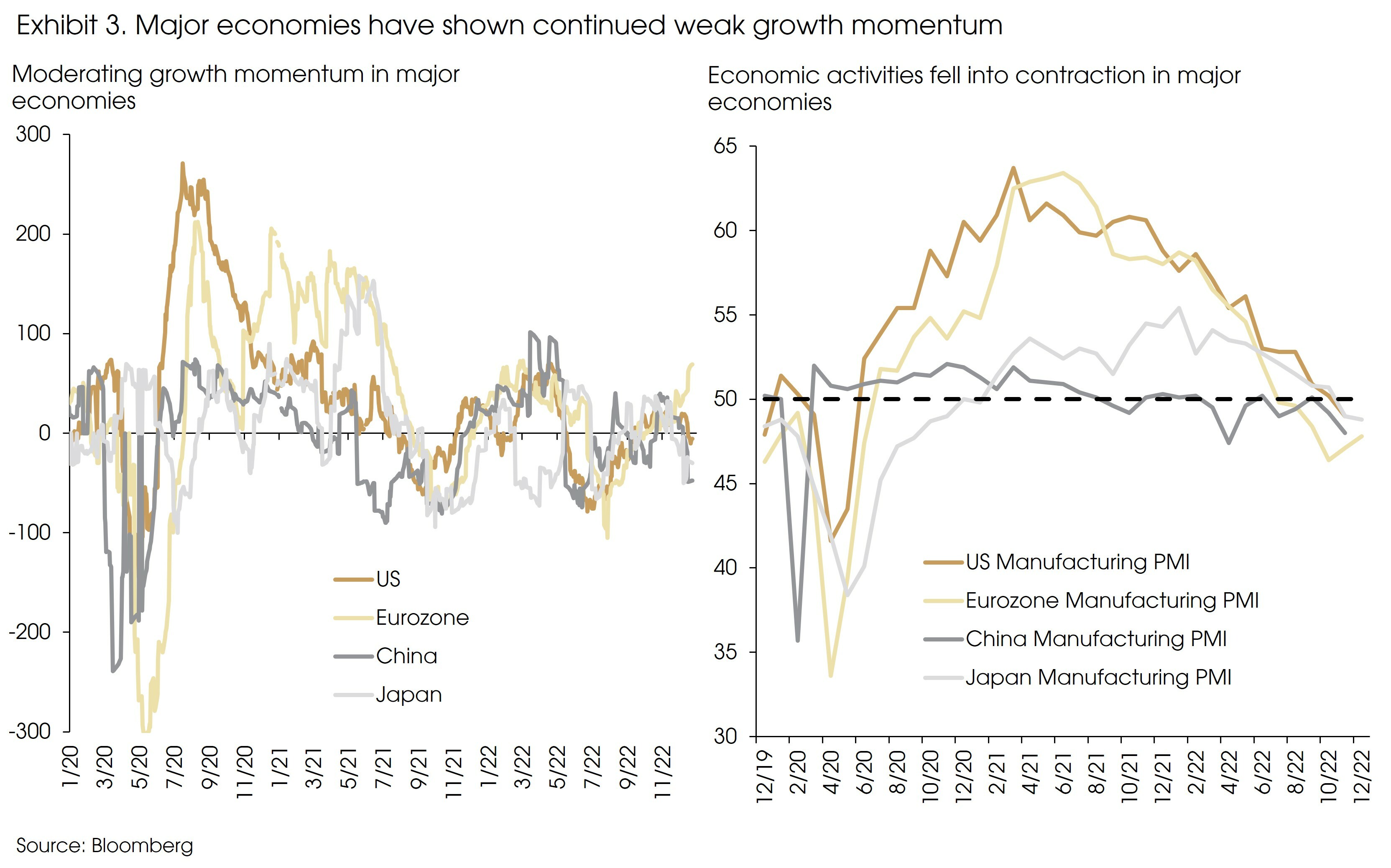

Therefore, negative supply and demand shocks led to moderating growth momentums this year: Economic data surprised to the downside since 2Q, and economic activities (indicated by manufacturing PMI) fell to contraction territory in major economies (Exhibit 3).

Going into 2023, we expect growth momentum to weaken further as the elevated inflation and monetary tightening persist as the key drags from the demand side, at least for 1H. The weakening growth may result in mild recessions in the Eurozone (probably already in a recession in 4Q 2022) and the US.

We do not expect to see severe recessions. Compared to previous economic cycles, the expansionary fiscal and monetary policies in 2020 and 2021 have not resulted in overheating among major economies.

Output in the US and Eurozone is still in line with or under its potential levels, partially due to periodic supply disruptions during the past three years. Despite the strong economic recovery experienced in 2021, US employment (measured by nonfarm payroll) only returned to its pre-COVID level. Capex in the global mining sector also remained low.

