CIO Viewpoint: Cryptocurrency - Speculation or Future?

Cryptocurrency has been a growing asset class since 2020

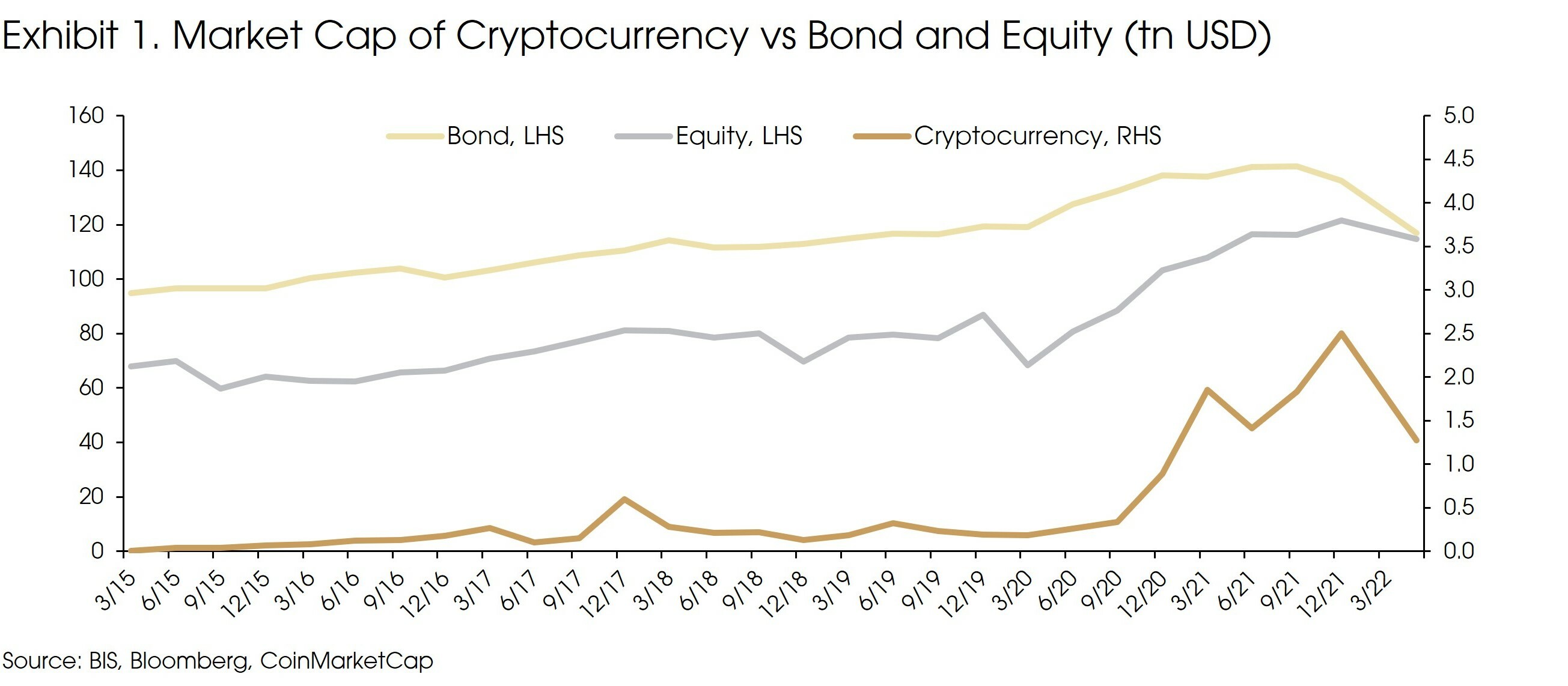

Although still small, the market capitalization of cryptocurrencies (or crypto) has increased by more than 10 times since the beginning of 2020. During the same period, the size of the global equity market only increased by 30% and the size of the global bond market did not change much (Exhibit 1).

Similarly, global crypto ownership is still low at 3%, but it surged last year from 100 million to near 300 million, as crypto became easier to buy. Crypto ETFs and futures were approved by a number of countries such as the US, Canada, Brazil, Australia, and Singapore. Exchanges also started to provide liquidity.

We have always been cautious on cryptocurrency, seeing the crypto rally as boosted by large scales of stimulus policies.

