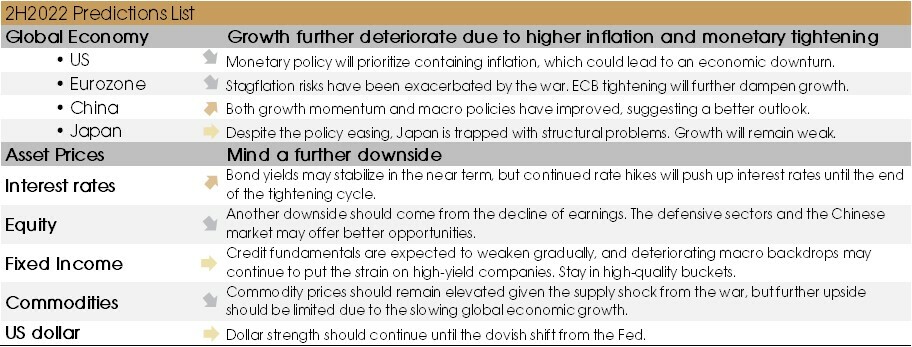

CIO Viewpoint: 2H 2022 - Mind a further downside

1H 2022 has been quite challenging for investors, as supply shocks, higher inflation, and aggressive monetary tightening became the main drivers in the market. Specifically, some unexpected shocks from the Russia-Ukraine war and China’s lockdown have further pushed up inflation pressure in many economies. Central banks (especially the US and European) are forced to prioritize containing the rising prices, regardless of supply-push or demand-pull inflation.

A potentially higher and stickier inflation and the more aggressive monetary tightening have turned stagflation risks into recession risks, pushing down the prices for almost all asset classes.

For 2H 2022, we still need to mind the rising interest rates; and pay attention to a potential economic downturn and probably a further downside in the capital market. For a meaningful rebound in asset prices, we may need a pivot from the central banks.

More aggressive monetary tightening to contain inflation

One big surprise for the first half of 2022 was inflation. Just as the pandemic-related disruptions started to improve (e.g., used car prices and apparel prices were already declining since the end of 2021), the outbreak of the Russia-Ukraine war led to another surge in commodity prices, especially energy and food. In addition, China’s strict lockdown to contain the Omicron wave in major cities in 2Q added further pressure on supply disruptions.

As the renewed price pressures may reflect prolonged supply-demand imbalances, central banks shifted towards the more aggressive tightening paths. Aggressive monetary tightening led to the further rise of interest rates, the yield curve inversion risks in the US, the dollar strength, fund outflows from emerging markets, and the broad-based corrections in asset prices.

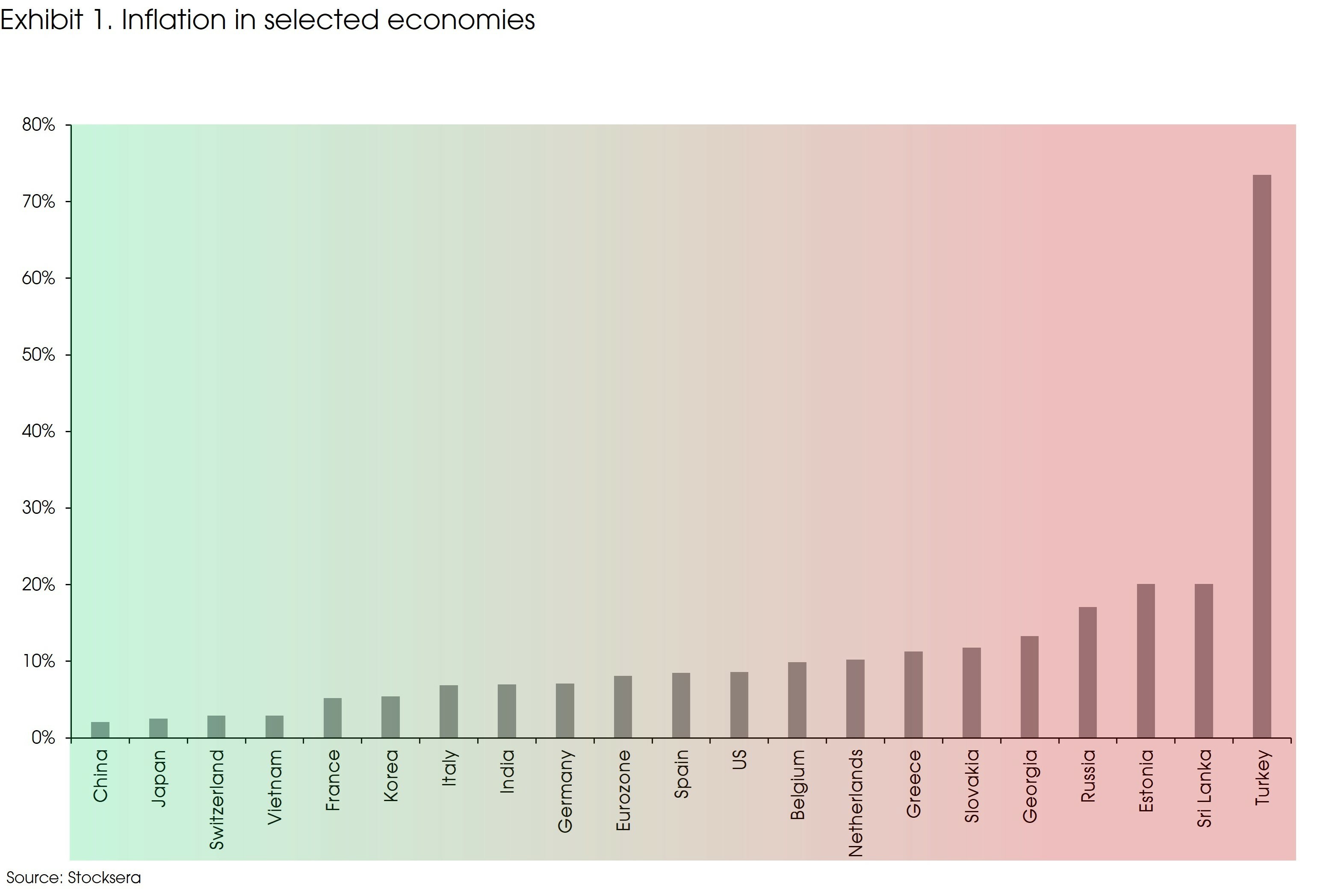

During the past decade after 2008, above 5% of inflation was already considered high globally, but now it has become quite common among developed and developing economies (Exhibit 1). For some countries, e.g., Switzerland and Japan, although inflation is still below 3%, they have reached the highest level in a decade.