Without overheating in economic activities, we do not see significant debt problems (usually caused by over-spending/investment and over-borrowing) in private sectors among both developed and emerging market economies. The sound fundamentals should limit the downside of a potential recession.

China and Japan had weaker policy stimulus and a slower reopening process than that of the US and of the Eurozone. Japan removed most of its COVID restrictions in late October 2022while China just announced the removal of such restrictions in January 2023. Therefore, Japan and China had weaker growth in 2022, and inflation remained muted in both economies. We expect Japan and China to benefit from the reopening boost and a more favorable policy backdrop going forward. Growth momentum should start to improve in 2023.

Falling inflation and peaking monetary tightening

Inflation in the US and Eurozone already showed moderation due to continued supply-side normalization and aggressive monetary tightening (which reduced aggregate demand). We expect inflation to come down further in 2023.

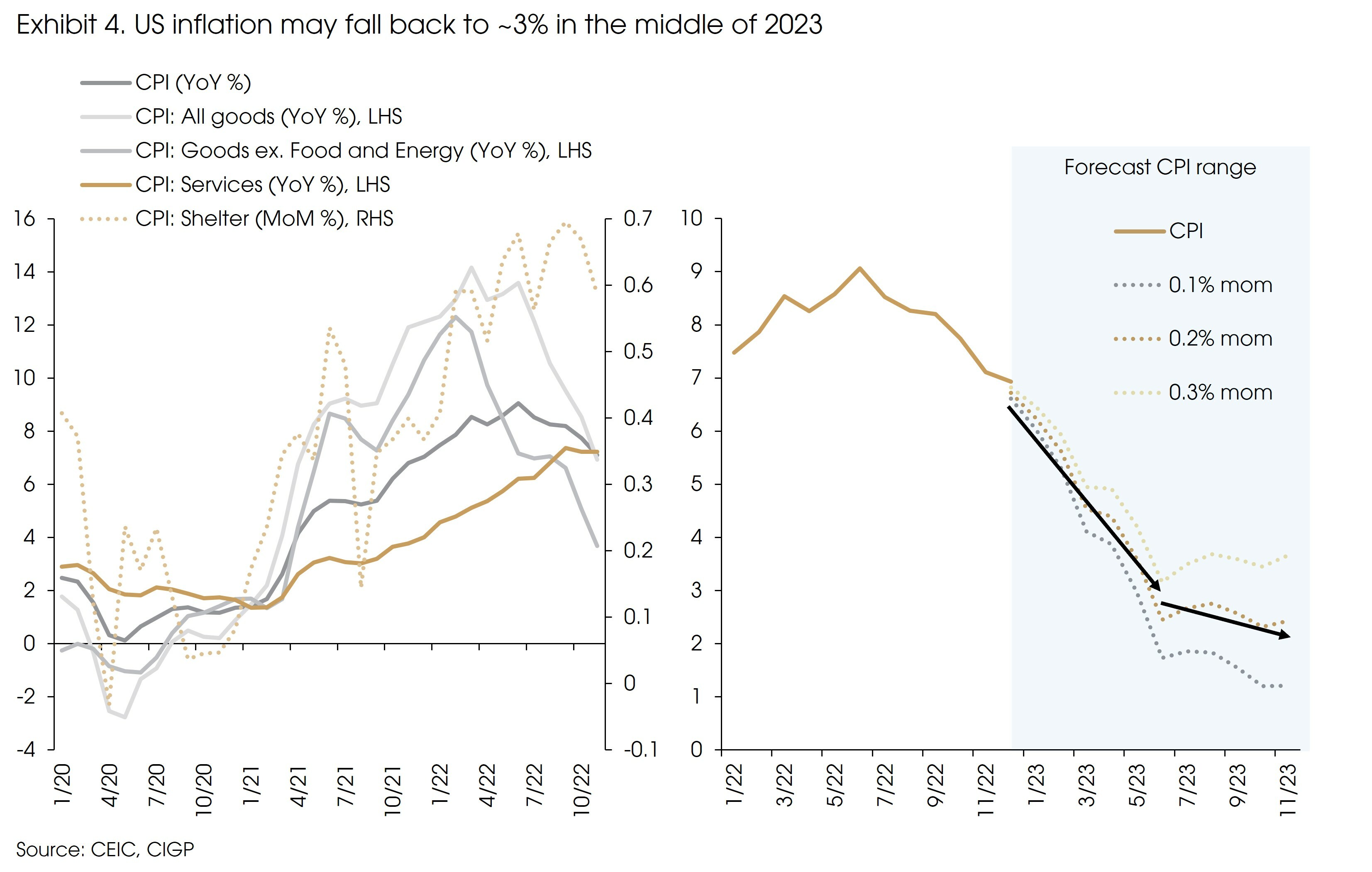

In the US, CPI inflation fell from 9.1% in June to 7.1% in November this year, mainly driven by decreasing goods inflation.