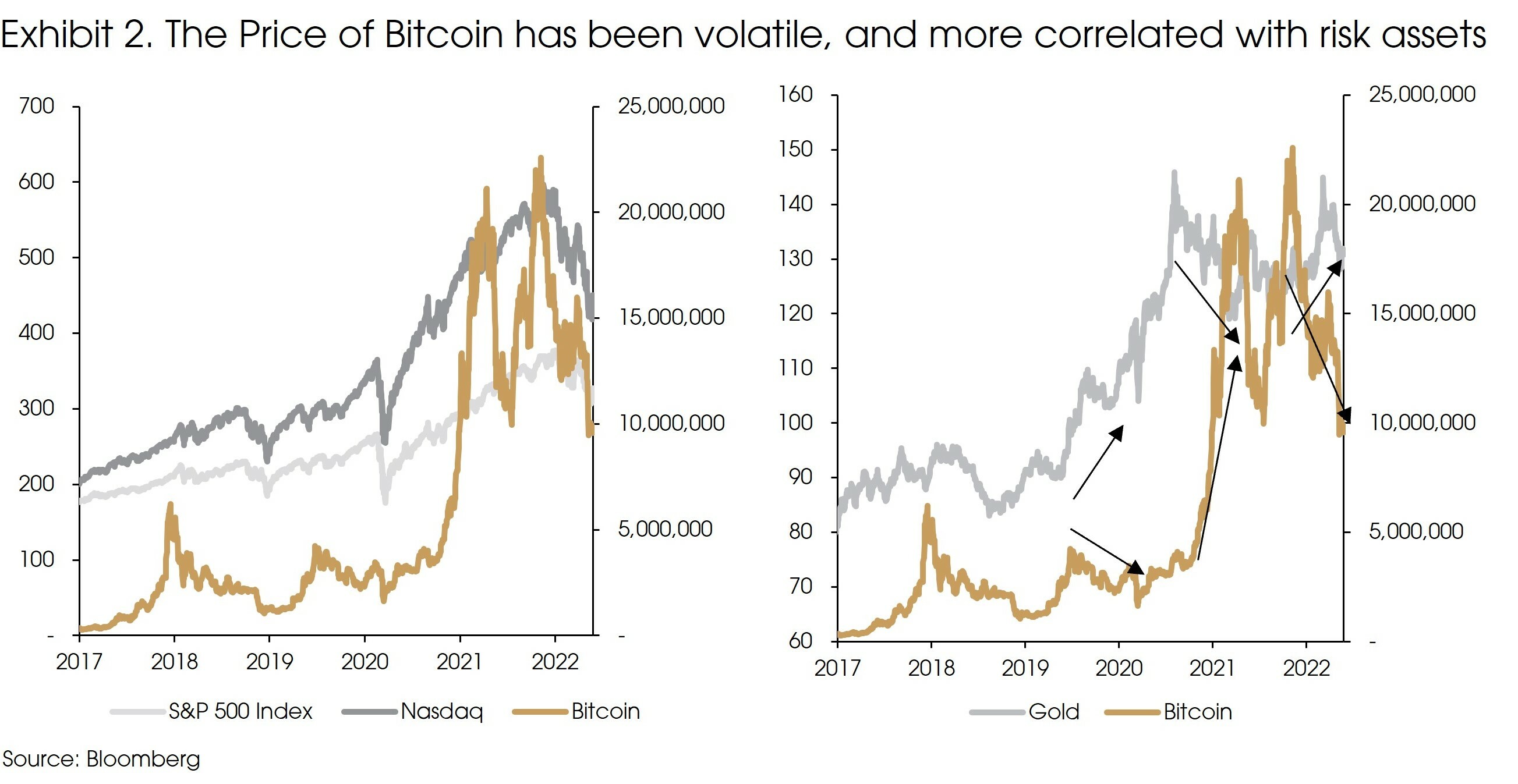

The rises and falls of the crypto market closely follow the Fed policy cycles. For example, the previous significant drops of Bitcoin (the longest-existing cryptocurrency) were in 2014 (-57.5%) and 2018 (-74.3%). In 2014, the Fed created a QE taper tantrum and announced their intention to increase interest rates, and in 2018 the Fed started to speed up its tightening cycle.