Specifically, inflation in some emerging market (EM) countries were typically affected by the dollar strength and rising commodity prices: the fragile ones have experienced significant currency depreciations (e.g., Turkey), while some low-income countries have been hit badly by rising food prices (e.g., Sri Lanka).

Developed economies (especially the US) have more demand-pull inflation compared with the EM, given the unprecedented stimulus during the pandemic. Meanwhile, the European countries are more affected by rising energy prices.

Countries still with relatively mild inflation pressures are the manufacturing-oriented Asian economies, such as China and Vietnam. Part of the moderated inflation in these economies was due to China’s economic slowdown since last year.

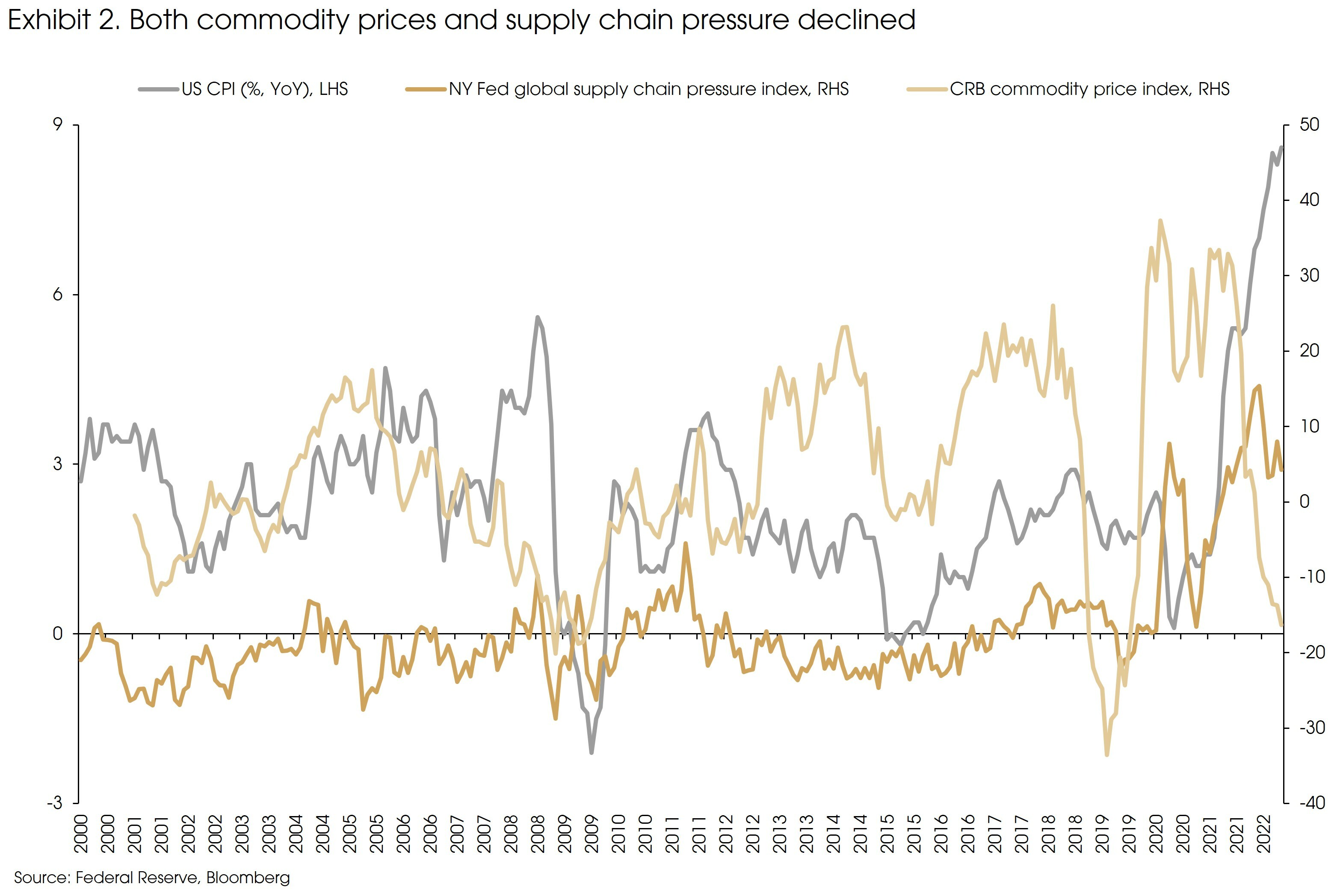

Looking forward, we expect the energy and supply chain disruptions related inflation to gradually retreat.

(Exhibit 2) Despite the increase of energy prices and the resurgence of supply chain disruptions in May, both commodity prices and supply chain pressure continued to ease on a year-over-year base.

Specifically, the surge in commodity prices since the Russia-Ukraine war may have already reflected the supply shock, and the slowing global economic growth will limit further upside in commodity prices. Overall, we expect commodity prices to remain elevated in 2H, but should not significantly drive-up inflation.

Supply chain disruptions should also continue to ease. China has ended its 2-month lockdown in some of its major cities and there are increasing signs suggesting further reduced restrictions against the Omicron wave. Also, higher prices have led to a weakening demand. We expect the rising supply chain pressures in April/May to be short-lived.

The future upward pressure in inflation should mainly come from services-related sectors, such as rent, travel, and wages, as is the case in the US. However, we see moderating signs in these sectors as well.

In the US, offline service consumption has already rebounded. For example, the hotel occupancy rate increased from 47.8% in January to 65.5% in April, already close to the pre-pandemic level (68.4%). In addition, higher inflation is affecting household income. Lower real income should also restrict further upside in service prices.

Wage growth can be the stickiest part of inflation. Monetary tightening does not work directly to contain wage inflation. However, monetary tightening will lead to moderated demand and tightened financial conditions, thereby helping to narrow the gap between labor demand and labor supply. Further upside in wage growth should also be limited.

Therefore, we still see inflation moderating going forward, but the peak is probably delayed by the war and the resurgence of supply chain disruptions.