The stickier services inflation has also shown signs of moderating in 4Q (Exhibit 4). The monthly shelter inflation stabilized at around 0.6-0.7% mom in 2H 2022. Although year-on-year shelter inflation may continue to rise in 1Q 2023, it is set to slow thereafter.

Historically, inflation pressure usually recedes quickly after peaking. It has seldomly formed a round top.

In case of a mild recession in the US, we expect monthly CPI inflation to average between 0.2-0.3% mom next year (slightly above the pre-pandemic average of 0.2%). The High base effect from this year will result in quick inflation abatements in 1H 2023, which may reach around 3%, then further decline to 2.5% towards the end of 2023 (Exhibit 4).

That said, even with this relatively optimistic inflation outlook, we do not expect the Fed to pivot from tightening to easing. The 3% (or even 2.5%) inflation is still higher than the 2% target. As we do not expect to see a severe recession in the US economy, there is no need for the Fed to cut rates.

However, the significant fall in inflation should be enough for a halt in rate hikes. We expect the Fed to switch to smaller rate hikes in 1H to bring the federal funds rate to 5-5.25%. Then, it may stop hiking and keep the policy rates unchanged for the rest of 2023.

For the same reason, i.e., a mild recession and still elevated inflation, the ECB should continue to hike at least during 1H 2023. Moreover, as Europe took a harder hit from the energy shortage, inflation could remain higher for longer than in the US. The ECB may continue to hike after the Fed’s hiking cycle ends.

In sum, inflation should continue to fall, but it is still too early to expect monetary easing from major central banks. The Fed and the ECB will continue to hike over 1H 2023 and will likely maintain the tightening stance throughout 2023.

Turning positive on investment grade bonds

Against such a backdrop, Investment Grade bonds should show resilience for both US and European markets in 2023. The shift of the Fed’s pivot is likely to set the tone for the markets in 2023.

2022 was an eventful year for the credit market, as we experienced one of the worst years for fixed-income markets. Bond yields have risen sharply. The yield curve has been deeply inverted since July, signalling a looming recession.

Moving into 2023, up in quality is still the case for 1H2023. We believe that investment-grade bonds will be an attractive carry to weather a potential recession. We prefer high quality bonds than high yield and loans.

On the monetary policy front of the US market, we are already in the late stage of a hiking cycle where the Fed has increased fed fund rates from 0-0.25% to 4.25-4.5% since March 2022. Given that much of the bad news is already priced in, this leads to a brighter outlook for the IG market next year.

In the European market, the ECB is expected to lag the Fed in regard to shifting pivots. The ECB has set an earlier and more aggressive schedule for Quantitative Tightening (QT) next year, this will be the key headwind in 2023. However, the valuation of Euro IG already reflects the majority of the risk. The strengthening in EUR will be the tailwind to support the performance of EUR IG credits in 2023.

Flows into investment-grade funds should switch from big and consistent outflows in 2022 to inflows in 2023. We already see some moderate pick-up in fund flows of the IG market.

Credit spreads performance will very much depend on what the recession looks like. Credit spreads should be less sensitive to the risk of a mild recession but more sensitive to the risk of a severe recession. Under a base case, the credit spreads will be stable in 1H2023 given that the upcoming recession is more likely to be shallow.

Based on historical recession cycles, IG bonds always outperform other asset classes in the first phase of recession. The positive correlation between bonds and equities was a clear burden for bond investors in 2022. We expect the correlation to normalize when a recession takes place for bonds to eventually regain their diversification benefit in 2023.

High Yield bonds in general are more sensitive to credit risk than duration risk. Moving into 2023, we expect credit pressures to intensify due to recession risk, especially for loan issuers. Loan issuers will find it more difficult to pass through high input costs to consumers struggling with rising prices and a recession in 2023.