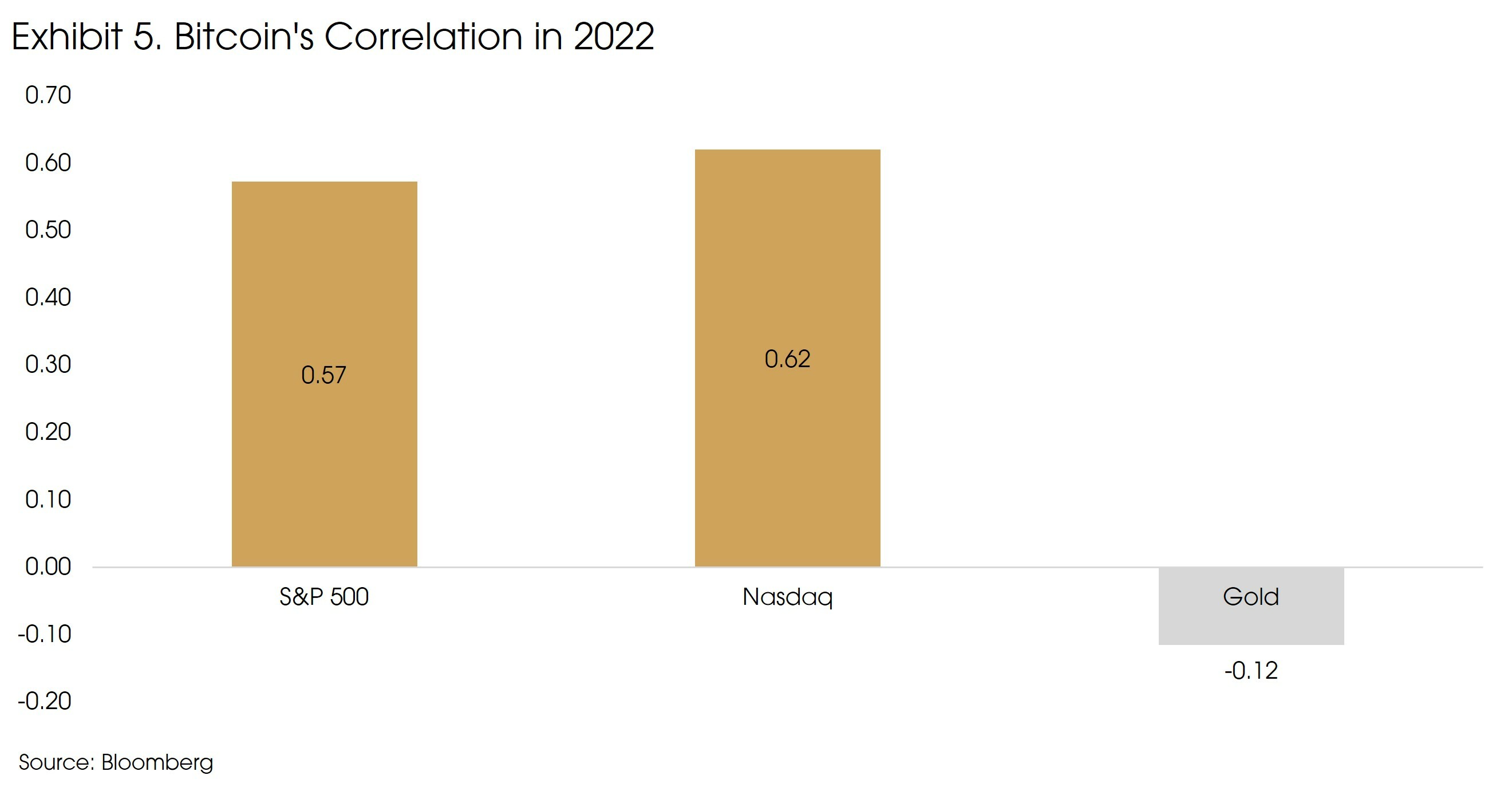

Therefore, as the Fed kicked off the hawkish tightening cycle this year, it is not surprising to see prices falling. Bitcoin has always been more correlated with riskier assets (such as the Nasdaq Index which is more sensitive to monetary tightening) than to assets considered safer, like gold (Exhibit 2).

