2H Outlook: Is The Worst Behind Us?

Author: Yao Wang and Jess Chung | Editor: Guillermo Muro

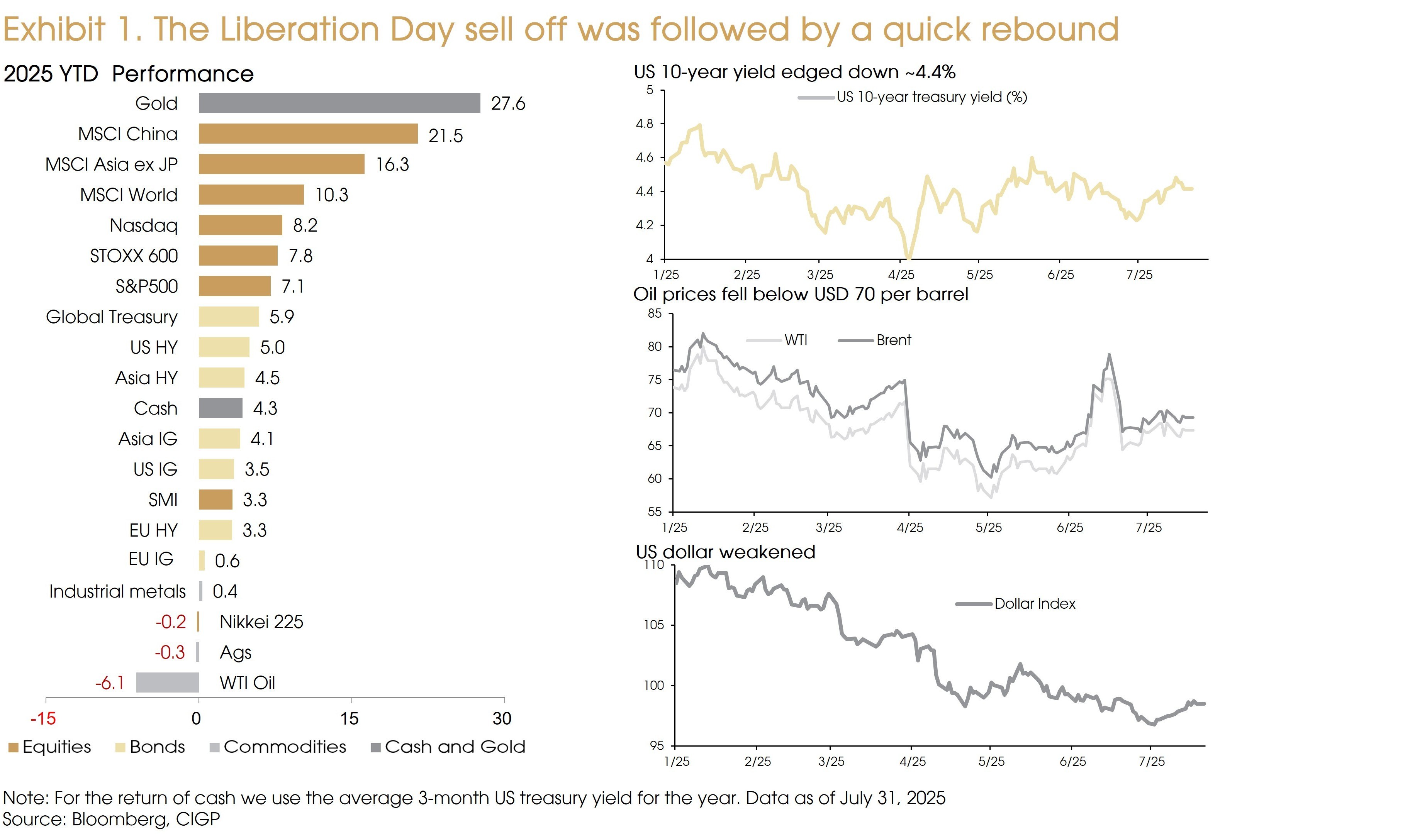

If there is one key moment to remember in the market during the first half (1H) of 2025, it is likely the Liberation Day selloff, triggered by President Trump’s announcement of significantly higher-than-expected tariffs on the rest of the world.

Hawkish tariff rates raised growth concerns not only for non-US economies, but also for the US. This is different from earlier market expectations that tariffs would primarily affect non-US economies. The three-day return of the S&P 500 Index following April 2nd (around -12%) was among the worst in US history, leading to similar declines in other markets as well.

However, following the market crash, the Trump government postponed the aggressive tariff hikes to allow for negotiations. Meanwhile, the US-China tariff conflict after Liberation Day also ended up with lower tariffs and a trade truce. Investors started to realize that tariffs are tools to facilitate trade talks, rather than the final outcomes that Trump desired.

Therefore, TACO (Trump Always Chicken Out) trade replaced tariff fears in the market, facilitating quick rebounds and positive 1H returns in most equity markets (Exhibit 1, LHS).

What were the major changes of the 1H 2025?

- The US 10-year yield trended down from 4.6-4.8% to below 4.5% as of end-July, reflecting weaker growth and rate cut expectations (Exhibit 1, RHS, Upper).

- Prices of crude oil fell from the level of 75-80 dollars per barrel at the beginning of this year to below 70 dollars (Exhibit 1, RHS, Middle).

- US exceptionalism seems to have faded, as reflected by the weakening US dollar (Exhibit 1, RHS, Lower).

- Germany has enacted a significant fiscal stimulus package earlier this year. This turn-around in fiscal stance brightened the country’s growth outlook after two years of stagnation.

- Tariff rates for goods sold to the US are higher.

What remains unchanged after 1H?

- The momentum for innovation and investment in the Tech/AI sector, both in the US and globally, remains strong, despite the concerns earlier this year.

- Recession risks remain low in major economies.

Looking forward, as the US reaches trade agreements with more trading partners (i.e., China, EU, Japan, UK, Vietnam, Korea, etc.), policy uncertainty should keep decreasing. The year-to-date (YTD) changes mentioned above (i.e., lower treasury yields, lower oil prices, a weaker dollar, and fiscal stimulus in Germany), and the continued trend in AI/tech optimism all suggest a positive backdrop for equities globally.

That said, tariffs should have a negative impact on global growth, while most developed market (DM) equity indexes reached new highs.