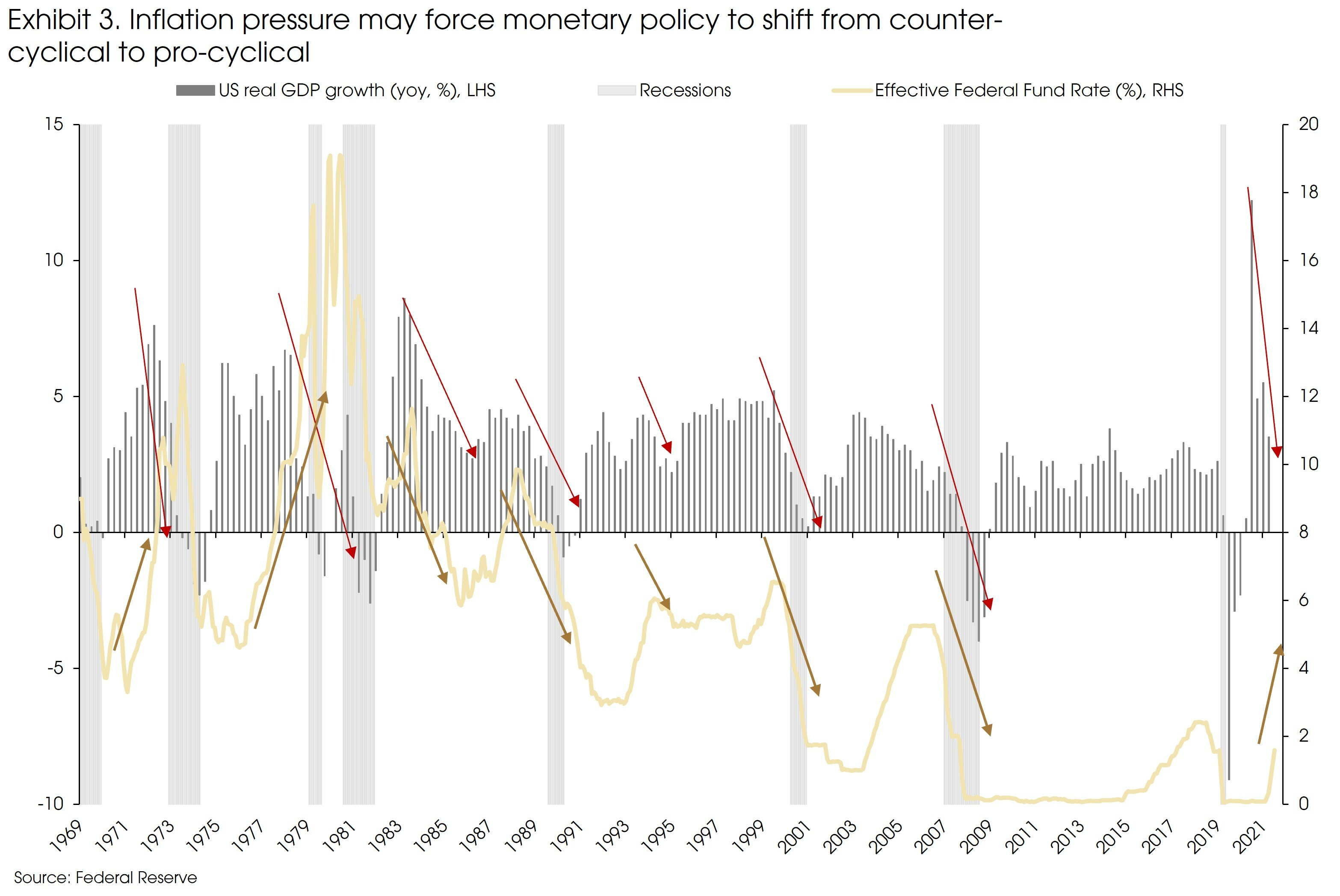

The slower fall of inflation will set a high bar for the dovish turn from major central banks. Now, the central banks not only need to see a peak in inflation but also the consensus that inflation will steadily fall back towards their targets. This could lead to tighter-than-needed policy for the underlying economy.

In other words, monetary policy may change from counter-cyclical (when GDP growth decreases, monetary policy eases) to pro-cyclical (monetary tightening coincides with economic slowdowns to contain inflation, like in the 1970s), making a soft landing more difficult (Exhibit 3).

Significant economic downturns are likely

The nearly/briefly inverted yield curve in the US, the Fed’s own forecast on rising unemployment rate, the declining growth in goods consumption, and the weakening housing market are all sending signals of a potential downturn in the US economy.