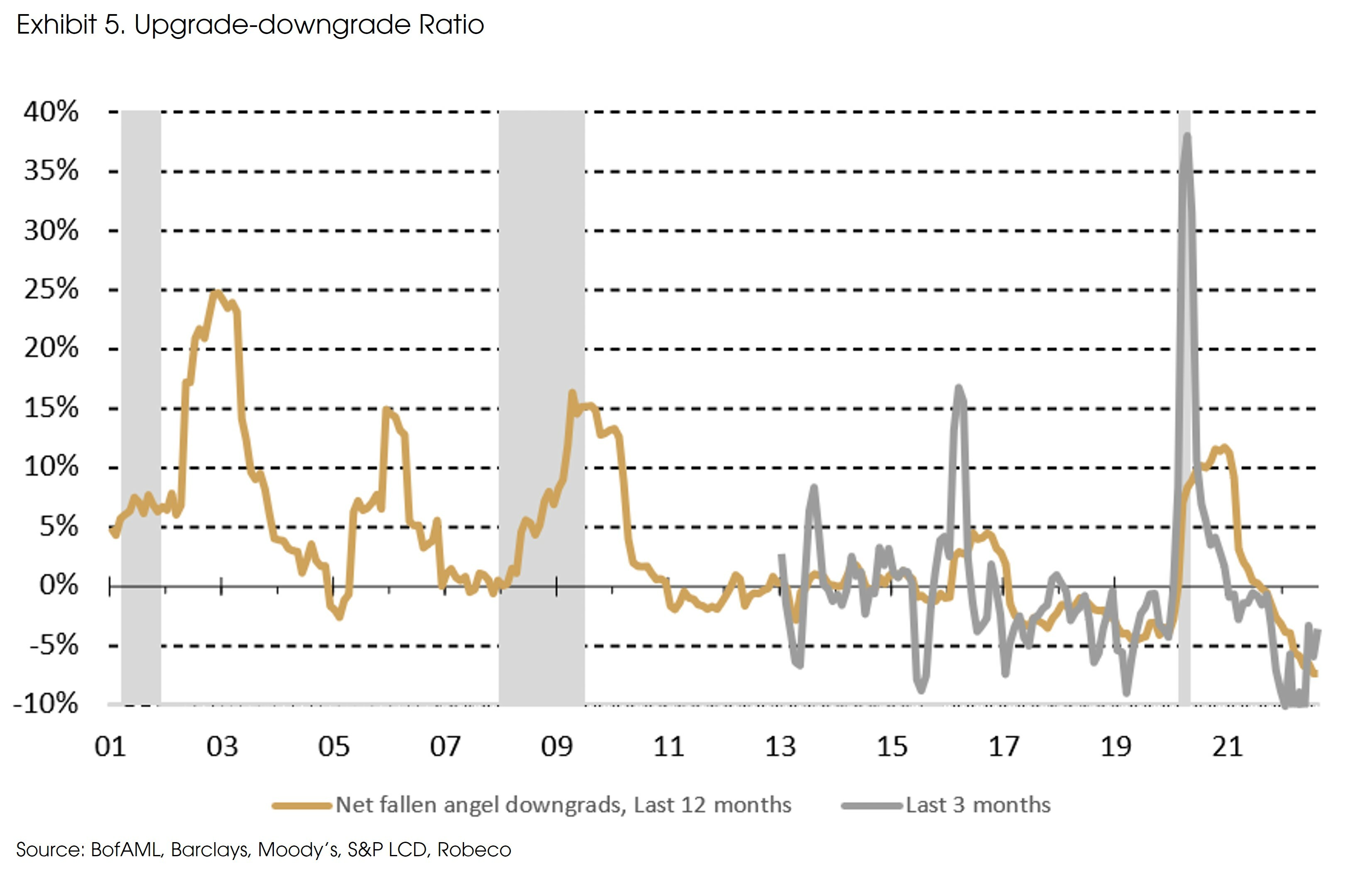

Default rates of the high yield sector will pick up in 2023. Currently, rising stars still outweigh fallen angels, however, the upgrade/downgrade ratio has started to deteriorate. This is one of the signs of credit quality weakening.

The global speculative-grade corporate default rate was 2.6% as of the end of November according to Moody’s. If the Fed downshifts policy tightening next year, the default rate will climb to the 4-5% range next year. Investors should be highly selective within risky assets.

Another trough in the equity market?

Most equity markets had in excess of a 20% drawdown so far in 2022, affected by aggressive rate hikes, slowing economic growth, and rising geopolitical risks.

The peaking inflation and the expected end of the rate hike cycle from major central banks have led to several rallies in equity markets, with the most recent one in October-December.

We kept asking ourselves the question: Has the US equity market bottomed or not? We maintain our previous view: Not yet (see Have We Reached the Bottom of the Bear Market).

The falling inflation and smaller rate hikes from central banks are positive for equity prices. However, we see several factors that do not suggest the “already bottomed” scenario for equities, especially in the US and in Europe.

History suggests that the worst time to buy equities is when growth is contracting and momentum is deteriorating. The best time is when growth is weak but momentum is improving.