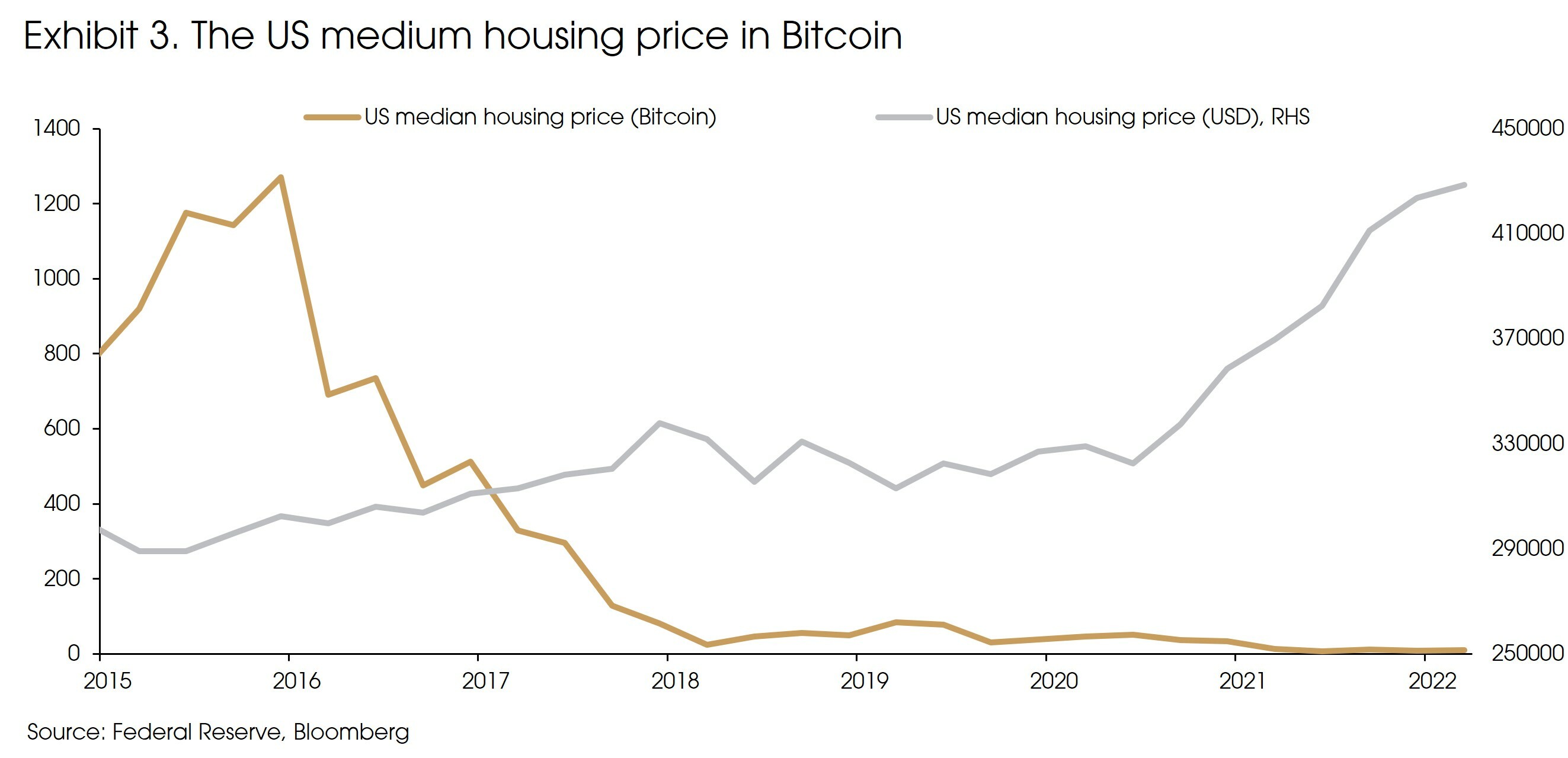

Moreover, cryptocurrency is seen by some as a potential inflation hedge given the finite supply. For example, the US housing price has been on an upward trend following the 2008 recession, but if denominated in Bitcoin, the “price” would have fallen by more than 90% (Exhibit 3). That said, during most of the period, the US economy was not experiencing inflation pressure at all. For the most recent months, when inflation surged, the US housing price increased by 1.2% in dollar term but increased 5.6% if denominated in Bitcoin. This suggests that even with a finite supply, cryptocurrency is not an inflation hedge, or at least has not been acting like one.