Will the better macro backdrop lead to an upside in equity markets, or the weaker economic growth and the new highs in equity prices suggest a downside?

We are cautiously optimistic, seeing structural opportunities in specific markets and sectors that could lead to overall positive equity returns in 2H.

At the beginning of 2023, the market expected a soft-landing/mild recession in the US after the aggressive rate hikes, but the US economy surprised everybody by showing signs of “no landing” (increasing economic growth) that year.

At the beginning of 2024, the market expected cooling growth/soft-landing in the US economy, given fading fiscal support, as well as the elevated interest rates and inflation. The 2024 GDP growth almost doubled the market consensus back then.

Earlier this year, market consensus finally turned positive on the US economy, expecting “US exceptionalism”, i.e., superior growth in the US vs. non-US economies, similar to the trends in 2023 and 2024. In 1Q 2025, the US economy contracted (vs the previous quarter) for the first time since the second half (2H) of 2022.

It is always hard to forecast the future, but easier to explain the past. After the market-wide optimism in the US economy early this year, three challenges arose.

- The emergence of DeepSeek raised questions about the growth in AI-related fixed asset investment.

- The Department of Government Efficiency (DOGE) implemented spending cuts, raising market concerns about fiscal consolidation.

- The reciprocal tariffs announced in early April increased stagflation risks in the US.

However, looking forward, all three challenges are weakening.

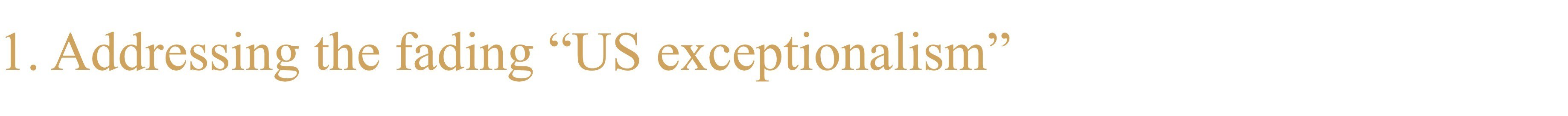

First, the US non-residential private fixed asset investment rebounded in 1Q, mainly driven by Tech/AI related investments, such as information processing equipment, computers and peripheral equipment, and software (Exhibit 2). Despite market concerns on AI capex growth, economic data revealed a record-high growth in AI-related capital spending in 1Q.

Additionally, the passage of the One Big Beautiful Bill Act (OBBB) allows full expense for equipment and R&D investments. Meanwhile, the recently released American AI Action Plan (AAAP) creates a permissive environment for private-sector-led innovation in the AI/tech-related sectors. Both should continue to encourage business investment (especially AI-related) to grow at a solid pace in the US.

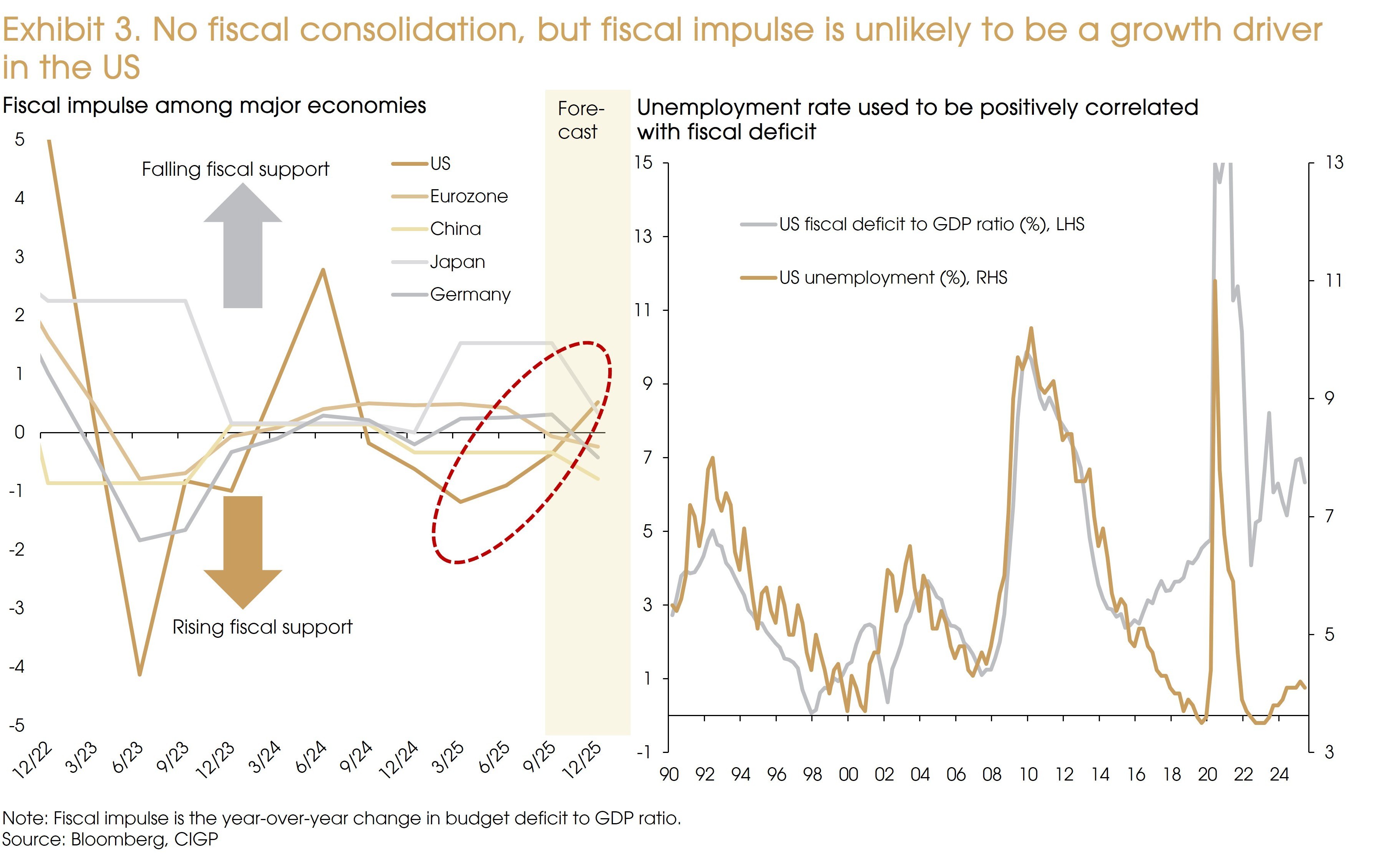

Second, concerns about government spending cuts have diminished, following Elon Musk’s departure from DOGE and the passage of OBBB (estimated to increase budget deficit by around USD 3 trillion in the next decade).