We are probably moving towards the phase of improving growth momentum in 2H 2023, but the near-term outlook is less promising. The continued weakening economic momentum in the US as well as in the Eurozone may add to concerns pertaining to next year’s earnings.

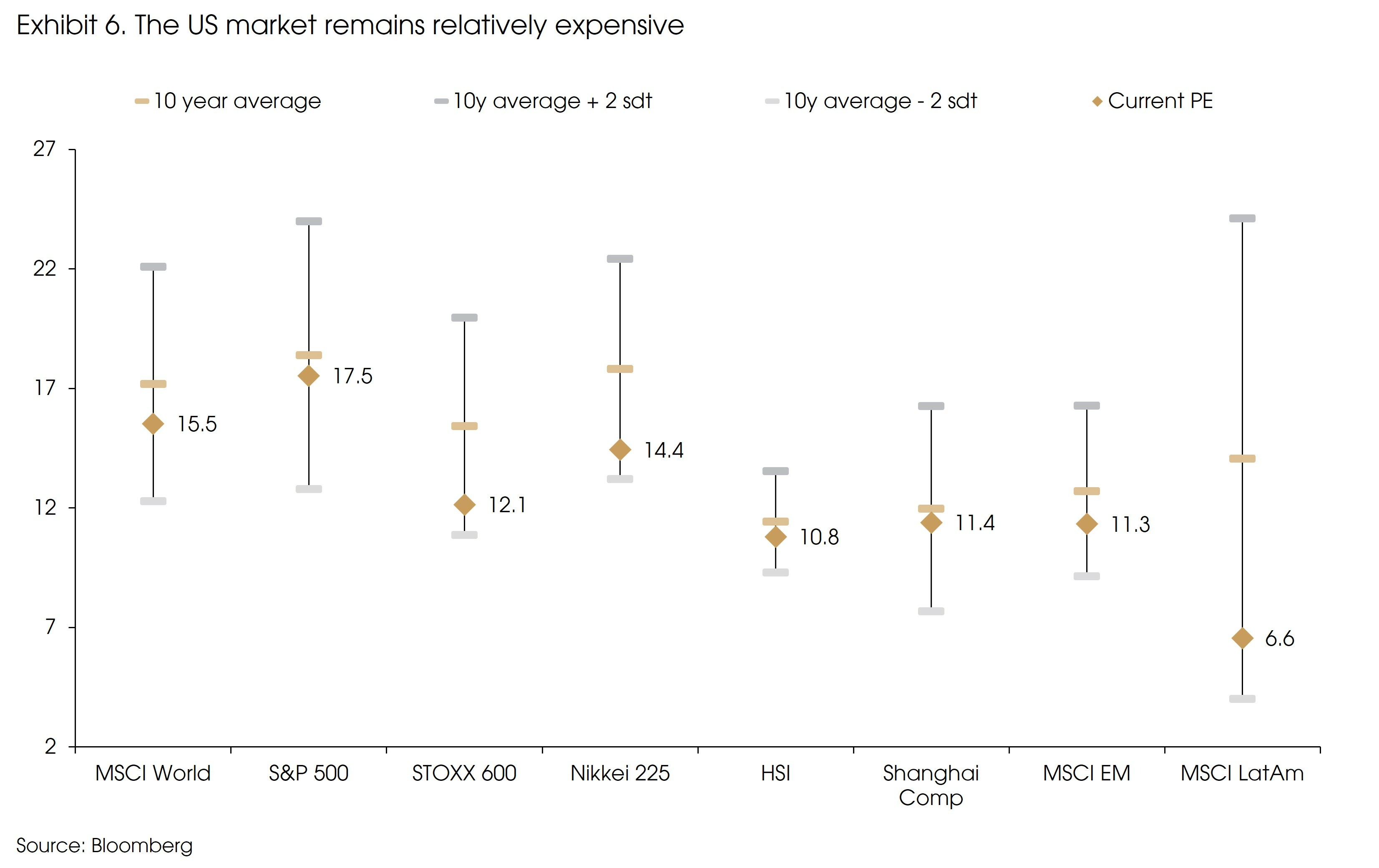

In addition, most equity markets have cheapened notably this year due to aggressive monetary tightening. However, valuations still seem stretched in the US, compared with other markets (Exhibit 6).

Another concern for the current valuation is that risk-free rates and credit markets now offer an attractive alternative to equities, as mentioned in Section 3.