However, what surprises us is that given the dramatic price volatility and the failure to hedge against inflation, investors interests in crypto did not fade, while a normal mania would have seen confidence crash in the market.

For example, the monthly trading volume of Bitcoin fell from above USD 1 trillion at the beginning of this year to 0.5 trillion in May (similar to the average monthly trading volume of Hong Kong Stock Exchange since 2021), which is still much higher than that seen in 2018 and 2019 (monthly trading volume was below USD 0.1 trillion). Moreover, new crypto creation remained high at around 20,000 per month, near the previous peak. Finally, the future of “crypto” remains a hot topic in the market, more governments have started working on crypto related regulations, investors are still exploring opportunities in the crypto assets.

Despite the price volatility of cryptocurrency, a number of big US retailers have announced their acceptance, or intention to accept, Bitcoin as payment, such as Starbucks, Barnes & Noble, Bed Bath & Beyond, Nordstrom, and Office Depot.

What has been supporting this increasing acceptance and ownership of crypto? We see two potential reasons.

First, the Russia-Ukraine war and the SWIFT ban on Russia further raised the concern about the dollar-dominated international monetary system.

It has been a long discussion both in the market and in academia (e.g., Hayek’s Denationalisation of Money) about the defects of the dollar system. Simply put, the dominant usage of the dollar led to the spread of the US monetary policy over the world, especially in emerging markets. Monetary easing and tightening cycles from the Fed are closely related with the ebbs and flows in emerging markets, forcing other central banks or other economies to follow the US cycle.

In addition, the SWIFT ban in Russia revealed another risk of using the dollar. Countries could be removed from the global payment system, significantly affecting cross-border trades and investments.

Switching to other currencies is hard in the real world. The near-zero interest rates on the euro are the biggest concern of holding the currency. All other major reserve currencies are issued by countries that more or less follow the lead of the US in international affairs, therefore unlikely to reduce the sanction risks.

The Chinese RMB has developed its own settlement system, the CIPS, which also offers communication functions. However, the CIPS is not completely independent to SWIFT. Most banks that use CIPS still communicate via SWIFT. The PBoC last year set up a joint venture with SWIFT to offer local network services and store messages in China.

By size, the CIPS (1,300 participating banks, 13,000 transactions per day) is minuscule compared to SWIFT (11,000 members and 42 million transactions per day). Besides, the CIPS is mainly a settlement system for renminbi transactions. For broader use of the system, the RMB has to become more international (i.e., free conversion with less capital control) which does not seem likely in the foreseeable future.

Although cryptocurrency is not a “currency” (currencies need to be backed by sovereign credit), it is politically neutral, not directly subject to government interventions, and can be used in financial transactions. Thus, several countries such as El Salvador and the Central African Republic have officially announced Bitcoin as a legal tender currency. One might not see these as good choices, but it shows that countries have real concerns about the international monetary system.