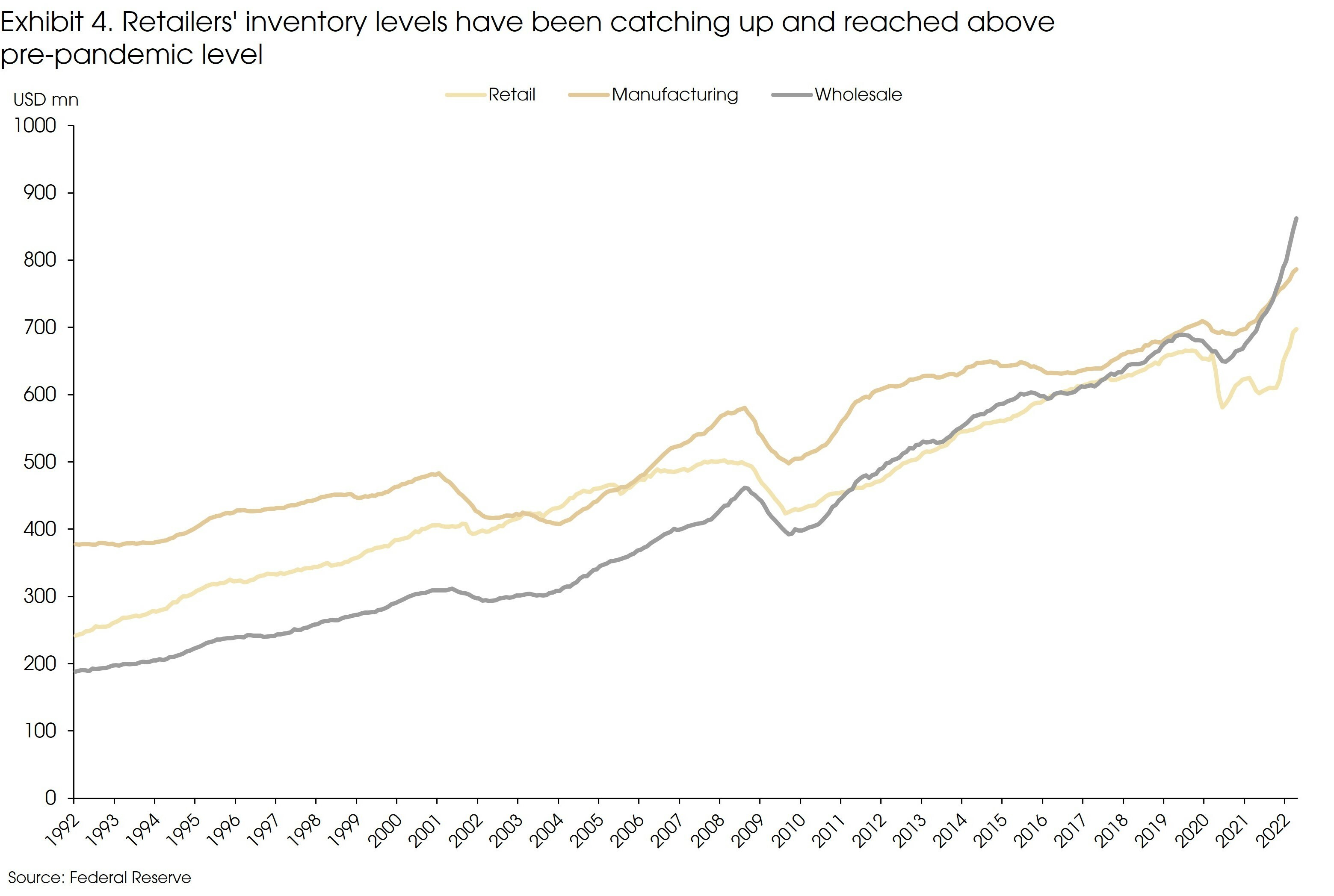

For example, the US retailers’ inventory has rebounded significantly this year and reached above the pre-pandemic level, suggesting eased disruptions from the shipping process. However, many retailers (such as Walmart, Target, etc.) reported unwanted inventory in their 1Q earnings reports, given the weaker consumption demand. As the inventory for wholesale and manufacturing companies are still significantly above that of retailers, we may see a de-stocking process in the coming quarters (Exhibit 4).

Overall, we are not as optimistic as the Fed. We think the expected terminal policy rate of 3.5-3.75% at the end of this year (based on the Fed’s dot plot) would probably push the US economy into a recession by then or early next year.

The eurozone’s headline inflation is similar to the US (8.1% vs 8.6% in May), but core inflation is much lower (3.8% vs 6%). This suggests relatively weak demand in the eurozone economy.

Monetary tightening from the ECB will probably be less aggressive than the Fed due to the fragmentation risks among peripheral countries (e.g., Italy, Spain, and Greece). However, to contain inflation, multiple rate hikes from the ECB have become increasingly likely in 2H.

Given the shocks from the war, the weaker domestic demand, and the tightening monetary policy, the eurozone economy is subject to more stagflation risks than the US. Negative GDP growth and more downside risks are expected in the coming quarters.

Japan has never had a meaningful rebound in economic growth after the 2020 recession. Its GDP is still 3% below the pre-pandemic level. Structural issues, e.g., labor shortage, are the main reasons for the lack of growth.

Besides, although the BoJ maintained its easing policy, the market is challenging such a policy stance by selling Japanese government bonds. The weaker Japanese yen is supposed to support the country’s trade balance and economic growth, but Japan recorded its biggest single-month trade deficit in more than eight years in May as high commodity prices and declines in the yen swelled imports.

Despite the tailwinds from accommodative monetary policy and the weak currency, we expect the Japanese economy to remain weak.

Finally, we think that the Chinese economy finally sees the light at the end of the tunnel. Monetary tightening and regulatory crackdown in a number of sectors last year have already led to a notable economic slowdown.

Macro policy and industrial regulations have both eased this year to support the economy. We finally see improvements of economic data in recent months, such as credit growth, industrial profits, and retail sales.

The zero-COVID policy remains the biggest concern for China. However, President Xi’s travel to Hong Kong may send some positive signals of potentially further eased COVID controls, especially on cross-border travels.

The already bottoming Chinese economy and the favorable policy setting may support China’s growth even if the US steps into a recession.

In sum, for 2H 2022, the combination of growth momentum and macro policy suggests notable downside risks in the US and eurozone economies. China’s outlook is turning positive due to its policy shift, while Japan is still trapped with its structural problems.

Mind another downturn in the equity market

As most major equity indexes have already corrected more than 20% from their recent high, we are probably already in a bear market.

First, we think that the current bear market should be a cyclical one, typically caused by rising interest rates and falls in profits.