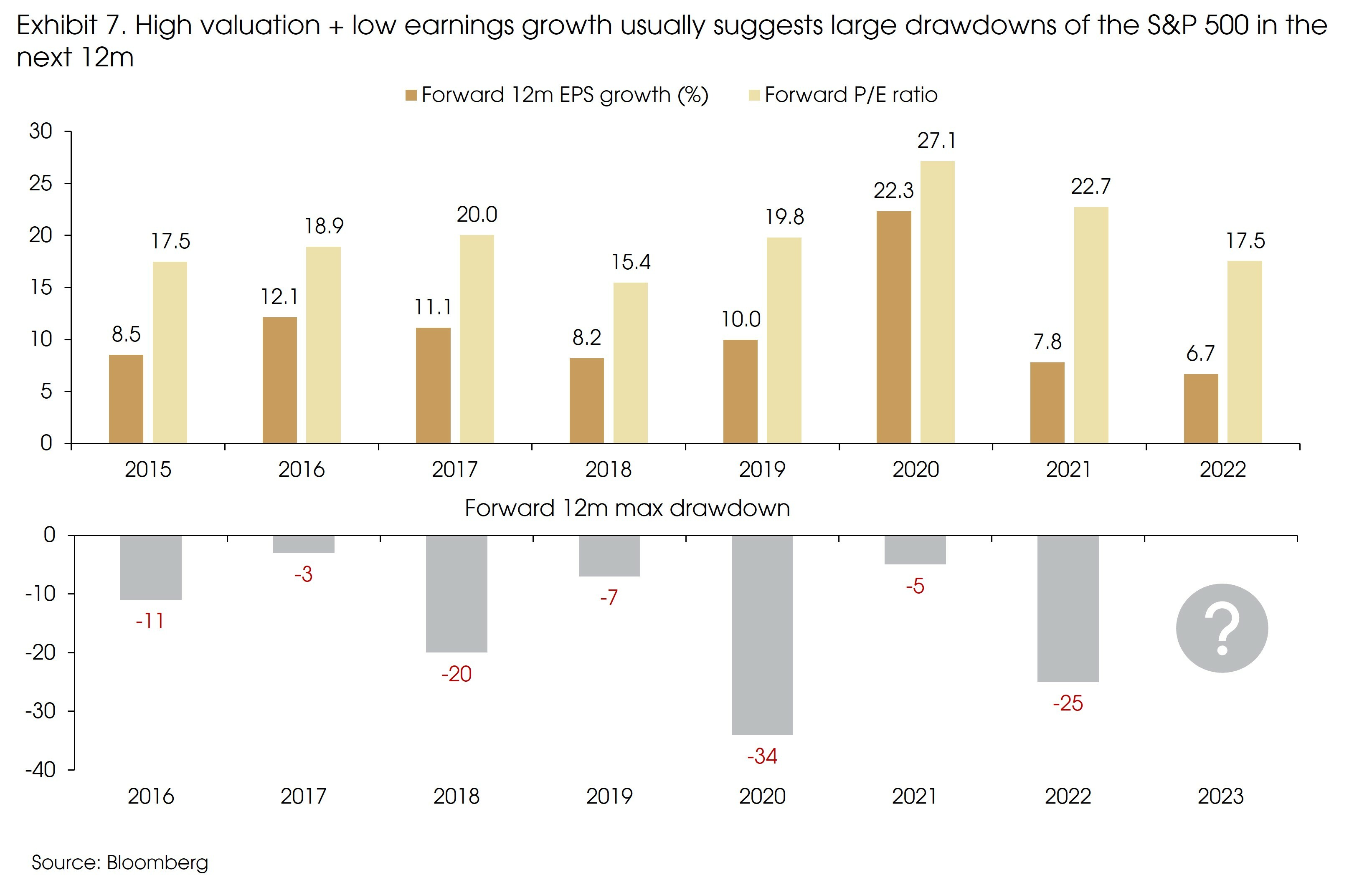

Under this much higher risk-free rate, the US market is charging 17.5x forward PE for a significantly lower earnings growth of around 6% in 2023. Such a combination of higher valuation and lower earnings growth usually leads to higher market volatility (larger drawdowns) in the next 12 months (Exhibit 7).

Finally, as long as recession risks and monetary tightening are still on the table, it is hard to make a bullish call on equities.