That being said, we do not expect fiscal impulse to be a major driver for economic growth, at least in 2H. The year-over-year change in budget deficit ratio is expected to turn positive in the US, indicating a declining fiscal support (Exhibit 3, LHS). Historically, the size of US fiscal deficits has been positively correlated with unemployment rate for most of the periods (Exhibit 3, RHS). Should the unemployment rate remain well-anchored, the fiscal deficit should decline, a point also mentioned by the Trump government.

Finally, the tariff fears have also dissipated, as the US signed trade agreements and frameworks with most of its trading partners (e.g., the UK, Japan, Korea, and the EU), setting tariff rates between 10-20%, thereby avoiding tariff wars that may affect global trade, growth, and inflation.

Although policy uncertainties have diminished, the tariff hikes will not leave the US and global economy without a scratch. We never expected tariffs to bring persistent inflation to the US. However, a one-time increase is unavoidable, especially given that the tariffs are broad-based (almost on everything imported by the US). Therefore, many (including the Fed) are surprised by the recent, muted inflation pressures.

Inventory upbuild before the tariffs hit and the self-absorption of the tariffs by some exporters could have both contributed to the muted inflation so far. However, according to a study by Goldman Sachs, tariff effects on inflation will eventually run their course, estimating core PCE inflation to edge up close to 3% (2.7% in May) by year end. Nonetheless, this price increase should remain a one-off.

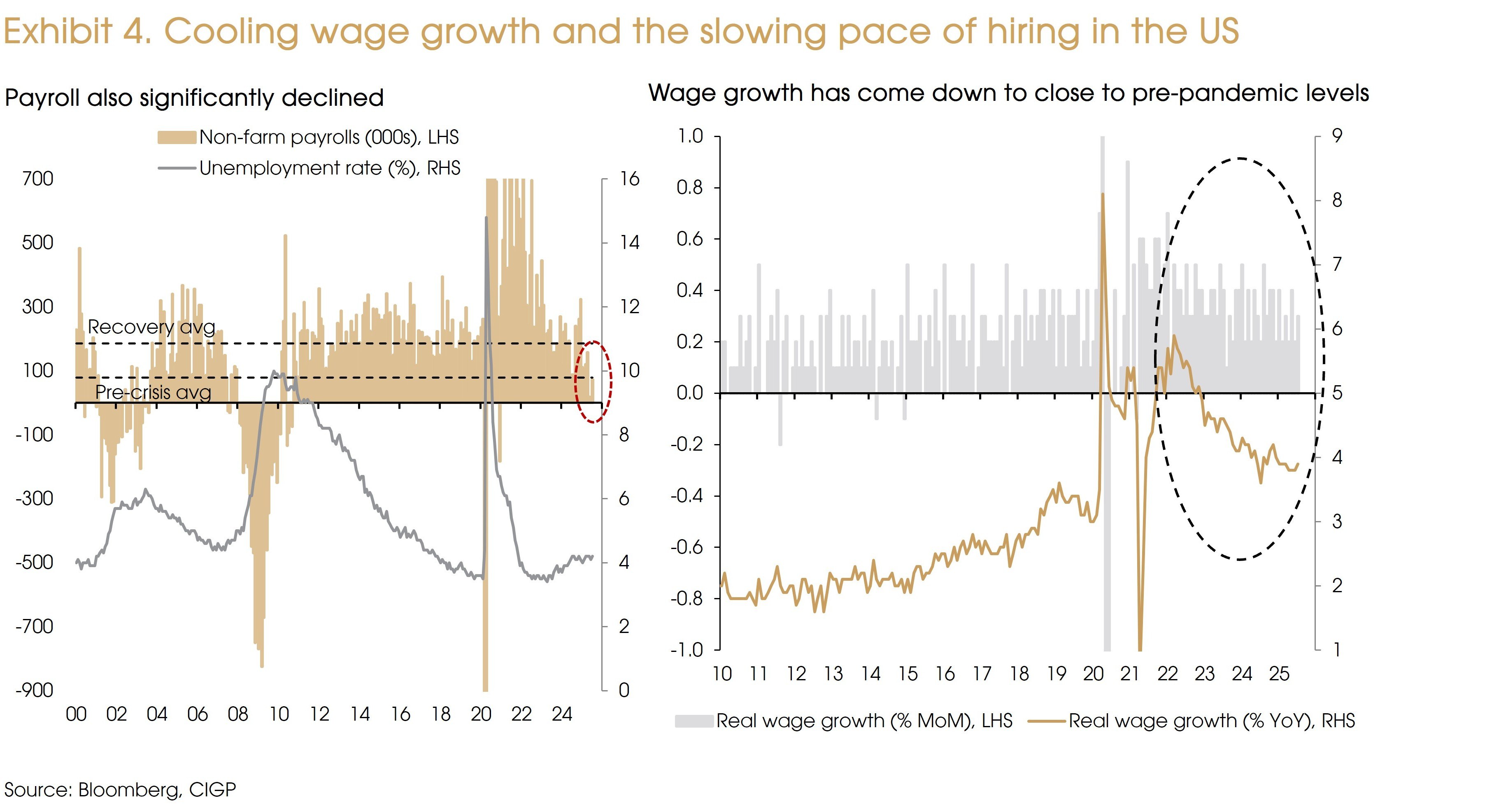

Even a one-time price increase will affect households’ real income, leading to weaker consumption growth, especially given the currently weakening labor market conditions. The pace of hiring significantly slowed in the US this year. Nonfarm payrolls grew at an average monthly pace of 85k (after the 90% downward revision of the May-June data), much lower than that in 2024 (168k) and 2023 (216k) (Exhibit 4, LHS). For context, the average monthly payroll growth during economic recovery is at 186k, while the pre-recession average is around 79k. The current pace indicates that the US economy is not facing an imminent recession, but definitely slowing down. In addition, real wage growth continues to edge down and is close to pre-pandemic levels (Exhibit 4, RHS).

