Focus: The Sleeping Tiger of South East Asia Awakens

Rensi Widjaja

Indonesia, once dubbed the Tiger of South East Asia under President Suharto’s 32 years of authoritarian leadership between 1966 – 1998, has been striving to re-establish an influential presence in the global economy.

Home to approximately 270 million people, Indonesia is the world’s largest archipelagic state and the fourth most populous country globally. With a GDP of USD 1.16 trillion, it is the biggest economy in South East Asia and sixteenth largest in the world. Part of the G20, Indonesia was the only Asian country in OPEC, Organization of the Petroleum Exporting Countries, until 2016.

We believe there are attractive opportunities in Indonesia stemming from its growing consumer market, digital economy, infrastructure and real estate development. On top of long term structural growth themes, we view the recent re-election of President Joko Widodo for his second and last 5-year term puts Indonesia on a stable footing over the short to medium term. Jokowi, as he is most commonly referred, looks to enact policy reforms which we view will be a powerful nudge to awaken the sleeping tiger of South East Asia and kick start a new era of growth and transformation.

A Resilient ASEAN Rising Star Amid Global Uncertainties

In recent years, the ASEAN region has been increasing its strategic importance globally. According to McKinsey, ASEAN ranked as the fourth largest exporting region in the world. The largest three being the European Union, North America and China/Hong Kong. The countries that constitute ASEAN account for approximately 7% of global exports.

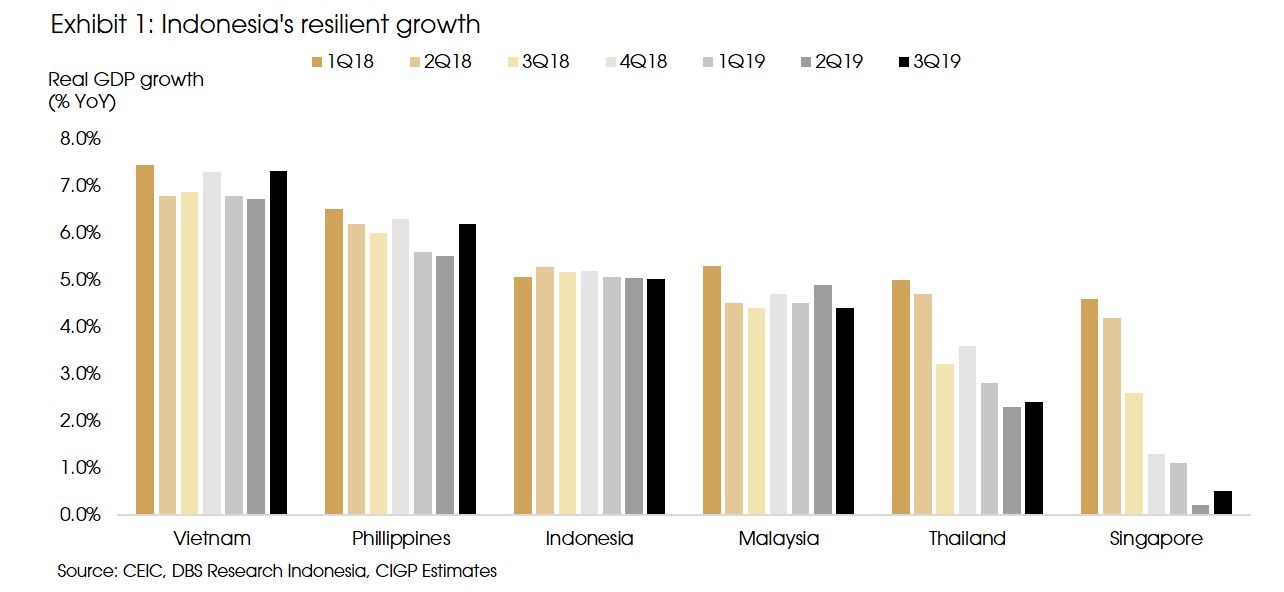

It is particularly worth noting, in the midst of current global geopolitical uncertainties, Indonesia has exhibited a relatively resilient growth in comparison to its ASEAN six neighboring countries. Indonesia’s GDP grew 5.2% YOY in 3Q19 (See Exhibit 1) and it has been growing at a stable range between 4.8 – 5.2% over the past six years. Indonesia’s GDP per capita is predicted by DBS to grow at a 4.5% CAGR reaching USD 7,310 in 2030.