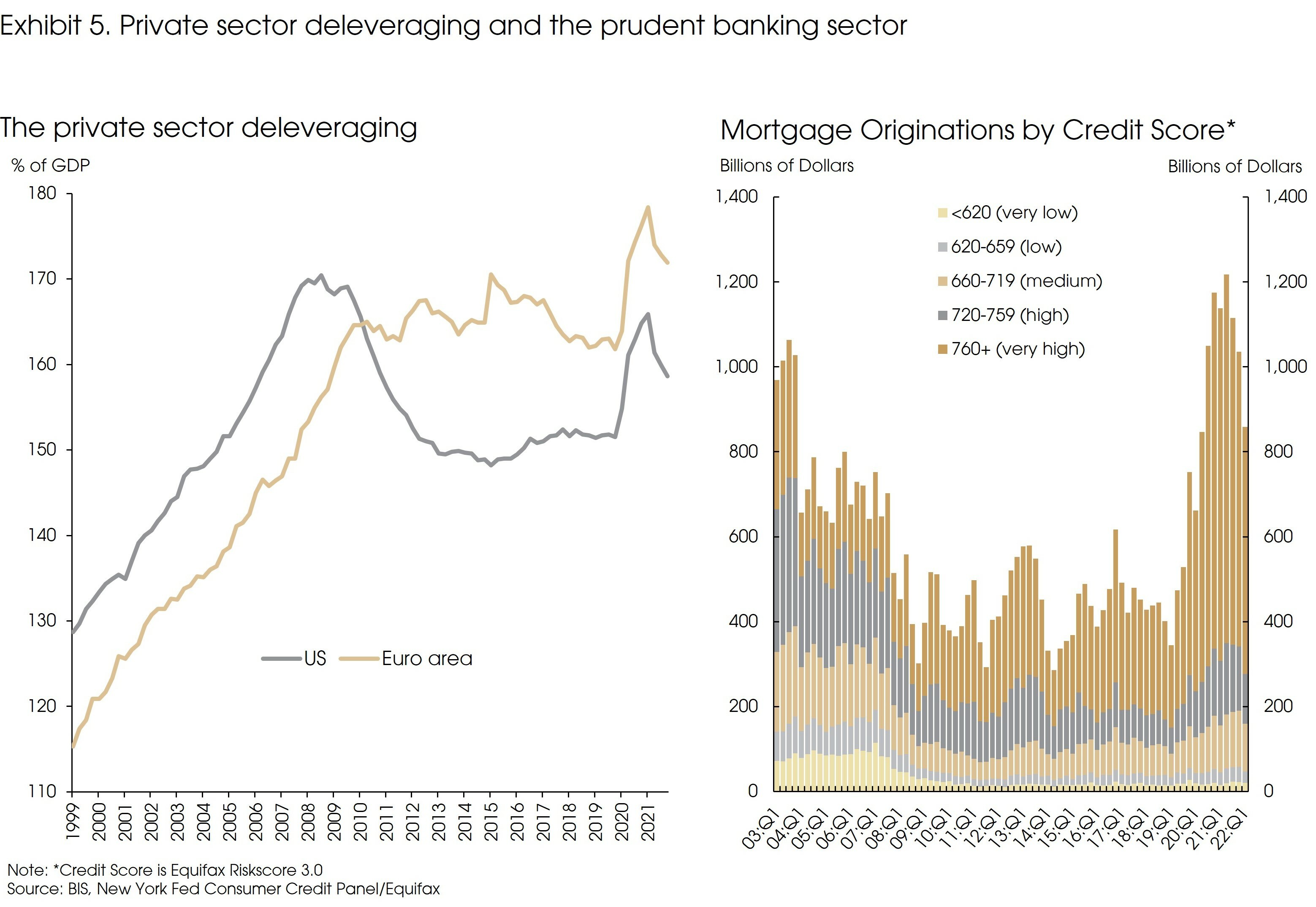

In contrast, a structural bear market is usually triggered by serious balance sheet problems in the private sector and financial bubbles. Usually, prolonged market downturns and deflation risks will follow a structural bear market. However, currently, we have not seen notable imbalances in major economies. For example, there is no significantly increased leverage in the private sector or notable risk-taking in the banking sector (Exhibit 5).

Second, we think that there could be another downside in this bear market, driven be further increases in interest rates and earnings downturn.

Interest rates may stabilize or even fall after the current surge. However, the higher terminal policy rate from the central banks should still push up bond yields until the end of the monetary tightening cycle. For example, given the Fed’s projection, the US policy rate will reach 3.5-3.75%, and we are only halfway there.

In addition, we also need to mind an earnings downside. The US market is still forecasting a 10% earnings growth this year. However, this will not happen if there is a recession or a significant economic downturn. We expect to see a substantial downward revision in earnings in 2H.

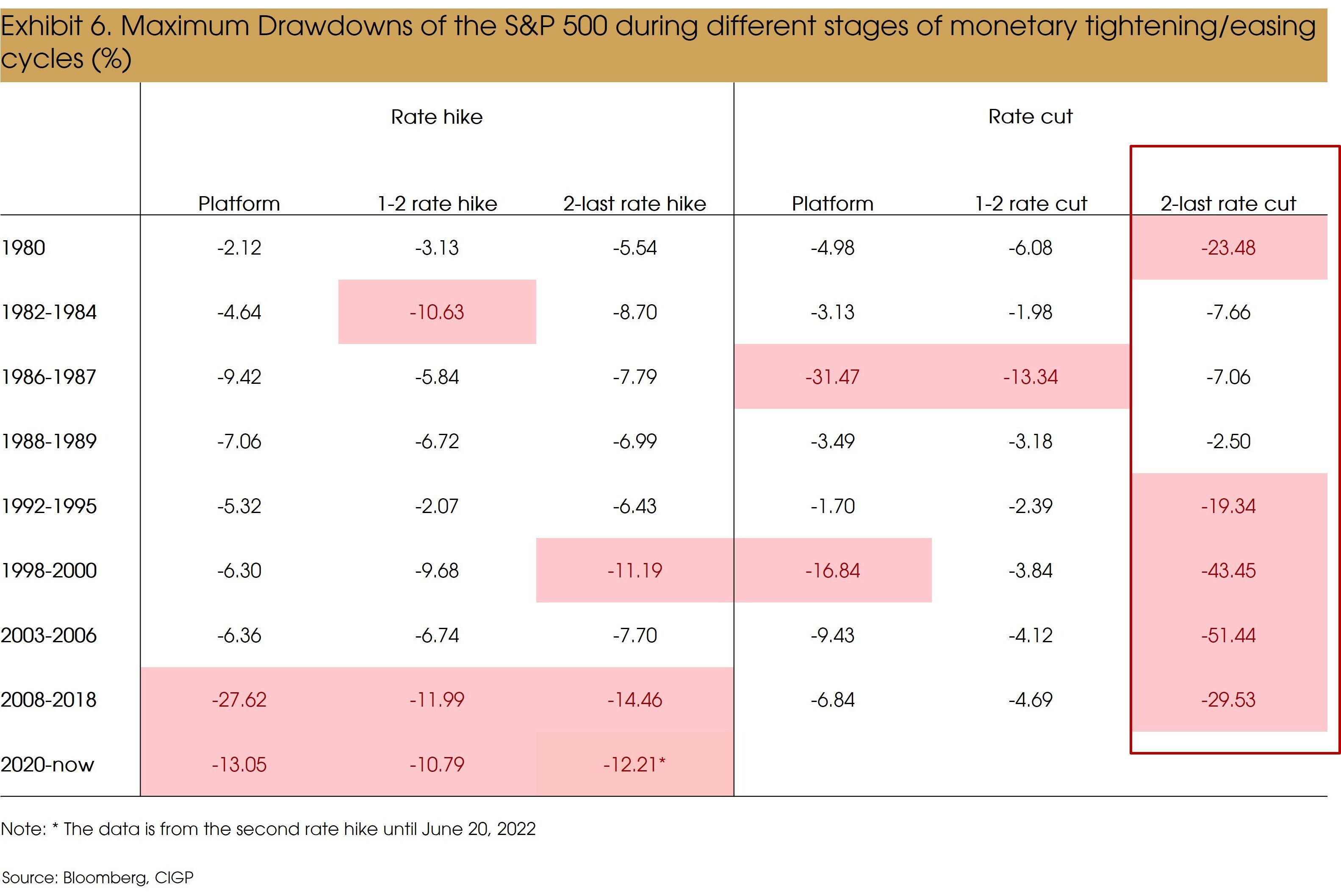

From another angle, we see that large drawdowns of the US market (more than 10%) usually happen after the Fed started to cut the rate (Exhibit 6).

Therefore, in general, we think that the recent rallies in the market should be more like selling opportunities instead of buying opportunities. For meaningful rallies in the market, we may need to wait for the pivot of the monetary policy.