The delayed but emerging tariff impact on inflation, the slow payroll growth, and the declining real wage growth all suggest weaker consumption growth ahead.

Overall, challenges regarding AI capex, government spending cuts, and tariff policy uncertainties have all diminished. However, this does not suggest a re-acceleration of growth in 2H: The US economy is still in the landing phase. A cooling job market and higher inflation from tariffs should finally weaken consumption growth in 2H. On a more positive note, solid business investment (supported by OBBB and AI optimism) and the policy put by the Fed (more inclined to cut than to hike) should help avert a hard landing for the US economy. The US GDP growth is expected to decline from 2.8% in 2024 to around 1.5% this year (significantly lower than the earlier expected 2.5%).

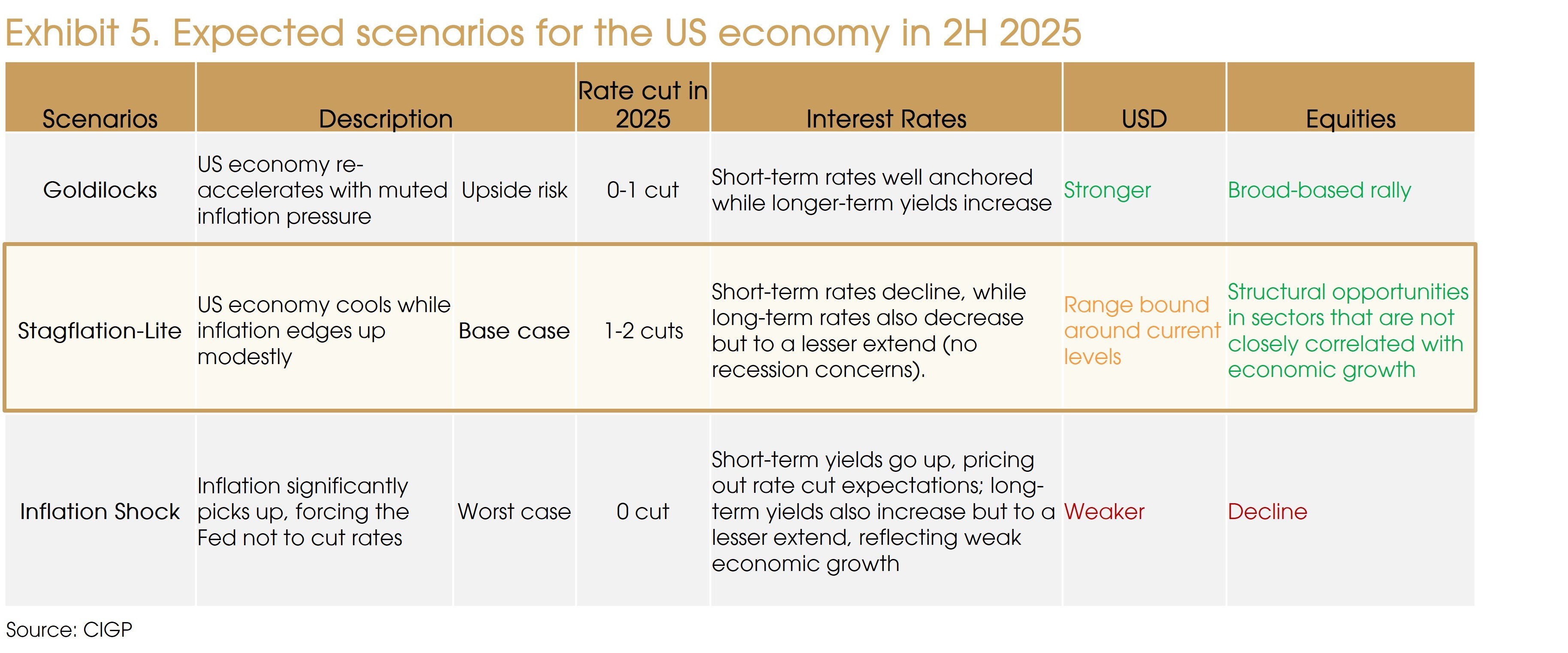

Therefore, our base case for the US economy in 2H is “stagflation-lite”: Meaningfully lower economic growth with higher but manageable inflation (from the tariffs) (Exhibit 5). We tend to believe that the Fed will still cut rates under this scenario later this year, given the modest (and one-off) increase in inflation and cooling economic growth.

The upside risk, however, stems from a muted tariff impact and sustained growth in consumption. If the disinflation trend persists, showing no signs of tariff pass-through, and consumption growth remains strong, then the US economy may accelerate in 2H, resulting in a “Goldilocks” scenario. In this case, the Fed will not have to cut rates to support economic growth, but could still lower policy rates given the continued disinflation trend.

Finally, the worst case is a significantly larger-than-expected increase in inflation. Under this scenario, the inflation shock will negatively impact consumption, while the Fed may not be able to cut rates as it takes time for the central bank to identify whether this unexpected shock is a one-off or persistent, which may push the economy into a recession. However, we see low odds for this scenario to happen.

Given such an economic outlook, we would expect overall positive returns in the US equity market. We only expect an equity downturn in the less likely “inflation shock” scenario. Meanwhile, the “Goldilocks” scenario suggests a broad-based rally in the US market. In our base-case scenario of “Stagflation-Lite”, we expect stronger performance from certain sectors to drive another leg up in the overall equity market.