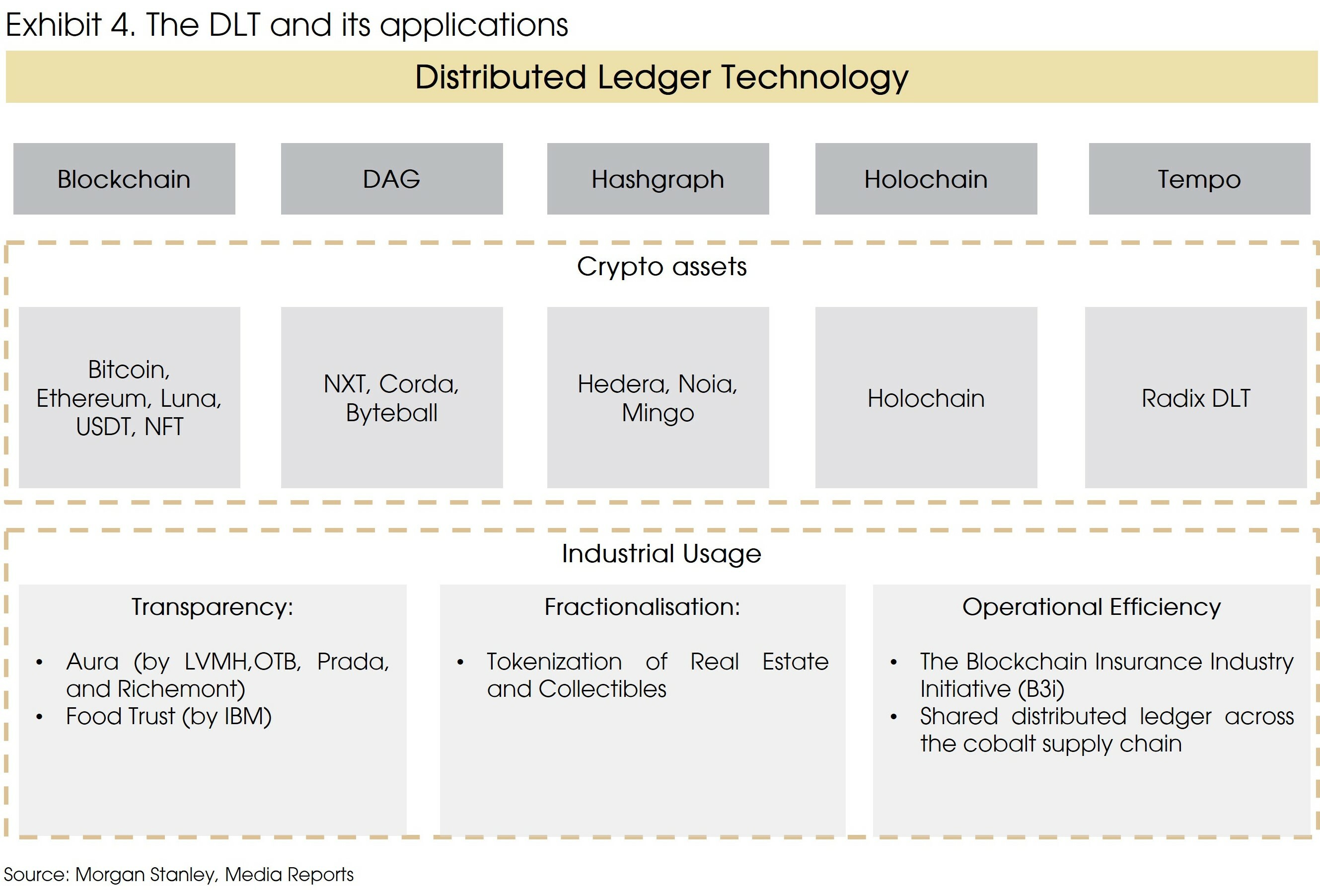

Second, we found that even if the crypto rally has faded, interest in the underlying technology has not. The Distributed Ledger Technology (or DLT) has a broader use than only creating cryptocurrency. It has an increasing use in different industries.

The underlying DLT: a potential game-changer in the long run?

Simply put, the Distributed Ledger Technology (DLT) is a different way of storing data and information. It can store, record, and exchange digital information amongst parties without the need for any centralized trusted authority.

Blockchain is the best-known example of DLT, mainly because the cryptocurrency derived from blockchain has caught a lot of attention from investors as a new asset class (Exhibit 4). However, we think that it is technology that has the potential to modernize various industries and could become a game-changer in the long run.

DLT can potentially unlock benefits for companies in a number of sectors. Increasing transparency and reducing operational cost may have the most short-term impact.

According to Morgan Stanley, we have seen material capital deployment. During the past year, the blockchain/Web3 venture capital sector experienced a 609% increase in capital deployed (vs 169% across VC). In addition, there is greater momentum in corporate exploration: Among the top 100 largest public companies globally, more than 80 are actively working on DLT solutions for infrastructure inefficiencies, and at least 25 already have a live product.

For example, in the healthcare sector, pilot programs are running and enabling insurers and hospitals to share patient medical data to verify insurance and medical records. In 2020, IBM helped Moderna to track the vaccine supply chain, allowing multiple participants to view, update and share sensitive data.

The Blockchain Insurance Industry Initiative (B3i) was launched in October 2016. The founders were 13 leading insurance companies, such as Allianz, Generali, Zurich and Munich RE. The initial idea was to explore if DLT could be used to automate and streamline the process of paying claims. The process was successful and expanded into other parts of the insurance and reinsurance business. The program helped automate the full lifecycle of insurance contracts.