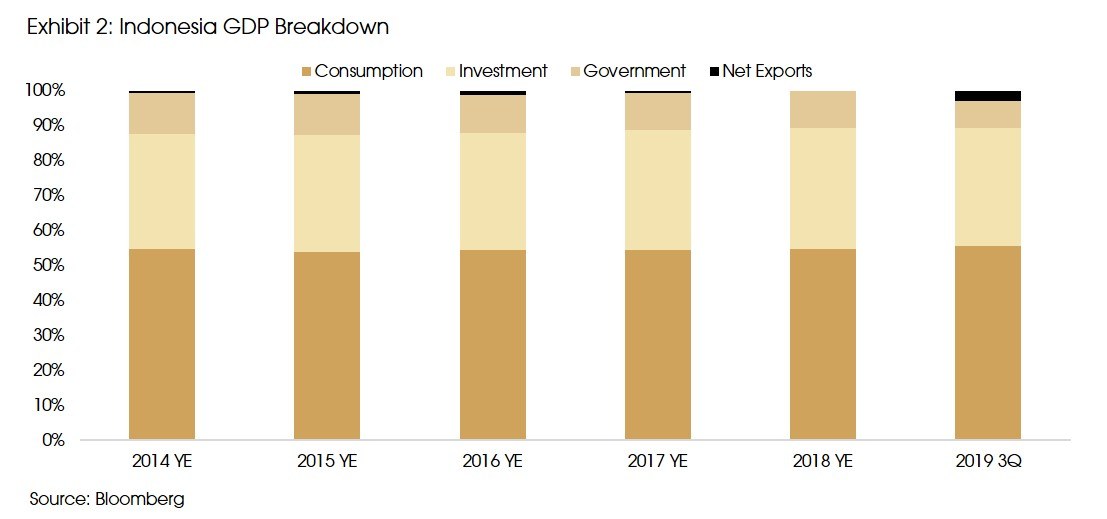

We like that the Indonesian economy is driven primarily by domestic consumption. Given this, we expect Indonesia to be more defensive against global uncertainties. Over the last 30 years, Indonesia has only been in an annual GDP recession once during the 1998 Asian Financial Crisis. Through the difficult periods of the 2008 Financial Crisis and 2013 Taper Tantrum, Indonesia managed to deliver an annual GDP growth of 4.6% and 5.6% respectively. We think this provides a promising opportunity given the current macro-economic backdrop of a looming global economic slowdown.

Accommodative Policy Stances

In the wake of a challenging global macro environment, the Indonesian government is expected to release fiscal stimulus in the form of corporate tax cuts from the current rate of 25% to 20%. In addition, newly listed Indonesian companies can expect to have further reductions. Their tax rate will be as low as 17% for the first 5 years of being listed. This puts Indonesia on par with other countries in ASEAN region. ASEAN countries tend to have lower corporate tax rates than Indonesia with Singapore at 17%, and Thailand and Vietnam at 20%.

Furthermore, The Central Bank of Indonesia has been on a monetary easing cycle in 2019, albeit raising rates in 2018 from 4.25% to 6%. The move was an imperative intervention from Bank Indonesia, the Central Bank, because in August 2018 the Indonesian Rupiah (IDR) weakened to the lowest levels since the 1998 Asian Financial Crisis. Since then, Bank Indonesia has cut rates for 4 consecutive periods in 2019 bringing the primary interest rate down to 5% during its last policy meeting in November.

Going into 2020, the IDR is expected to be broadly stable on the back of solid balance of payment outlook. Bank Indonesia forecasted the current account deficit will narrow to 2.7% of GDP at the end of 2019 from 2.9% in 2018.

In addition, the Indonesian government will provide further stimulus through relaxation of macro prudential policies. This includes lowering the loan to value ratio as well as increasing the threshold of property value subject to income tax and luxury goods. We expect these accommodative regulations to be a positive catalyst in particular to the real estate sector.