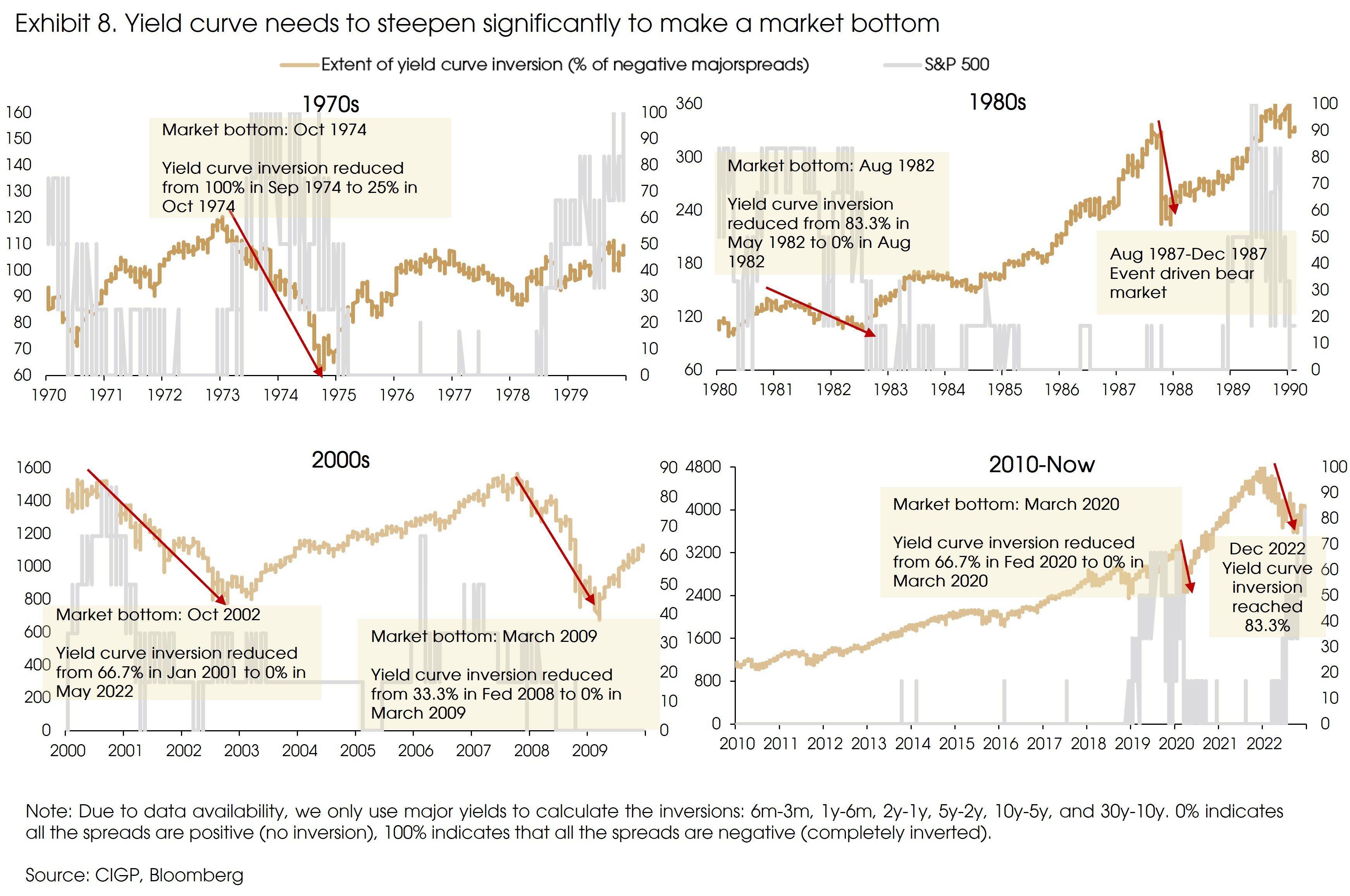

Monetary tightening and recession risks usually result in yield curve inversions. The yield curve will only start to steepen when growth momentum improves (rising longer-term yields), or monetary easing is expected by the market (declining short-term yields).

Seen from the past bear markets in the US, the following bull market always arose after the extent of yield curve inversion had significantly decreased (most yield spreads turning from negative to positive, Exhibit 8). However, currently, the US yield curve remains deeply inverted, with negative yield spreads from 6-month to 10-year, indicating another potential market downturn ahead.

Therefore, we only expect to see sustainable market rallies upon the end of the rate hike cycle or the improving economic momentum sometime in 2H 2023.

That said, we see more positive trends in emerging markets (EM), especially China.