In the food industry, there is an increasing demand from consumers and corporates to have better visibility and traceability of consumer goods throughout the supply chain. IBM started the Food Trust initiative in 2017 to leverage blockchain's DLT technology to increase the transparency of the food-to-fork journey of products. The Food Trust can help on multiple fronts, including food fraud, food waste, brand trust, and supply chain efficiencies. Companies like Nestle and Carrefour are already partnering with the project.

Similarly, companies such as Glencore, Umicore, Tesla, and CMOC share a distributed ledger across the cobalt supply chain. This allows the cobalt to be easily and effectively traced from the mine to the battery.

In the luxury sector, companies like Prada and LVMH are rolling out programs leveraging the technology to reduce counterfeiting and to understand the secondary market. In 2021, LVMH, OTB, Prada, and Richemont jointly created the Aura Blockchain Consortium with the aim of introducing more transparency and traceability of luxury brands.

Other applications include Anti-Money Laundering (AML), integration of DLT into companies’ Enterprise Resource Planning (ERP), and tokenization of less-liquid assets such as Real Estate.

Even if the underlying technology might be promising, whether the derived cryptocurrency (or crypto-assets) can gain continued recognition among investors (especially among traditional asset managers) still depend on their value. Unlike traditional assets, a major part of crypto assets’ value depends on their use cases. We will take Bitcoin as an example to give a more detailed picture on the use cases of cryptocurrency.

Use Cases of Bitcoin

Bitcoin at its peak in November 2021 had a market capitalization of USD1.2 trillion, albeit plummeting to around USD 560 million since then. This ranks Bitcoin among the highest valued companies such as Alphabet and Amazon, whose products are used globally. Bitcoin’s adoption has similarly grown significantly to a size hard to ignore by both institutional investors and regulators. New players have entered the market seeking to innovate on the largest cryptocurrency and its expanding user base, developing more use cases. We will look into Bitcoin’s following uses: speculation, transactions, financial products, inflation hedge, and as a reserve currency.

Speculation

Firstly, Bitcoin still serves as a speculative risky asset for many. Traders buy and sell the largest cryptocurrency on the future belief that its price will go up, whether directly or via derivatives. The 10 times price surge in Bitcoin in 2020-2021 has bred a new class of “crypto millionaires”. In Bitcoin’s short life cycle thus far, it has experienced dramatic streaks of volatility with two notable upswings, in 2017 and in 2020, which has led more investors to place speculative bets on the fear of missing out (Exhibit 2).

What makes Bitcoin complicated is its valuation. It is unlike traditional equities or fixed income that use fundamentals and discounted future cash flows in order to assess the value of such securities. Bitcoin does not generate future income, therefore some liken its value to that of gold, as a store of value. Its worth is determined on its supply and demand, and like gold, its supply is limited, creating scarcity and an upward price pressure. However, unlike gold, it has shown equity-like volatility and more recently a strong correlation to market indices. Bitcoin, nonetheless, is still new, hence there is no consensus on its appropriate asset categorization or whether it should be in its own class. But for what the market can observe, the opportunity to get rich quick is hard to abstain from despite its significant risks.

Transactions

Bitcoin is also touted as a potential means of transaction, aimed at making current financial markets more efficient in trust, fees, speed, and reach among other areas. Built on the blockchain, Bitcoin supposedly eliminates the need for a middleman, like a bank, to facilitate and verify the transaction as all the data is verifiable to the public and immutable. Each transaction is made in the form of a block and are then connected together in a chain, which makes past transactions permanent. If a change is attempted, it will require amendments towards all the other blocks to make sense, which requires solving highly complex cryptographic problems and a significant amount of energy.

By eliminating the middleman, the fees are then lessened with fewer parties taking cuts. Bitcoin is also not tied to any government or jurisdiction; hence it is theoretically less restricted in terms of reach and should be able to facilitate payments globally, smoother and simpler. One would not need to engage in foreign exchange or rely on middlemen between countries and international settlement agencies, reducing counterparty risk.