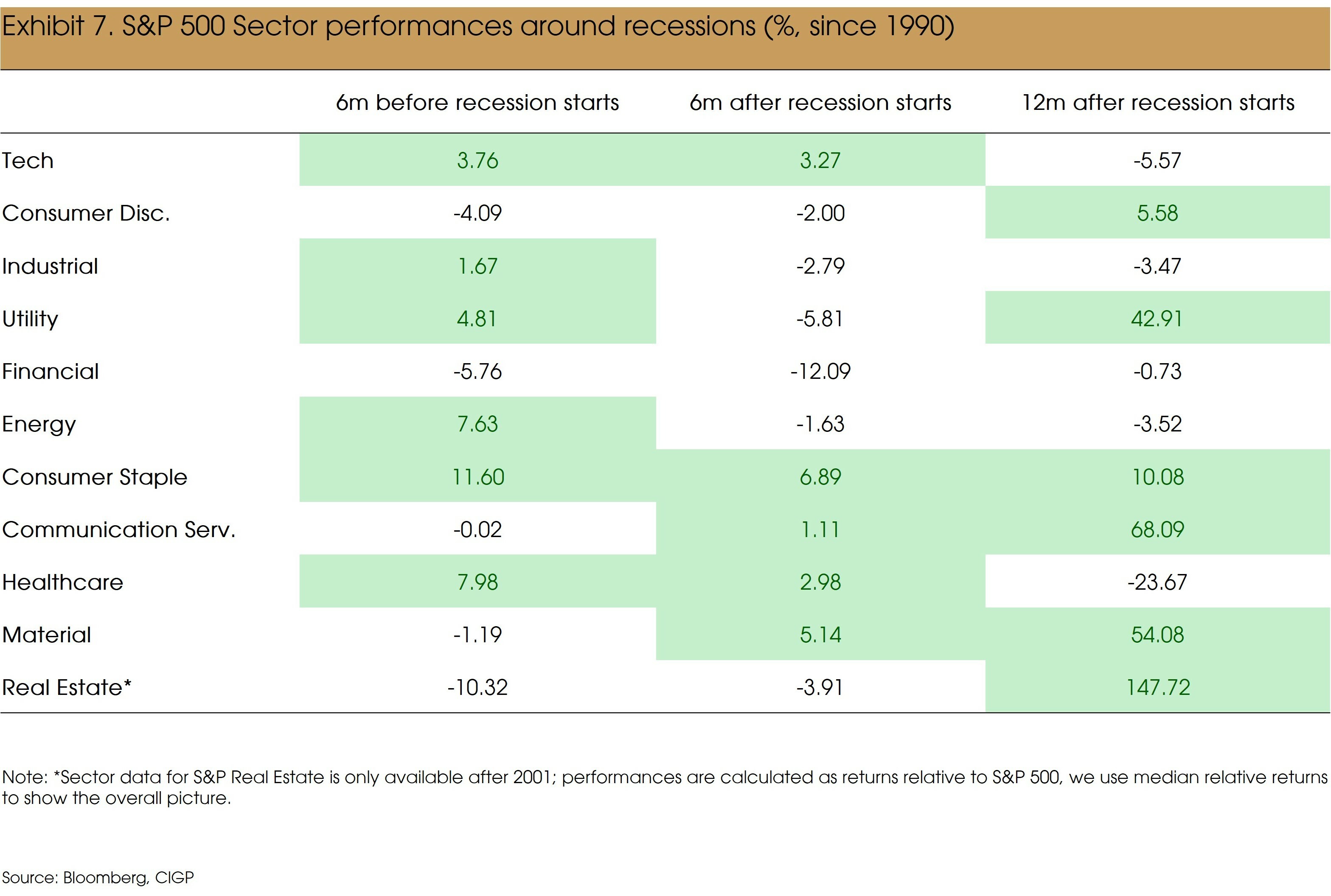

That said, there is still a considerable period between now and a potential shift from major central banks, and a recession may happen in between. Therefore, it can be useful to look at which sectors tend to perform better around recessions.

Exhibit 7 shows sector performances relative to the market index in the US for the most recent four recessions since 1990, Healthcare is a clear winner during the six months before recessions (relative performances were positive for all four periods). Consumer Staples also performed well, and outperformed the market in three out of the four recessions. More importantly, it is the only sector that kept outperforming the market during the 12 months after the recessions started.

Therefore, although the growth names are currently leading the market rallies, we remain cautious due to the remaining upside in interest rates and the recession risks. A meaningful rebound of the growth sectors and the overall market may require a shift from the Fed, which probably will not happen soon.

For 2H 2022, we expect the defensive sectors, i.e., Healthcare and Consumer Staples, to offer better opportunities for equity investment. The Chinese market has also become more attractive given the big corrections last year, the bottoming growth momentum, and the favorable policy setting.

Stay High Quality in the credit market

The credit market has also recorded poor performances in all sectors during 1H 2022.