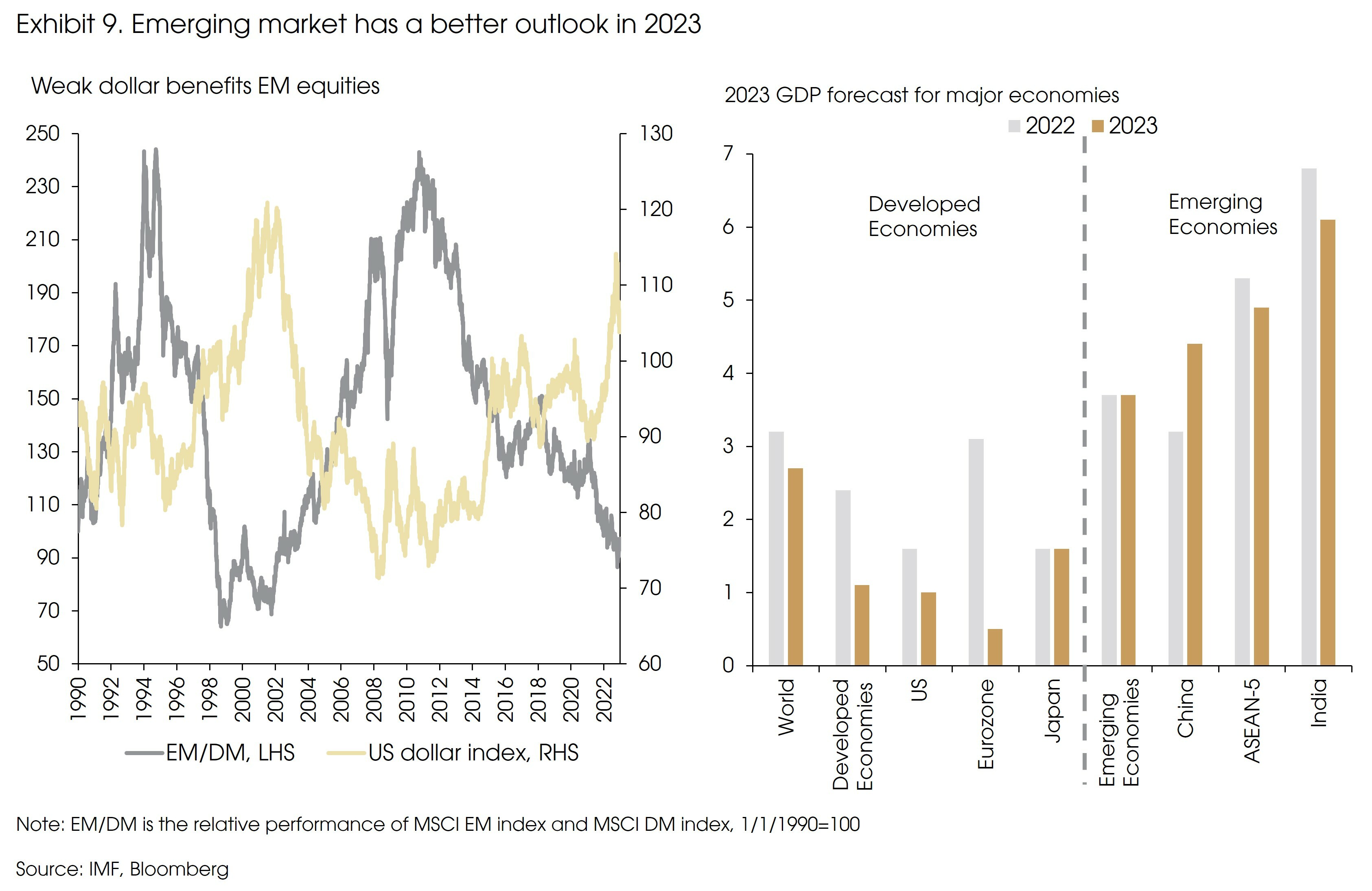

First, EMs should benefit from the weakening dollar in 2023 (Exhibit 9).

Moreover, EM countries did not implement large fiscal/monetary stimulus during the pandemic, which led to better debt profiles among these economies. As a result, even with the Fed’s aggressive monetary tightening and a decades-high US dollar in 2022, there was no major crisis in EMs, very different from what happened in 2013 and 2018. EM economies are expected to have a relatively better economic outlook in 2023, compared with developed economies.

Among EM, we have turned more positive on China. The Chinese economy has been under strict COVID lockdowns for the past three years, longer than any other economy. While the reopening boost is fading in other economies, it has just started to kick in for China.

Secondly, after last October’s Party Congress, President Xi tightened his grip on the Chinese government by appointing his closest allies at top leadership positions. We saw this as a potential negative factor for China back then. But now, we realize that after interests are aligned at the top leadership and political uncertainty is accordingly reduced, the government finally moves to prioritize economic growth.

China could be the perfect case of “growth remains weak but stabilizing”. Both monetary and fiscal policies have turned accommodative in 2022. Although lingering geopolitical tensions and a possible global economic downturn will continue to affect the market, we have seen meaningful improvements in fundamentals.

To conclude, we expect a weakening growth momentum in 1H 2023. However, peaking inflation and central bank tightening should benefit the bond market first. Equity markets, especially the US and Europe’s, could see a further downturn. Meanwhile, EMs, and more specifically China, may outperform due to their/its significantly improved fundamentals.