The Re-Election of President Joko Widodo

President Jokowi who was officially declared as the winner of the April election in June 2019 is going to be President for his second and last term for the period of 2019 - 2024. This was received positively by investors and the market. Jokowi’s re-election was further cemented with his political party’s coalition success in securing 74% of parliamentary seats giving a majority control over the government. This is a positive boost and should drive more efficient execution towards Jokowi’s planned policy reforms. One of the most highly anticipated reforms is expected to come under Jokowi’s Omnibus’ Law Plan which will tackle three main issues: labor, tax and the negative list, a restriction list for foreign ownership. These are expected to improve Indonesia’s ease of doing business in order to lure more foreign direct investments.

At Jokowi’s inauguration, he outlined his vision for Indonesia. It is to achieve an advanced economic status by 2045 with an annual per capita income of IDR 360mn (USD 22,643). In order to achieve this target, he has set 5 main priorities. These are human capital development, infrastructure development, simplification of inefficient laws and regulations, bureaucracy simplifications, as well as economic transformation.

In the Indonesian State budget plan for 2020, the main priorities for the government will revolve around human capital development and infrastructure development. The education sector received a staggering allocation of USD 36.3bn, a 35.5% increase since Jokowi started office in 2014. The government plans to boost the country’s human capital as the quality of education reforms for the past 15 years have been viewed as insufficient. It is estimated that around 58% of the Indonesian labour force only received an education up until junior high school or lower. In addition, according to Citibank, Indonesia is ranked 74th out of 79 countries reviewed by the Program for International Student Assessment, PISA. Both of these indicate why development of human capital is a priority for the Indonesian government. Programs the government are introducing include additional subsidy programs such as an Indonesian smart card system, known as Kartu Indonesia Pintar, for tertiary education as well as a pre-employment card system, known as Kartu Prapekerja. The pre-employment card system aims to provide vocational training, particularly on technology education and computer usage, to individuals who are actively seeking employment.

The President and Millennials

President Jokowi is renowned for his forward thinking and ambitious plan to put Indonesia on par with international standards. Under his leadership, Indonesia has seen one of the most progressive transformations in its domestic economy. One of the reasons for this has been his push for infrastructure development and technological transformation in the country.

An example is Jokowi’s commitment towards building the Indonesian digital economy. The Indonesian internet economy was valued at approximately USD 40bn in October 2019 and is expected to cross the USD 130bn mark by 2025. There are 134mn active internet users and 124mn mobile internet users in Indonesia. Mobile phone users spend on average more than 4 hours per day on their phone. This fast growing segment is even more evident with the surge of e-commerce, mobile payments, digital wallet, and online marketplace lending such as P2P platforms. Indonesia is currently the home of 4 out of 10 biggest Unicorns in South East Asia. These include the ride hailing app, Go-Jek; e-commerce business, Tokopedia and Bukalapak, as well as the online travel booking site, Traveloka. The Indonesian e-commerce business itself is estimated to grow at a CAGR of 17% through 2022.

When talking about this particular segment, the word digital and millennials are never too far apart. Part of the reason why this has been such an exciting growth area is due to Jokowi’s support towards millennials. He embraces and acknowledges the value this generation, which accounts for a third of Indonesia’s population, brings to the Indonesian economy. His support can also be seen through his cabinet picks. Jokowi’s second term cabinet introduced young prominent ministers such as Go-Jek ex CEO Nadiem Makarim for education bureau, NET Media ex CEO Wishnutama for tourism and creative economy, and former owner of Inter Milan FC and D.C. United Erick Thohir for ministry of state owned enterprises. Jokowi has also announced an additional seven other prominent millennials, comprising of business owners and activists, who will act as an advisory team to the President.

Indonesia’s Consumer Market

Short-term macro environment is expected to be a laggard for the consumer sector, particularly with the government’s main priorities focused on education and infrastructure. Rising soft commodity prices, higher healthcare premiums, higher electricity price, and lower energy subsidies are seen as major risks for this sector. Cigarette makers in particular are expected to face major headwinds as prices are expected to increase significantly on the back of a 23% tax hike.