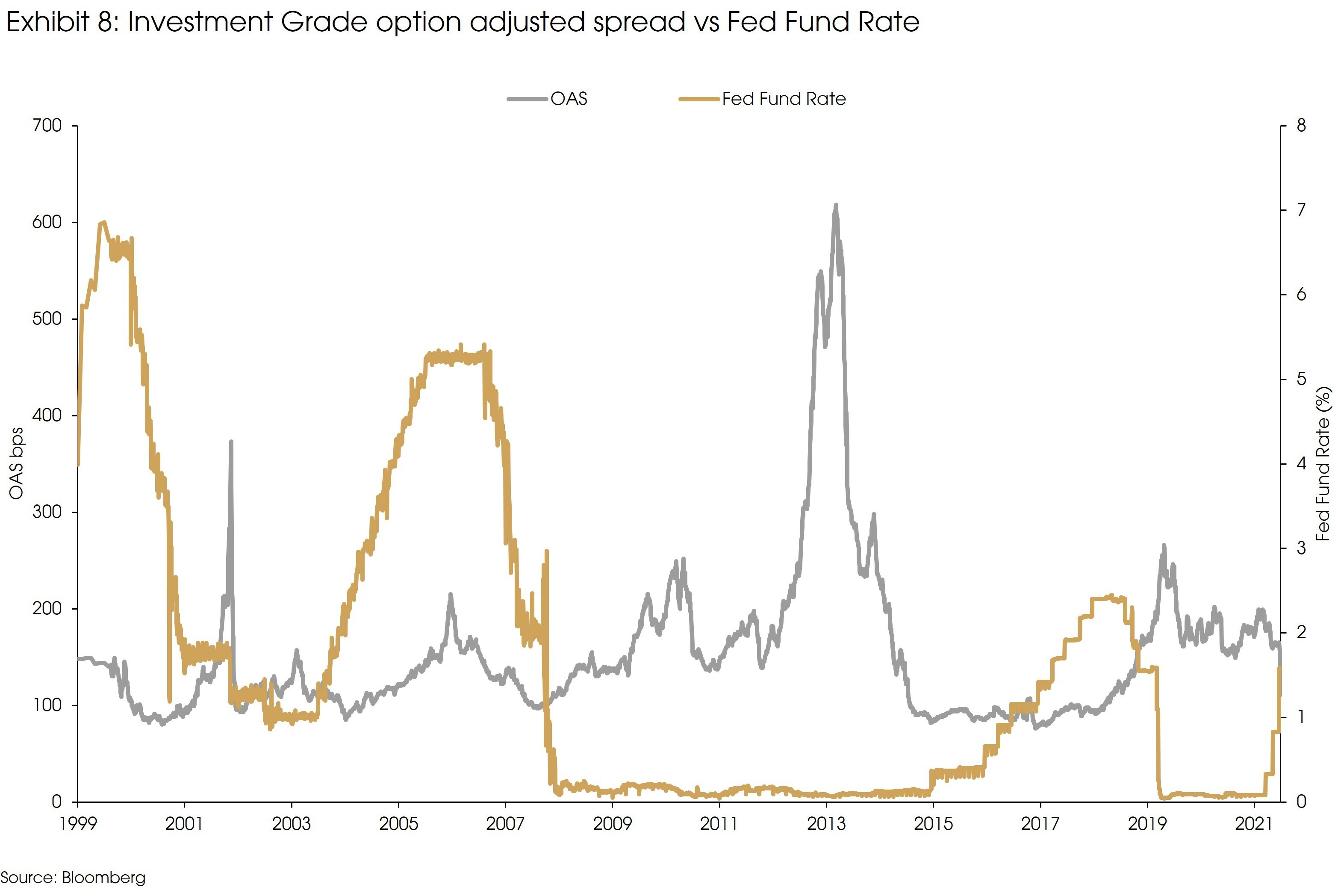

The IG OAS (Investment Grade Option-Adjusted Spread) reacted differently versus prior rate hike cycles (Exhibit 8). One of the reasons was that the correlation changed between stocks and bonds amid a lower risk appetite in the market.

Duration risk dominated in 1H2022. What we have seen is that growth is already slowing down in the US and Europe. Thus, duration risk has morphed into growth concerns. With the duration risk mostly priced in, recession risk and growth risk will be the key elements to keep the volatility elevated in the 2H2022. From the credit spreads perspective, we expect a modest spread widening in the IG corporate bond sector, mainly in BBB buckets. High-quality credits will be able to withstand the effects of a potential recession or slowdown in growth.

Within the IG buckets, Chinese onshore bonds will be an interesting sector to look at, supported by continuous policy easing measures and a potential RMB rally.

For High Yield Bonds and Leveraged Loans, we have seen a significant repricing in June and the spreads marched wider in the low-quality credit space due to the recession fears, leaving the yields of HY bonds breaking through the level of 8%. Looking ahead, HY spreads widening may continue in 2H2022, again, this will be mainly driven by low credit quality issuers, such as issuers with a rating below B.

In the base case, we expect the HY spreads to widen by around 50-80bps. The current US HY credit spreads are trading at the range of 520-540 bps (measured by the BofA US High Yield Index), we believe that 580 bps will be the case when the Fed is able to anchor a soft landing. However, trading with spreads of over 600 bps will be the case under an adverse macro landscape. This will mainly be led by growth-sensitive and low-quality names.

Leveraged loans were the sector we placed a high conviction in 1H2022. Turning into the 2H2022, we revise to a neutral stance due to fundamental concerns. On one hand, we believe that loans will continue to benefit from floating-rate features. On the other hand, there are downside risks of weakening fundamentals that may influence the loan issuers.