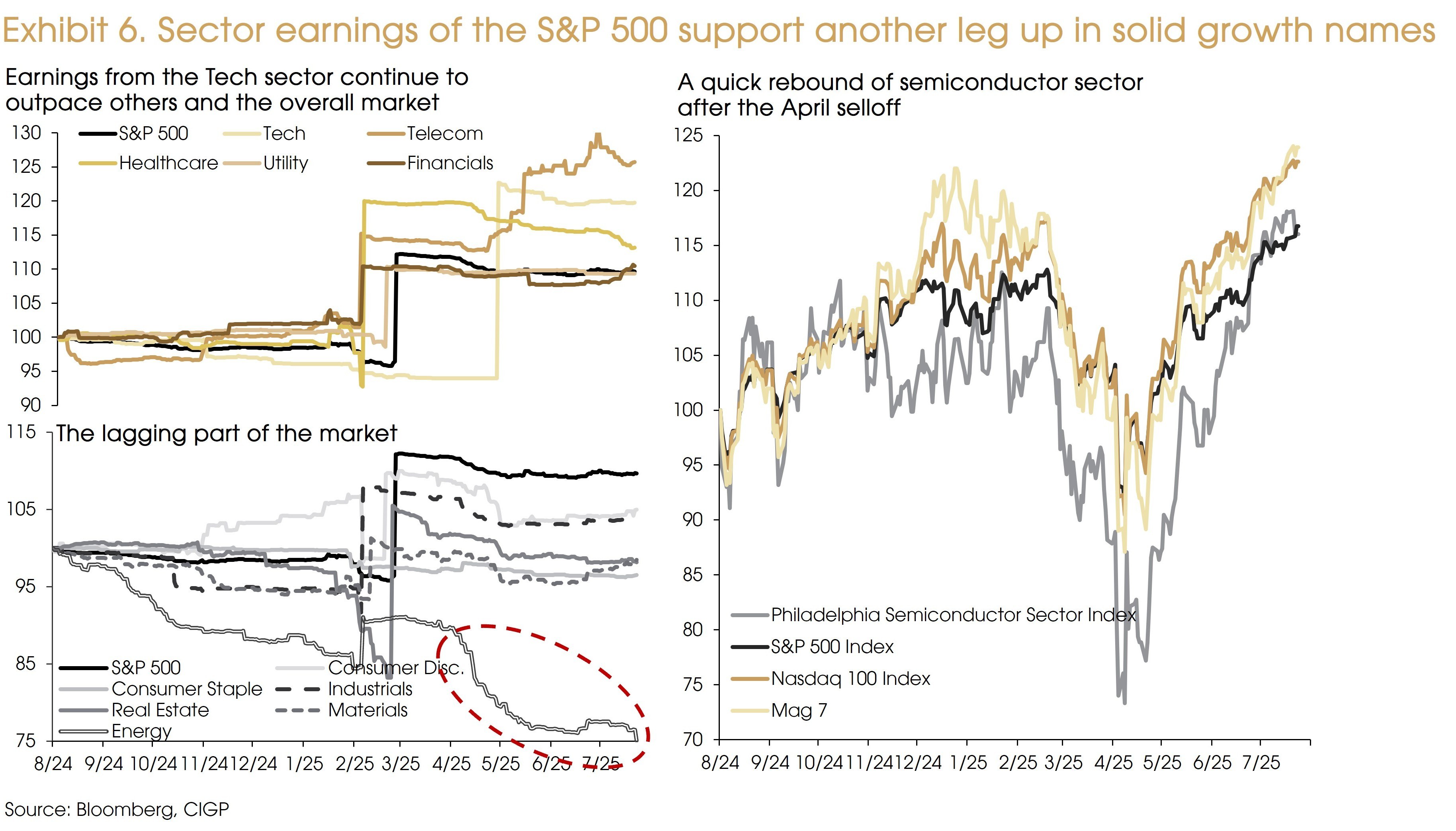

Cooling economic growth with modestly higher inflation creates an ideal environment for solid growth names to outperform.

In addition, the immediate and full expensing for equipment and R&D investments under OBBB should lead to higher profitability among sectors with high R&D or equipment capex, such as healthcare, Tech, consumer discretionary, communication services, and Utilities. Most of the above-mentioned sectors are expected to have higher earnings growth versus the overall market (Exhibit 6, LHS).

The renewed optimism around AI and the deregulation aimed at encouraging investment in AI infrastructure should continue to support semiconductor companies and the Mag7, even after their quick rebound and outperformance since April (Exhibit 6, RHS).