However, Bitcoin also faces problems with speed or scalability. It can only handle four transactions per second, which is demonstrably slow compared to the likes of Visa which can do about 1,700. This makes it less viable, especially on global scales, but solutions are being developed as well as entirely new cryptocurrencies directly addressing this.

Another, and perhaps the most significant issue is adoption. Despite strong growth rates, the number of consumers or merchants that use Bitcoin remains very few. Businesses may also not be familiar with the process and infrastructure needed to use Bitcoin for payment or may simply be unwilling to take on the volatility risk that comes with it. Today, Bitcoin is still far from widespread usage.

Financial Products

New financial instruments have also come from the rise in the popularity of Bitcoin. Financial institutions are coming to recognize that Bitcoin and its growing user base is here to stay, hence they have sought financial innovations to provide better services to their customers.

One such use is lending, where the likes of Goldman Sachs or more crypto-native firms like BlockFi have participated in. They have created a facility where one is able to put up their Bitcoins as collateral and take out a cash loan. This is particularly notable to the newly born “crypto millionaires” that have their wealth tied to Bitcoin and thus can put it up as collateral. It might also be of interest if there is a preference to keep their assets in Bitcoin because of the belief in its value.

Other financial products that have come to market are fund-type vehicles that aim to allow investors to gain exposure to cryptocurrency through fiat currency. The largest such example is the Grayscale Bitcoin Trust which has about USD19 billion in AUM and where investors can buy a unit using USD and gain exposure to the Trust’s underlying Bitcoin, making the investment process simpler for less crypto-nuanced individuals.

Inflation Hedge

Fiat currencies are inherently inflationary because of the central bank’s ability to print, which erodes the value. Bitcoin, in contrast, has an inherent deflationary characteristic because of its limited supply, where no authority can create more because of its decentralization. There is a total supply of 21 million, with which about 18 million are currently circulating. Technically, more Bitcoins are being mined every day, hence its supply is still growing, but there will come a time when all 21 million have been mined. Provided demand remains and continues to grow, having a fixed supply will provide a continuous upward value pressure, opposite of the inflationary pressure fiat currencies face.

It is this thinking that proponents argue for Bitcoin’s ability to act as an inflation hedge. The current macroeconomic climate is its first real test of such use case, to which it is unable to protect value so far. As inflation has been on the rise and far out of most central banks’ 2% target, Bitcoin has since fallen more than 50% from its peak in November, far greater than any broad market index. Another key trait of an inflation hedge is its decorrelation to the market, which gold typically satisfies to varying degrees. On the other hand, Bitcoin shows a positive correlation, especially with the tech-heavy Nasdaq (Exhibit 5). It is likely still too early to arrive at a conclusion given the early phase of Bitcoin’s adoption, but despite its deflationary fundamentals, its trademark volatility works against its use to protect value.

Reserve Currency

A reserve currency is used to help stabilize foreign exchange and demand for one’s own currency. Today, the common ones are the USD, JPY, EUR, CNY, and GBP as these are the currencies of the most influential nations and are involved in global trade, with the dollar as the most dominant one. However, given the sanctions the US government has placed on Russia’s USD reserves, other nations, particularly those not allied with the US, may see this as a catalyst for greater diversification to other currencies.

One such alternative could be Bitcoin given its decentralization, where no political authority has influence over its use, which is the key concern in Russia’s situation. No government will be able to deny a country from accessing its hypothetical Bitcoin reserve.

However, there remains a reluctance from governments and regulatory bodies to promote or even allow for greater adoption. Doing so would mean governments lose control of domestic currency and impact their monetary policy ability. As a result, policymakers globally have started to direct research toward creating a “central bank digital currency” or CBDCs. This would act as a digital version of their own currency, present on the blockchain, but still maintained by the central bank. China trialed its version, called the e-CNY, in the spring of 2020 with many others including the EU, UK, and US conducting studies. Perhaps, CBDCs stand to gain from the benefits of Blockchain technology but with regulatory support.

One final word: we maintain our cautious views on cryptocurrencies but continue to believe that DLT is a technology that offers tremendous opportunities to many industries and sectors, even if those uses are not directly investable. This report only aims to bring discussions based on recent developments in the crypto world, it does not attempt to make investment recommendations.

Sources: BIS, Bloomberg, CoinMarketCap, Media Reports, Morgan Stanley, Federal Reserve, CIGP Estimates