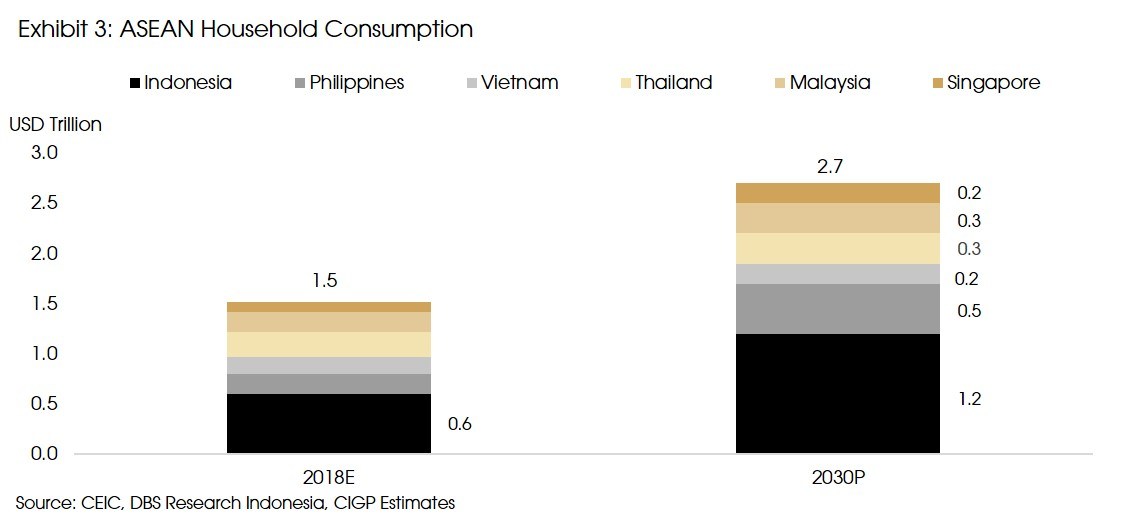

Nevertheless, we find the local domestic consumption play in the Indonesian consumer sector particularly attractive. At present, Indonesia has the largest consumer market in ASEAN. Its household consumption tops its neighboring countries with total household expenditure of USD 0.6 trillion as of 2018 (See Exhibit 3). This is approximately 42% of the total expenditure of ASEAN 6. By 2030, it is forecasted that this number could double to USD 1.2 trillion, mainly driven by population growth.

On average, according to DBS, Indonesian households spend approximately 51% of their expenditure on food. Amongst food items, growth of packaged food and beverage is predicted to be relatively robust with a CAGR of 6.7% from 2018 to 2030 as urbanization effects influence consumers to opt for quicker meal alternatives.

Indonesia’s Infrastructure

Since his first term in office, infrastructure has always been one of the core focus areas for Jokowi. He is expected to continue this in order to connect underdeveloped rural areas. Unequal infrastructure developments and connectivity has been a topical issue in Indonesia. Going into his second term, Jokowi’s government will continue to push its aggressive infrastructure plans, recently headlined by the USD 33bn plan to move the Indonesian capital city from Jakarta to East Kalimantan.

A core focus for infrastructure development for Jokowi’s second term is expected to revolve around five priorities for travel destinations in order to boost its tourism sector. One destination is Mandalika in Lombok which will host the MotoGP in 2021. We believe this could act as a positive catalyst in order to address the country’s widening current account deficit.

In the State budget plan for 2020, infrastructure received an increase in expenditure allocation of 4.9% YoY amounting to USD 29bn. The expenditure allocation has been increasing consistently since Jokowi started office in 2014. The major beneficiary from this increase is the Ministry of Public Works and Public Housing who received a 19% increase. The bureau will continue its infrastructure projects building toll roads, water dams, and railways.

Conclusion

Overall, we believe there are a number of attractive opportunities in the Indonesian market on the back of medium term political stability. The combination of accommodative monetary and fiscal policies should provide sufficient support to the Indonesian equity market and allow the economy to flourish. In particular, we believe the real estate sector will benefit from the relaxation of macro prudential policies.

We find the Indonesian local domestic consumer sector attractive driven by a rising middle class and population growth. In addition, we think the importance President Jokowi puts towards building the Indonesian digital economy as pivotal in his quest to revive Indonesia as the Tiger of South East Asia.

All in all, we particularly like that Indonesia is less reliant on exports for growth. This could provide a shield if the global economy slows down or if there are escalations in trade war conflicts. We believe that due to this, investing in Indonesia could lead to diversification benefits. However, as always, we advocate for active selection, prudence and care when investing in Indonesia.

Sources: Ciptadana Sekuritas Asia, Citibank Research Indonesia, DBS Research Indonesia, Goldman Sachs, JP Morgan Research, Ministry of Finance Indonesia.