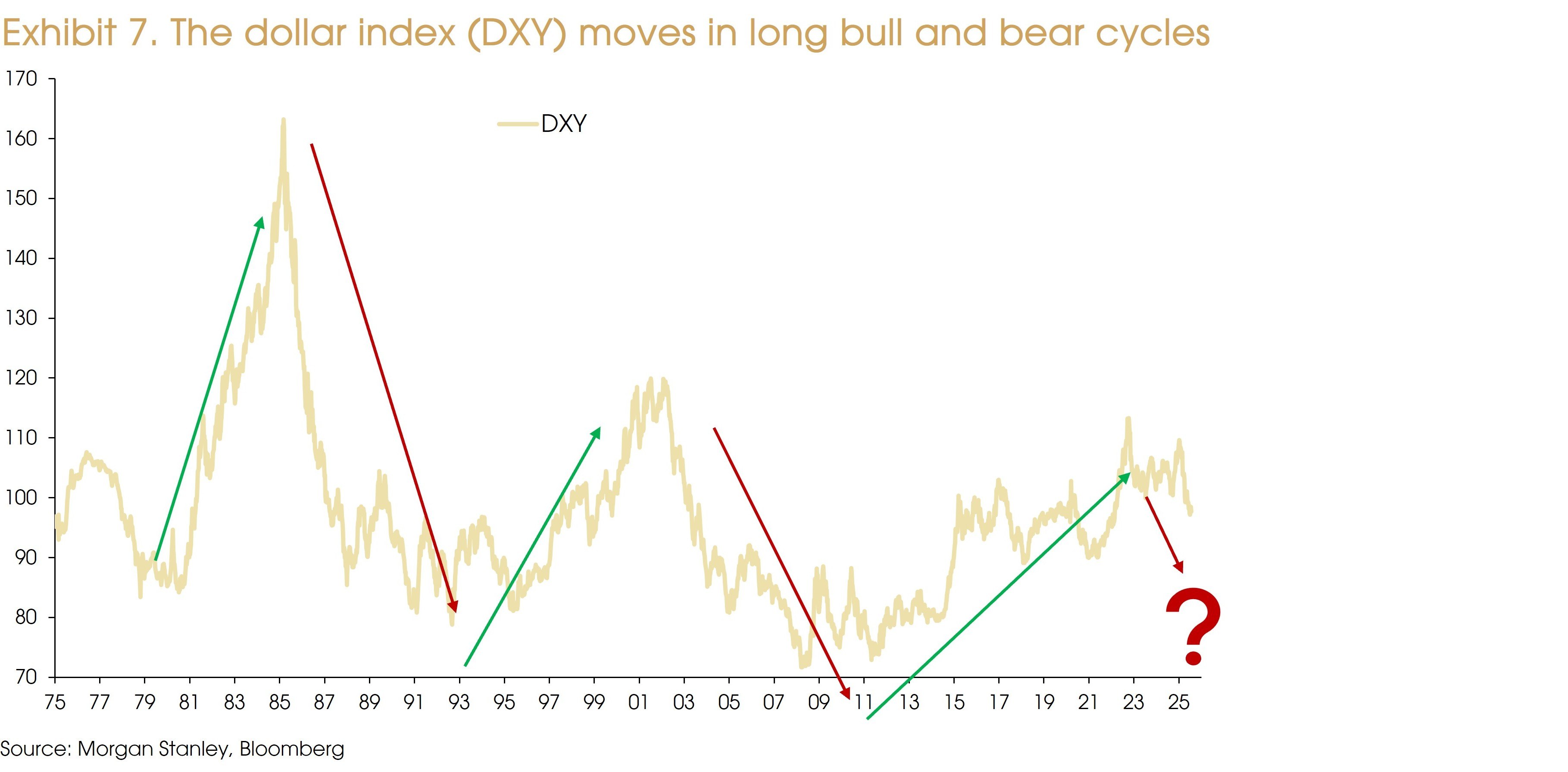

The US dollar has significantly depreciated against most major currencies so far this year, with the dollar index (DXY) falling around -10% YTD. Rising policy uncertainty under the Trump administration has undermined investor confidence in USD assets, challenged its status as a safe haven, and prompted diversification away from US markets. Besides, the deteriorated outlook of the US economy also contributed to the dollar depreciation.

After such depreciation and reduced concerns regarding Trump’s policies, we see limited downside for the USD. However, for a meaningful rebound of the DXY, we may need to see significantly better growth in the US economy, or meaningful drivers suggesting outperformance of US assets. In other words, we need to see a recovery of the “US Exceptionalism”.

Therefore, we only expect the USD to strengthen notably under the “Goldilocks” scenario (Exhibit 5). Meanwhile, under our base case of “Stagflation-Lite”, the DXY should remain rangebound around current levels (95-100). Under the worst-case scenario, however, even with no cuts from the Fed, we expect the USD to further weaken against other currencies.

In the long run, a down-cycle for the USD may have just started (Exhibit 7). Given the rising concerns about USD dominance and the ongoing trend of diversification away from the USD toward other currencies, as well as gold and cryptocurrencies, rebounds of the dollar might not last long.

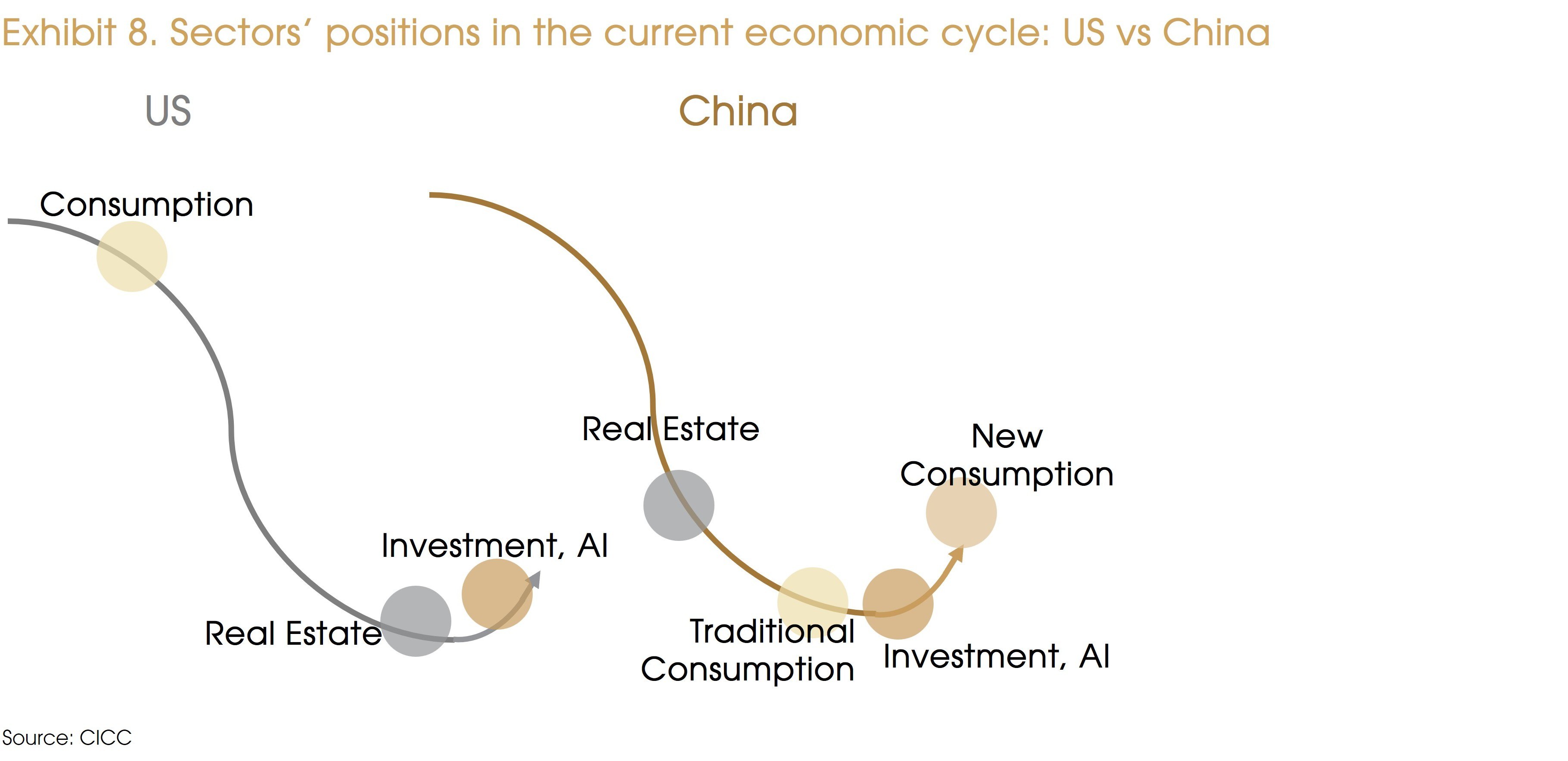

Since the start of this year, the Chinese government's continued efforts to support domestic capital markets and economic growth, along with an AI breakthrough led by DeepSeek, have led to a turnaround in market sentiment toward China, leading to significant outperformance of Chinese equities. However, the Chinese economy continues to face persistent deflation risks due to weak domestic demand. (Exhibit 8) Key sectors with significant weight in the economy, such as real estate and traditional consumption, are still bottoming.