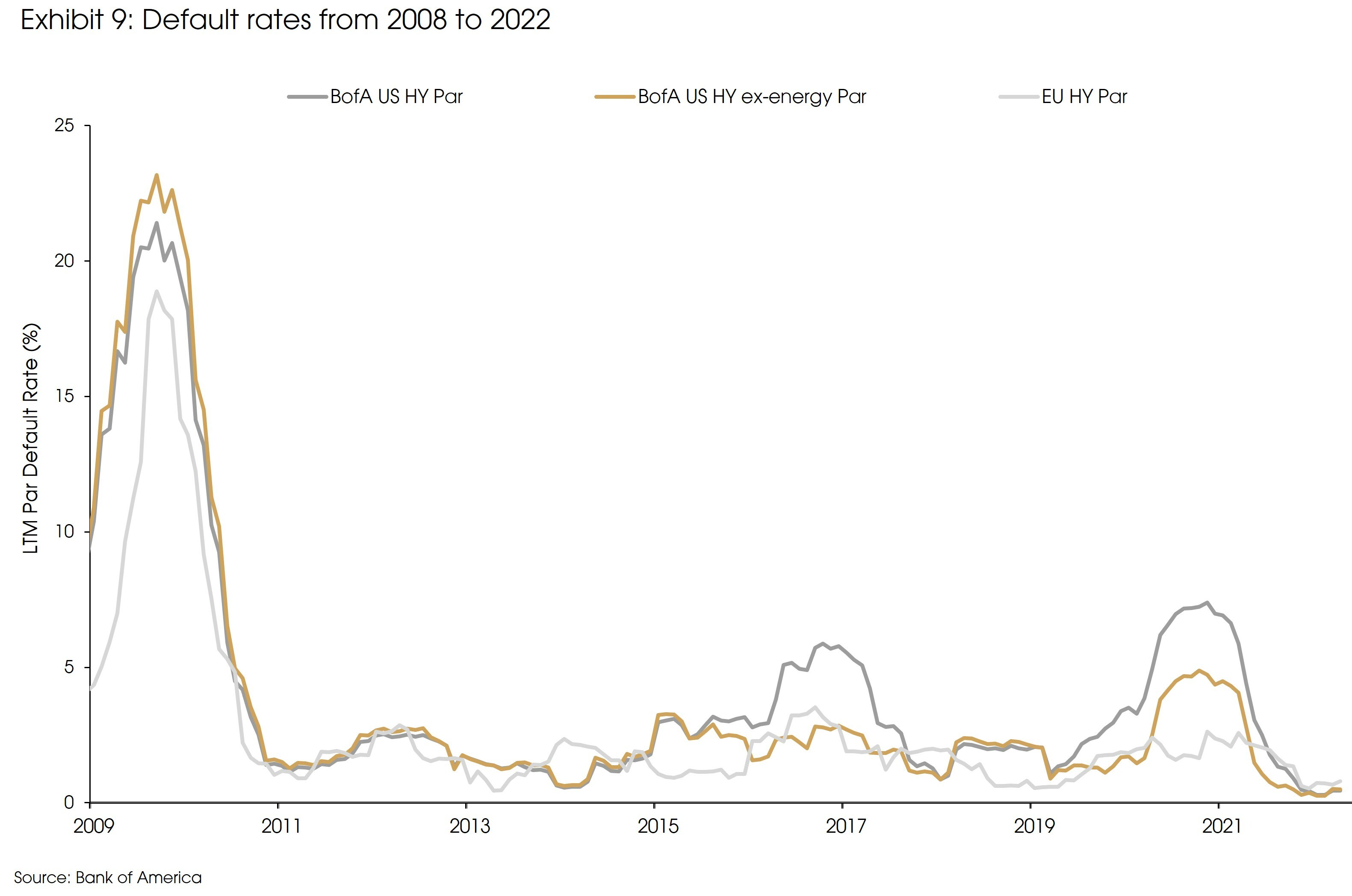

The current default rates remain in a healthy position and the majority of companies were resilient through the initial phase of the rate hike cycle. However, earnings will slow down in the 2H2022 gradually while we only expect a modest pickup in default rates in 2022. Fallen angel volumes should remain stable.

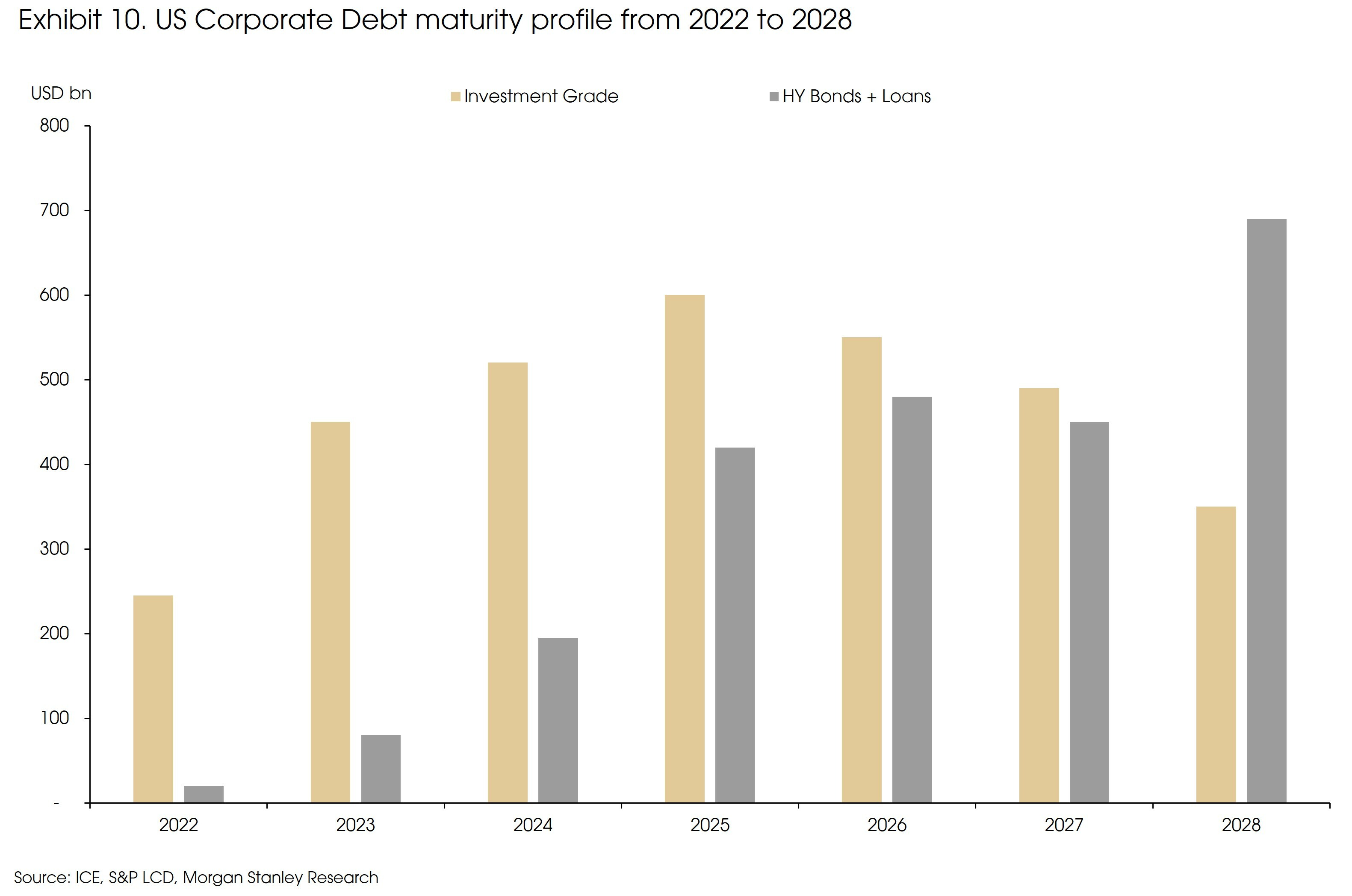

High Yield bond issuance has tumbled 75% YoY due to the surge in financing costs. This is likely to persist in the 2H2022. We believe the duration of upcoming new issuance will tilt to short-end maturities, suggesting that the duration of fixed income indices will decline at a gradual pace.

The maturities and refinancing needs of leverage loans and HY bonds are still muted, particularly in the leveraged credit market. Therefore, the defaults in the near term should be manageable.

Meanwhile, we also observed that the cash level of HY issuers declined significantly and some of the issuers were replacing their debts by using cash balances, suggesting that the current cash balance of the borrowers should be able to absorb the initial rate hikes.

European HY issuers will be relatively more vulnerable than the US HY issuers due to their geographic proximity to Russia, thus we suggest increasing the quality of assets for Europe credits.

The valuation of credits cheapened considerably which makes the credit sector extremely attractive. However, the sentiment is still weak and the upcoming volatility should remain elevated. A meaningful correction will only happen when the Fed changes to a dovish pivot. Therefore, we stay defensive and favor high quality credits.

Sources: Bank of America, BIS, Bloomberg, Federal Reserve, ICD, ICE, Morgan Stanley Research, New York Fed Consumer Credit Panel / Equifax, CIGP Estimates