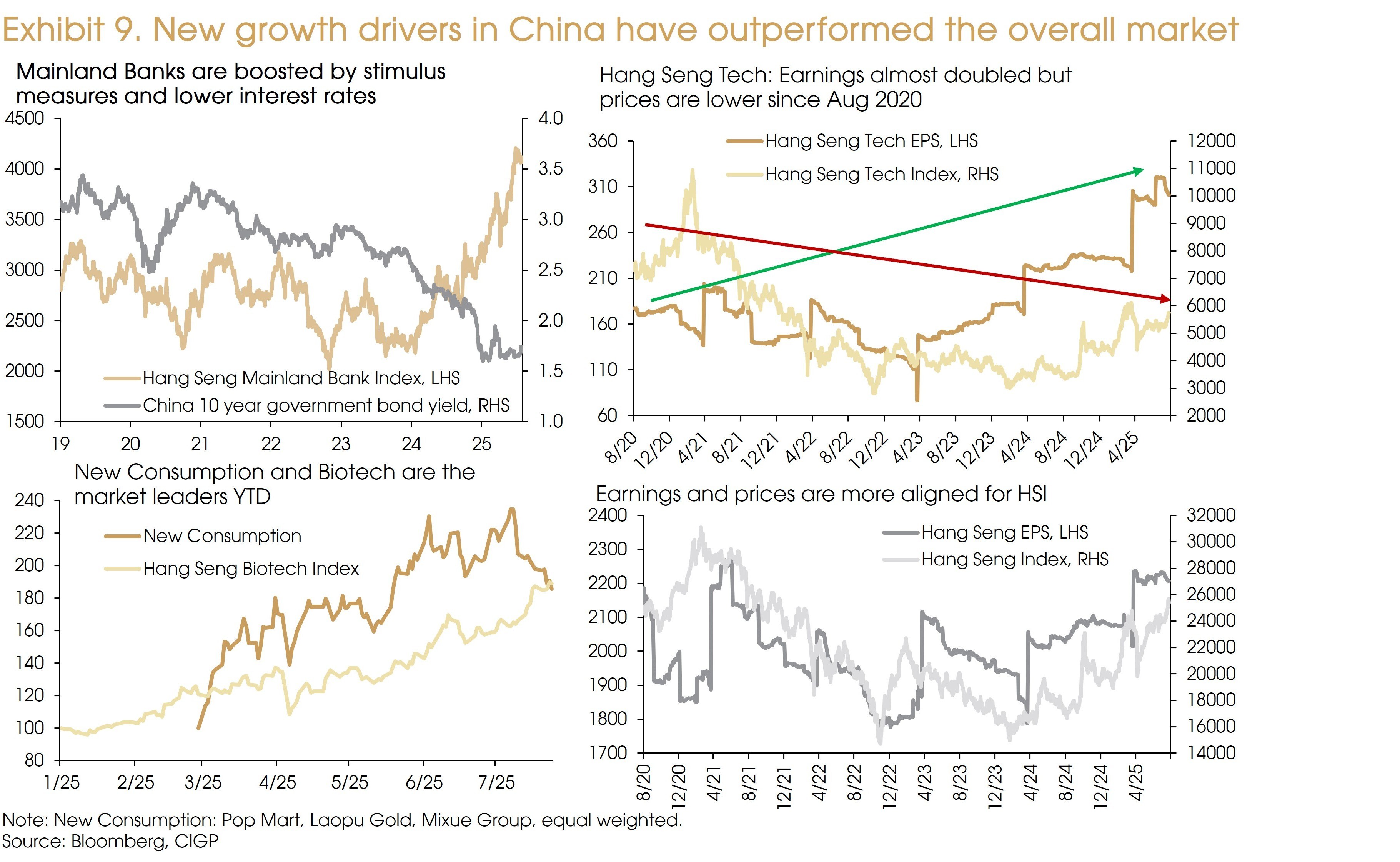

Nevertheless, new growth drivers are emerging. AI optimism is not only limited to the US. Chinese companies (especially large tech firms) have significantly increased their capital expenditures related to AI. Meanwhile, the “New Consumption” sector (emerging businesses focused on trendy food and beverage, lifestyle retail, and cultural experiences) boomed with high revenue and earnings growth, supported by the Gen-Z consumers in China. Additionally, the biotech sector has also bottomed out, thanks to a remarkable surge in high-value licensing deals between Chinese biotech firms and global pharmaceutical companies, in addition to Chinese firms’ growing competitiveness in global clinical trials.

(Exhibit 9, LHS) The new drivers in the Chinese economy led the gains in the equity market so far this year, which also raised concerns over high valuation. However, Exhibit 9 RHS shows that the EPS of Hang Seng Tech index (a proxy for the new economy sector in China) has nearly doubled since August 2020, yet the current price of the index is still below the August 2020 level. For context, the EPS and the performance of the Hang Seng Index are more closely aligned, with both relatively flat since August 2020. Meanwhile, the EPS and performance of the S&P 500 Index both doubled during the same period. This could suggest that the increased earnings of the Hang Seng Tech Index are still relatively undervalued by the market and the re-rating still has room to run, especially for the new growth drivers.

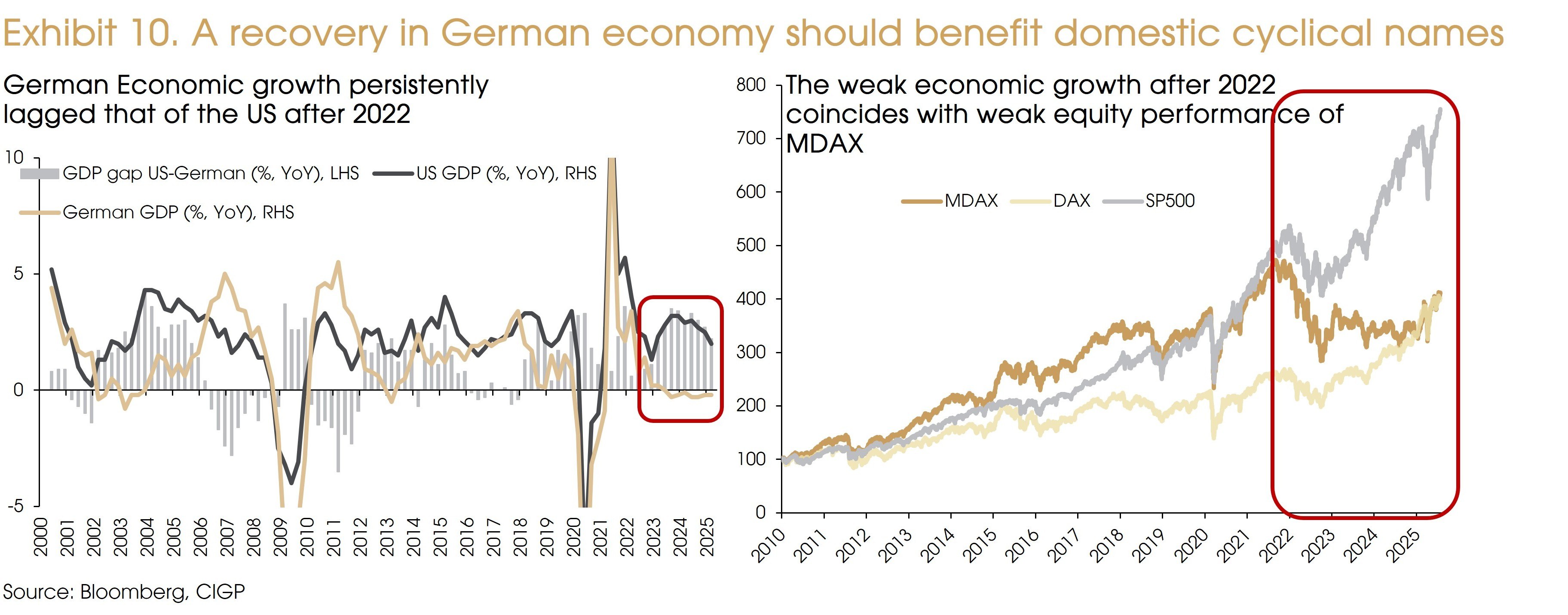

We are also positive on a potential recovery in the German economy. Germany was the only bright spot in Europe during the decade after the 2011 European Debt Crisis. However, the Russia-Ukraine war led to a surge in energy prices and prompted rate hikes from the ECB. These have impacted the German economy more severely than the rest of Europe, given its heavier weight in the manufacturing sector. Germany had two years of zero GDP growth since 2023 (Exhibit 10, LHS).

However, we see drivers indicating better growth ahead. The ECB has been cutting rates since June 2024. The EUR 500 billion funding on infrastructure should boost economic activities and growth outlook especially in the struggling industrial sectors. Although energy prices remain higher than the pre-2022 level, the increased share of energy supply from renewables and the declining prices in natural gas and oil should both help to bring down energy costs further across Europe.

The potential recovery in the German economy should benefit domestic cyclical names (Exhibit 10, RHS). That said, negative impacts on economic growth, such as aggressive tariff hikes from the US, or another significant rise in energy prices, will undermine this positive view.

Additionally, the regained optimism in AI should support AI/tech supply chain-related markets, such as Taiwan and Korea. We remain positive on emerging Asian markets that are primarily driven by domestic demand (e.g., India and Indonesia), given the rising trade barriers.

The outlook for US bonds remains neutral, with expectations of improved conditions in 2H as much of the negative news are already priced in.

On one hand, concerns about US fiscal sustainability may continue to challenge the safe-haven status of Treasuries and add pressure to long-term bonds, and Tariff-related uncertainties should keep the yield curve steep. On the other hand, a slowing US economy (given the tariff impacts) should prompt further rate cuts, making Treasuries more attractive.

In addition, we expect demand for Treasuries to improve. The US government is actively exploring ways to boost demand for Treasuries, such as loosening banking regulations. In addition, the Genius Act could help boost some demand for US Treasuries if stablecoin issuance continues to grow, as stablecoin issuers often use safe, liquid assets like US Treasuries to back their tokens.

Given the lower rate path and the improved demand, we believe the US bond market is better positioned than the EUR bond market. That being said, we do not expect a significant rally in US Treasuries, as the elevated risk premium and a challenging fiscal outlook may cap potential gains.

In Europe, the growth outlook, especially in Germany, is improving, but the ECB is probably close to the end of its rate cut cycle. Trade risks have eased after the US-EU trade agreement which sets tariff rates at 15% instead of 30%.

It is important to note that a notable risk comes from the Dutch pension reform, which will shift funds from defined benefit to defined contribution by 2028. Dutch pension funds are among the major buyers of long-term bonds, such as German Bunds. This change will slash demand for long-dated bonds especially in 2026–2027, indicating the need for greater private absorption and steepening of the yield curve. Additional long-term Bund issuance to finance Germany’s fiscal stimulus will further strengthen this steepening trend.

French budget negotiations could also inject some volatility into OAT spreads in the second half.

Within high-yield bonds, it is more prudent to remain cautious. Although default rates are historically low, they may rise slightly, resulting in wider credit spreads. Preference is given to higher-quality issuers and AT1 instruments, supported by a robust European banking sector.

Commodities delivered mixed results in 1H25: Oil prices softened on growth worries, industrial metals were overall flat, while gold gained on safe-haven flows.

Going forward, we remain positive on selected commodities. For example, gold remains a proven hedge on the debasement of fiat currencies, and Uranium is still facing deficits in supply. Overall, however, we are now less positive about the commodity outlook than we were at the beginning of this year. While concerns over inflation and supply shocks persist (such as tariffs and weaponization of certain critical minerals, additional sanctions on Russian oil, and geopolitical uncertainties in the Middle East), rising global trade barriers are likely to weaken commodity demand, limiting the upside for commodity prices in general.